You may have elected to compute the taxable amount under the Simplified Method or General Rule.

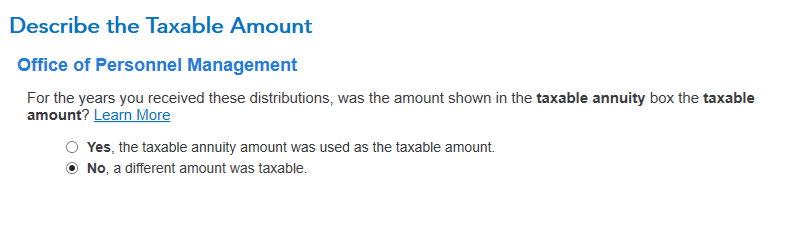

At the screen Describe the Taxable Amount, did you select No, a different amount was taxable?

If you did select No, you may have computed a taxable amount based upon the Simplified Method or General Rule.

If you have basis - an amount of money you contributed and already paid taxes on - in your retirement funds, then you will use one of these methods to determine the taxable amount on this distribution which may be different from the amount in box 2a. Click Learn More for more information.

The Simplified Method is explained in IRS Publication 575 page 13.

The General Rule is explained in IRS Publication 939 page 2.

@OddQuestioner

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"