- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- 1099-R Box 15a

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-R Box 15a

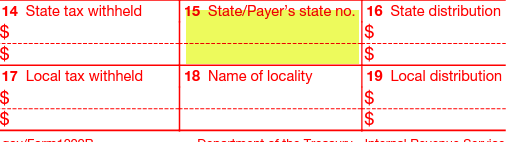

Turbo Tax is asking me to enter information from Box 15a of my 1099-R form however, my 1099-R form does not have a 15a box. It only has box 15 listed as State/Payer's state no. what should I do or what should I enter for the missing 15a box? Thanks!

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-R Box 15a

There are 2 box 15's for 2 states both 15, so one is called 15a and the other 15b.

If there was no state withholding and no dollar amount in box 14 then all boxes 14-16 must be BLANK.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-R Box 15a

The exact situation is occurring with my 1099R! There is no Box 15a on the form that was sent to me, and Turbotax will no let me add the number listed in Box 15!

Somebody help! I called the 1099-R issuer, and they told me to call Turbotax. I cannot fine a Telephone help number for Turbotax

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-R Box 15a

Exactly my problem!!! Is TurboTax so inept????

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-R Box 15a

I amm not filing for 2 states, just a single state!! Why won't you file my state tax return??????!!!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-R Box 15a

@spudhugh wrote:

Exactly my problem!!! Is TurboTax so inept????

The 1099-R box 15 is for state tax. There are 2 lines for two states. The top line for state 1 is referred to as "15a" and the bottom line for state 2 (rare to have two states) as "15b".

15a/b are only used if where was state tax withheld in box 14a/b.

If box 14a/b is blank (or zero) then all boxes 14-16 must be blank. Some financial institutions put the state information in 15a/b even if there was no state withholding which is wrong - it must be blank.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-R Box 15a

The best way to enter Box 15 if there is no state identification number listed is to enter the Federal identification number of the payer. If there is no additional state or local information on the 1099R leaving the rest of the fields blank should be fine. Just enter the same number in box 15 that shows in the Payers TIN right above your name in most cases on the 1099R.

The highlighted field below is where you would enter the number:

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

riram

New Member

ken-golkin

New Member

user17725500531

New Member

Ikigai

Level 1

Ikigai

Level 1