- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- 1099- and 1096 form

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099- and 1096 form

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099- and 1096 form

TurboTax generates one Form 1096 for each social security number or Employer Identification Number (EIN).

No, you don't need to enter the name of the rental unless you have it registered as a business, in which case you may have an EIN which will have the rental name.

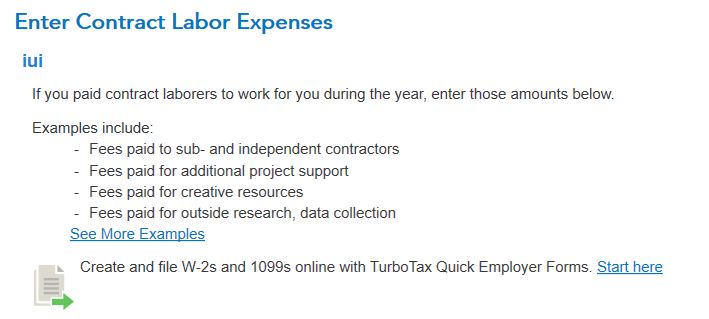

Quick Employer Forms helps small business owners like yourself quickly and easily create W-2, 1099-MISC, 1099-INT, and 1099-DIV forms.

It asks you easy questions, and then completes the forms for you automatically. It even e-files the forms for you.

For unlimited access to Quick Employer Forms, which you can e-file at no additional cost, you'll need to use one of the following TurboTax products:

- TurboTax Online: TurboTax Self-Employed or TurboTax Live Self-Employed

- TurboTax CD/Download: TurboTax Business or TurboTax Home & Business

- Quick Employer Forms supports e-filing to the Social Security Administration and Internal Revenue Service only. It doesn't support filing any state employer forms, nor does it support printed and mailed forms.

- If you need to file 100 or more forms, we recommend our 1099 E-File Service, designed to accommodate larger businesses.

- If you use our Lacerte and ProSeries software, contact your sales representative for information on Quick Employer Forms.

See also Quick Employer Forms questions.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099- and 1096 form

How do I issue 1099s for my non-rental Schedule C business? I has been frustrating to find and an answer, especially when I initiated filing my 2020 1040 (using Home & business version), the program took me there an gave me an option to do so. But I thought, Id do this after I import my info from 2019..... and then the option disappeared!!!!! I have been trying to see how I can go back to that option within the software but to no avail. I need to issue 3 1099s for a non-rental schedule C business. Thank you

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099- and 1096 form

It can be hard to find the option for the Quick Employer Forms in TurboTax.

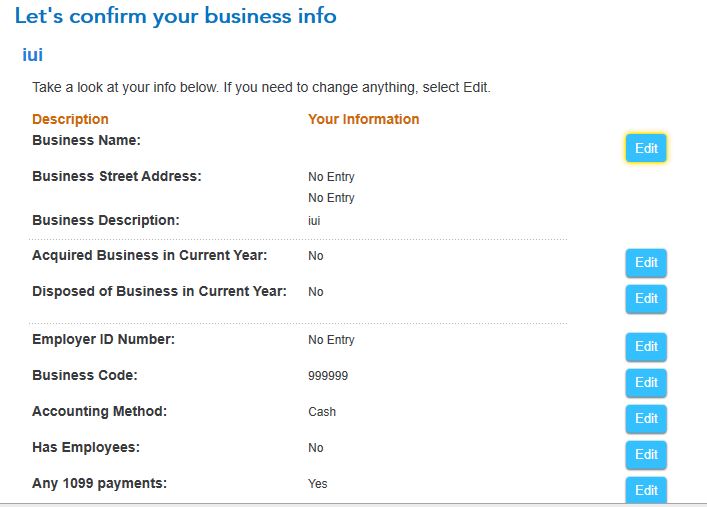

You need to first indicate that you have to add 1099 payments in the screen that says Let's confirm your business info:

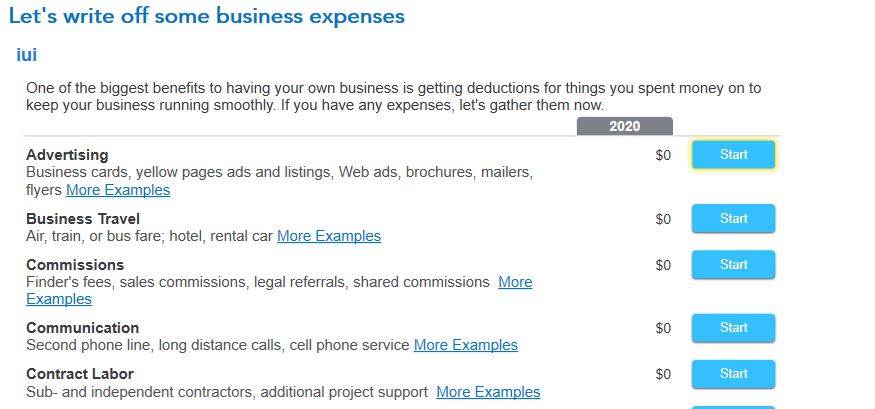

Then, you need to edit your business expenses and select Contract Labor:

Then, you will see the option for Quick Employer Forms:

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

user17570924693

New Member

Darenl

Level 3

craginm

New Member

user17569186982

New Member

dpadge

Returning Member