- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Military filers

- :

- Re: I have 100 percent tax exempt through military service where do I enter that in at on taxes?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have 100 percent tax exempt through military service where do I enter that in at on taxes?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have 100 percent tax exempt through military service where do I enter that in at on taxes?

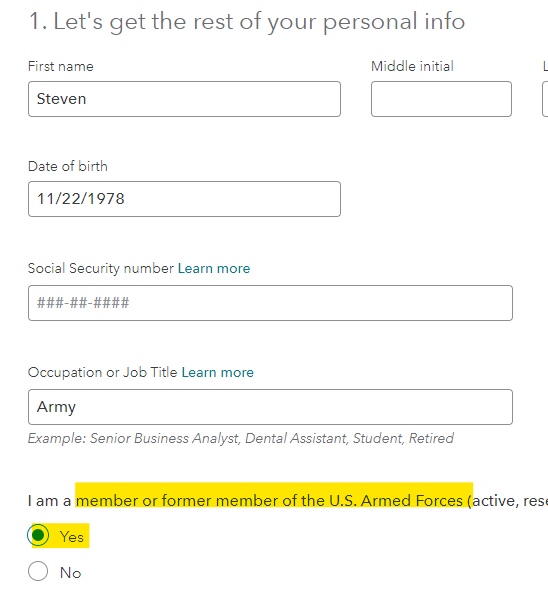

You will enter that information when you enter your personal information. In the My Info section (left side menu), you will indicate you are a military member after you enter your name and birthday in question 1.

The next question is going to ask for your home of record, the state where you lived when you joined the military. Your resident state stays the same unless you file a specific form to change it, and it's part of the info on your Leave and Earnings Statement (LES).

Carefully enter that information to ensure your military income receives the correct tax treatment!

While all pays are taxable, most allowances are tax-exempt. The primary allowances for most individuals are Basic Allowance for Housing/Subsistence (BAH/BAS), which are tax-exempt. CONUS COLA (Continental USA Cost of Living Allowance) is one allowance that is taxable. A law change mandated that every allowance created after 1986 would be taxable. CONUS COLA was authorized in 1995 and, thus became, the first taxable allowance. Tax savings can be significant as BAS and BAH averages over 30% of a member's total regular cash pay. In addition to being tax-exempt from Federal and State taxes, these allowances are also excluded from Social Security taxes.

Military Filing Information on State Websites

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

mread6153

New Member

michael_s_peterson

Level 2

emh_SpencerTop

Level 2

neweyzmedia

New Member

Once a year Accountant

Level 3