- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Military filers

- :

- Are military members with state taxes still obligated to pay those taxes for the full year if not even present there.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Are military members with state taxes still obligated to pay those taxes for the full year if not even present there.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Are military members with state taxes still obligated to pay those taxes for the full year if not even present there.

Generally for military you will have to pay taxes on your military pay to your state of legal residence which is usually your home of record unless you changed it with Form DD Form 2058.

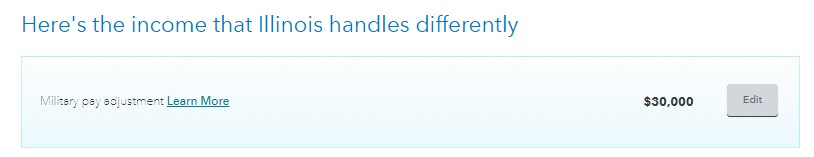

But Illinois has a military pay subtraction please see Pub102 Illinois Filing Requirements for Military Personnel for detailed information.

Please ensure that you have entered Illinois in the State that you lived in in the "My Info" section even when you were stationed somewhere else:

- Login to your TurboTax Account

- Click "My Info" from the left side of your screen

- Click “Edit” next to your name

- Please scroll down to “2. Tell us the state(s) you lived in”

Also, make sure that you checked the active-duty military box for the W-2 on the "Do any of these uncommon situations apply to this W-2?" screen right after you enter your W-2.

Furthermore, when you get to your state return double-check that your military pay is entered correctly on the "Military Pay Exclusion" screen for Illinois.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

lapate

New Member

ericparrish93

New Member

NiCd

Returning Member

Marka81

Level 3

Dragon28

New Member