- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- Why isn't the personal-use % being applied to Sch E certain rental expenses? TurboTax is not calculating this for car/truck, mgmt fees, or ANYTHING within Other Expenses

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why isn't the personal-use % being applied to Sch E certain rental expenses? TurboTax is not calculating this for car/truck, mgmt fees, or ANYTHING within Other Expenses

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why isn't the personal-use % being applied to Sch E certain rental expenses? TurboTax is not calculating this for car/truck, mgmt fees, or ANYTHING within Other Expenses

The Schedule E worksheet is used to allocate expenses before transferring the data to the Schedule E that is filed with your return. There is no IRS guidance with regard to the Schedule E Worksheet, only the Schedule E itself.

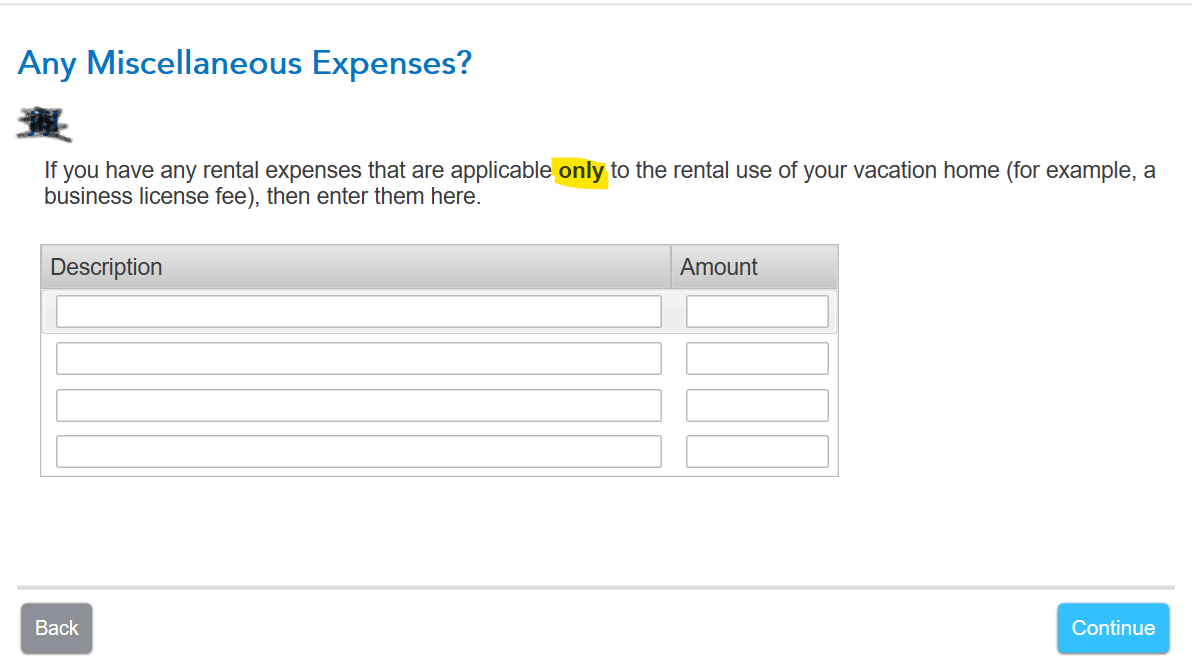

The expenses that you list in the 'other' category are 100% allocated to the rental property itself because that is what TurboTax tells you to enter in that category. If the expense should be allocated between rental and personal use, you will need to do that math before entering the expense.

For a visual reference, see the screenshot below:

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

hijyoon

New Member

Benjamine

Level 4

btuffield

New Member

COSBO

Level 1

DaveFrick

Level 2