- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- Where to include De Minimis Safe Harbor expenses on Schedule E.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where to include De Minimis Safe Harbor expenses on Schedule E.

Wondering whether there are any specific requirements or best practices as to where to put the actual expenses on Schedule E. Whether to:

(a) Roll all De Minimis expenses in with other expenses as part of the Repairs amount on Schedule E.

(b) Use the 'Other Expenses' line.

If (b), is it required to give a description of the actual items (i.e. what the purchase/repair/improvement was), to just write 'Total De Minimis Amount', or something else?

Thank you

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where to include De Minimis Safe Harbor expenses on Schedule E.

Show the Safe Harbor as a Miscellaneous Expense with the explanation of De Minimus Safe Harbor. It is not a repair and would not be included with repairs. It is either a purchased asset or an improvement asset. Repairs included with a major improvement become part of the improvement.

In terms of your other question, physical invoice amount itself is >$2500 but is on a joint owned property i.e. the expense is the 50% share of the invoice which would be for an amount under the limit, here are the rules you need to meet to take this election:

- You don't have an applicable financial statement (most people don't).

- You have a consistent process for how you record expenses and assets.

- You record these items as expenses on your books/records.

- The cost of each item as shown on your receipt is $2,500 or less.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where to include De Minimis Safe Harbor expenses on Schedule E.

You should attach a statement titled "Section 1.263(a)-1(f) de minimis safe harbor election" to the timely filed original federal tax return including extensions for the taxable year in which the de minimis amounts are paid. The statement should include your name, address, and Taxpayer Identification Number, as well as a statement that you are making the de minimis safe harbor election. Under the election, you must apply the de minimis safe harbor to all expenditures meeting the criteria for the election in the taxable year. For more information, see When and how do you make an election provided under the final tangibles regulations?

De Minimis Safe Harbor Election

This election for items $2,500 or less is called the De Minimis Safe Harbor Election. This election is an option you can take each year that lets you write off items $2,500 or less as expenses instead of assets. Expenses typically reduce your income by a larger amount than depreciating an asset over multiple years does. This means you could get a bigger refund.

If you decide to take this option, a form called De Minimis Safe Harbor Election will show up in your tax return. This election will apply to all your businesses, rental properties or farms.

Here are the rules you need to meet to take this election:

- You don't have an applicable financial statement (most people don't).

- You have a consistent process for how you record expenses and assets.

- You record these items as expenses on your books/records.

- The cost of each item as shown on your receipt is $2,500 or less.

How to enter in TurboTax-

- Click on Federal Taxes > Wages & Income [In TT Home & Biz: Business > Continue > I'll choose what to work on]

- In the Rental Properties and Royalties section, click the Start/Update button.

- If you have already started adding information about your business, you will be asked if you want to review your rental and royalty information. Click the Yes box.

- When you come to the Rental and Royalty Summary screen. Click on the Edit box next to the property.

- If you haven't already started adding information about the property, continue through the screens to enter the needed information.

- You will now be on the Review Your [property name] Rental Summary screen.

- In the Assets/Depreciation section, click on the Start/Update box.

- When you come to the screen, Did you buy any items that each cost $2,500 or less in 2020? mark the Yes button and click Continue.

- On the screen Let's see if you qualify to deduct these items as expenses, mark both of the Yes buttons and click Continue.

- On the Now, let's review each item you bought screen, mark whether all your new assets cost $2500 or less.

- If you mark that every item cost $2,500 or less, you will be brought to the Rental Summary screen. You have elected the De Minimis Safe Harbor provision. Proceed with Step 2, below.

- If you mark that some cost above $2,500, you will be asked Did you make improvements to rental in 2020?

- If you say Yes, you will be taken through the screens for the Improvements election.

- If you say No, you will see the screen Do you have any items that aren't covered by your elections? Proceed through the screens to enter these assets.

-for additional information follow this link-

Tangible Property Final Regulations | Internal Revenue Service

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where to include De Minimis Safe Harbor expenses on Schedule E.

Thanks for replying. To clarify, I'm fine as to how to get TT to generate the election statement i.e. no issues with getting to Step 11, and Step 12 does not apply in my case.

What I'm looking to understand is if there is any specific (IRS) rule that says those items being expensed under said election MUST be reflected (e.g. separately) in a particular place on the return.

If you use the "Any Miscellaneous Expenses?" section in TT, they go Line 19 of Schedule E and you need to fill out a description:

If they MUST go here, I am asking whether you have to describe the specific items or if it's permissable to just have one lump sum for all the items included in the election along with a general description such as 'Total De Minimis Expenses'.

If they do not necessarily need to go on Line 19, is it OK to include them in the appropriate boxes e.g. Repairs, Supplies, Cleaning/Maintenance (Lines 5 - 17) as the case may be. The latter case is more straightforward, but there would be no way to tell the amount of expenses you have included under the election that would otherwise have had to be capitalized. It would look like any ordinary Schedule E except that you would have a generic "Section 1.263(a)-1(f) de minimis safe harbor election" statement attached.

In fact, in Step 8 TT tells you "Don't include any items you've already entered as expenses" but it's unclear whether it would have been incorrect to do so whilst still making the election, or if it is simply indicating there will be another way to enter them later (as Misc Expenses) if you have not already included them in your regular expenses.

Thank you.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where to include De Minimis Safe Harbor expenses on Schedule E.

In the days of old when I started doing taxes, anything over $100 was depreciated. Times changed and we got up to about $250. Along comes de minimis and suddenly you are expensing $2,500 items instead of depreciating them. They go on the correct line of the return, supplies, maintenance, whatever is the appropriate field.

For example:

If you are ever audited and they look through your expenses, they just better not find a $4,000 item, like a jacuzzi, listed in with your expenses rather than being depreciated.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where to include De Minimis Safe Harbor expenses on Schedule E.

That's great, I appreciate the clarification. Not to contradict you, but in between posting and seeing your reply I came across this verbiage in Pub 527:

De minimis safe harbor for tangible property.

If you elect this de minimis safe harbor for your rental activity for the tax year, you aren’t required to capitalize the de minimis costs of acquiring or producing certain real and tangible personal property and may deduct these amounts as rental expenses on line 19 of Schedule E. For more information on electing and using the de minimis safe harbor for tangible property, see chapter 1 of Pub. 535.

Just thought I would put that out there in case of any comment, but I don't take this to mean you have to use Line 19. Having let this sink in some more, I guess in many cases the item in question doesn't fit one of the standard expense categories otherwise you probably wouldn't have had the dilemma as to whether to depreciate or take the safe harbor in the first place (hence Line 19). But if it does, it does i.e. I understand that something that would seem to a lay person to be a repair, but that IRS rules would regard as a depreciable 'restoration', can now just go into the Repair line under the safe harbor.

No jacuzzis but in case you are bored, I have a semi-related question to clarify whether there is any issue if the physical invoice amount itself is >$2500 but is on a joint owned property i.e. the expense is the 50% share of the invoice which would be for an amount under the limit:

Thanks again.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where to include De Minimis Safe Harbor expenses on Schedule E.

Show the Safe Harbor as a Miscellaneous Expense with the explanation of De Minimus Safe Harbor. It is not a repair and would not be included with repairs. It is either a purchased asset or an improvement asset. Repairs included with a major improvement become part of the improvement.

In terms of your other question, physical invoice amount itself is >$2500 but is on a joint owned property i.e. the expense is the 50% share of the invoice which would be for an amount under the limit, here are the rules you need to meet to take this election:

- You don't have an applicable financial statement (most people don't).

- You have a consistent process for how you record expenses and assets.

- You record these items as expenses on your books/records.

- The cost of each item as shown on your receipt is $2,500 or less.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where to include De Minimis Safe Harbor expenses on Schedule E.

Show the Safe Harbor as a Miscellaneous Expense with the explanation of De Minimus Safe Harbor. It is not a repair and would not be included with repairs. It is either a purchased asset or an improvement asset. Repairs included with a major improvement become part of the improvement.

In terms of your other question, physical invoice amount itself is >$2500 but is on a joint owned property i.e. the expense is the 50% share of the invoice which would be for an amount under the limit, here are the rules you need to meet to take this election:

- You don't have an applicable financial statement (most people don't).

- You have a consistent process for how you record expenses and assets.

- You record these items as expenses on your books/records.

- The cost of each item as shown on your receipt is $2,500 or less.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where to include De Minimis Safe Harbor expenses on Schedule E.

Show the Safe Harbor as a Miscellaneous Expense with the explanation of De Minimus Safe Harbor. It is not a repair and would not be included with repairs. It is either a purchased asset or an improvement asset. Repairs included with a major improvement become part of the improvement.

In terms of your other question, physical invoice amount itself is >$2500 but is on a joint owned property i.e. the expense is the 50% share of the invoice which would be for an amount under the limit, here are the rules you need to meet to take this election:

- You don't have an applicable financial statement (most people don't).

- You have a consistent process for how you record expenses and assets.

- You record these items as expenses on your books/records.

- The cost of each item as shown on your receipt is $2,500 or less.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where to include De Minimis Safe Harbor expenses on Schedule E.

Thank you RayW7 for the "How to enter in TurboTax" portion of your answer! I had been struggling to find the way to generate that de minimis safe harbor election form.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where to include De Minimis Safe Harbor expenses on Schedule E.

Your answer looks tailor made for my question - almost - except that I am looking to do it on Schedule C. Everything seems to be going fine, including questions about $2,500 or less but never the term "safe harbor' and when I get to your Step 11, I see nothing like "You have elected the De Minimis Safe Harbor provision. Proceed with Step 2, below.:"

My only choice for an immediate deduction (other than possibly depreciation which I don't want) is listed as "I'll deduct the full value of the item this year (Take the Safe Harbor) " which just ends up listing it as S179, which is not what I want, because I don't want recapture.

PS Turbotax's line of questioning is very confusing to me as to if this should be under Other Miscellaneous Expenses (under Business Expenses) or under Business Assets, but neither way worked.

Please help soon. I've been struggling with this for 10 hours! Even an enrolled agent on their phone lines can't figure it out. Thanks much.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where to include De Minimis Safe Harbor expenses on Schedule E.

It doesn't look like RayW has been posting for almost a year (hope he's OK), so I am wondering if you can help me. I just replied to the advice you ended up thanking him for and, because mine is via a Schedule C ,rather than E, perhaps your experience will not help me but could you please look and see. I simply cannot get that de minimis safe harbor election form to show up. Thank you!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where to include De Minimis Safe Harbor expenses on Schedule E.

I did eventually figure this out via some help on another thread, so I retract the question.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where to include De Minimis Safe Harbor expenses on Schedule E.

The Safe Harbor Election covers all assets purchased during the tax year for a Schedule C business, Rental Properties, or a Home Office. If you have made the election once, it covers your entire return.

When you Edit/Update your Schedule C (Self-Employed) business, scroll down to Business Assets and Edit/Update. You should see a question "Do you want to go directly to your asset summary?" If you check the box for "No, I want to review my answers to the annual elections questions," you will be asked again about the Safe Harbor Election (although the pages may not use those words).

If you haven't yet gone through the Assets section, simply click Start and follow the prompts.

When you elect this special treatment and report those costs as Business Expenses, your return will include a statement called "Section 1.263(a)-1(f) De Minimis Safe Harbor Election."

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where to include De Minimis Safe Harbor expenses on Schedule E.

If I take the Safe Harbor Election for my Schedule C business, where all of my assets cost under $2500, TT directs me make sure that I entered them under Miscellaneous Expenses. Quickbooks SE imported my expenses already and under miscellaneous expenses they are broken down as other business expenses, apps/software/services, etc. with some categories having total amounts over $2,500. My question is whether it is acceptable to have my expenses grouped this way, or do I need to have a de minimis safe harbor category, or do I need to write out each individual asset that falls under the safe harbor election and put them each on their own line. Thank you for any input.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where to include De Minimis Safe Harbor expenses on Schedule E.

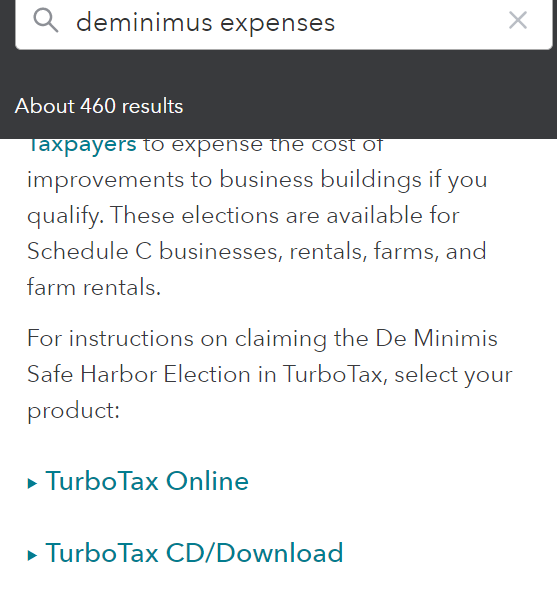

In the Miscellaneous expense category, you would list each individual asset that falls under the safe harbor election and put them each under their own seperate line. If you type in the search bar of your program deminimus expenses and scroll down a little, you will see how to enter the miscellaneous items both under the online version and the desktop version like this

Hope this works for you.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

ekudamlev

New Member

scatkins

Level 2

realestatedude

Returning Member

currib

New Member

user17523314011

Returning Member