- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- Where to enter purchase closing cost as cost basis on sale of a rental converted from primary

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where to enter purchase closing cost as cost basis on sale of a rental converted from primary

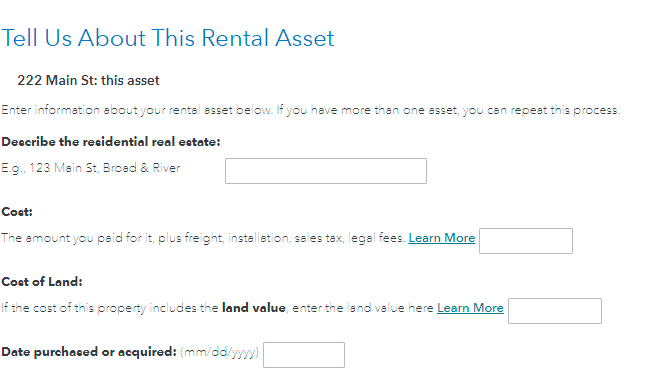

I converted primary home to rental for 2 years and sold in 2020. I'm using Turbotax premier. Where to enter the closing cost paid at purchase? I paid real estate commissions on purchase so it's a material amount to add to the cost basis. I tried to add as a separate asset in the rental disposition section and Turbotax asks in service date treating it as asset or improvement. But purchase closing cost doesn't amortize, does it?

Thanks

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where to enter purchase closing cost as cost basis on sale of a rental converted from primary

Do not include a separate asset, simply add it to the basis of the property.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where to enter purchase closing cost as cost basis on sale of a rental converted from primary

Your amortized costs are only entered in the assets/depreciation section when you purchase the property. When you sell the property it just gets added to the cost basis of the property, or included in your sales expenses.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

user17545861291

Level 2

eric6688

Level 2

user17524181159

Level 1

eric6688

Level 2

mamamahon1

New Member