- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- Where to enter data from schedule K-1 section 199A information, Box 20, Code Z STMT?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where to enter data from schedule K-1 section 199A information, Box 20, Code Z STMT?

On my K-1 Section 199A info, Box 20, Code Z; I have the following info:

Description:

Trade or Business - Entity Expenses

Ordinary Income (LOSS) - <85>

Passthrough - ABC 2013, LLC

Ordinary Income (LOSS). - <9,872>

Unadjusted Basis of Assets. - 71,880

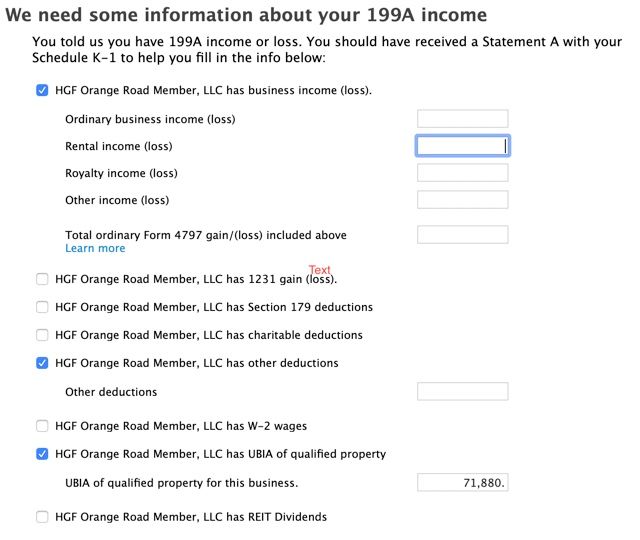

I have made it to this box and in searching I believe the 71,880 belongs where i put it in the UBIA of qualified property box, but if you can confirm I am right? So I am not sure how to enter the <85> and the <9,872>. Can you please advise me which boxes these 2 numbers belong in? Thank you in advance for your help!

Greg K

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where to enter data from schedule K-1 section 199A information, Box 20, Code Z STMT?

Because your K-1 is reporting Section 199A information generated by the partnership and Section 199A information generated by a passthrough entity, you'll need to "split" this K-1 into two separate K-1s for entry into TurboTax. Enter one K-1 with only the "box" amounts generated by the partnership, and a second K-1 with only the "box" amounts generated by the passthrough entity. If you can't figure (deduce) that "split" from the information you have, you will need to contact the preparer of the K-1 to get those amounts.

Note that when you enter each K-1, you'll encounter the question "Is the business that generated the Section 199-A income a separate business owned by the partnership?" screen, TurboTax is asking if the Section 199-A income was passed through to the partnership sending you the K-1 by another partnership, S-Corp, or trust; versus being generated by the business operations of the partnership that sent you the K-1.

The Section 199A loss amounts go on the "Ordinary business income (loss)" line as a negative number. The Unadjusted Basis of Assets amount goes on the "....has UBIA of qualified property" line.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where to enter data from schedule K-1 section 199A information, Box 20, Code Z STMT?

Thanks David, but a bit confused as to why I'd need to make 2 K-1's from this one that I received? I've been a limited partner for a few years and never split my K-1's in prior years? They seemed to change this Box 20 this year using this STMT as an amount? Last year my Box 20 code Z had a dollar amount listed. Doesn't that screen I pasted from TT give the ability to split this <9,872> and <85>? These 2 amounts total what is in my Box 1.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where to enter data from schedule K-1 section 199A information, Box 20, Code Z STMT?

Can David or anyone provide follow up?

Greg

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where to enter data from schedule K-1 section 199A information, Box 20, Code Z STMT?

No, you can't enter both those amounts on one K-1 in 2019. You'll need one K-1 with the amounts related to the "entity" and another for the "Pass Through - ABC 2013, LLC. The box 1 on the "entity" K-1 will have the ($85) loss, and the box 1 on the "pass through" K-1 will have the ($9,872) loss.

The first year for the "Section 199A Qualified Business Income Deduction" would have been 2018, when the QBI deduction was implemented.

TurboTax changed the "screens" for entry of this information in 2019 versus 2018, because in 2018 the IRS used separate codes AA, AB, AC, and AD to report the Section 199A information. In 2019, all that information goes on a Statement/STMT instead of having separate codes for each component of Section 199A information. See the 2018 Form 1065 K-1, page 2, box 20 codes at this link. Compare those to the 2019 Form 1065 K-1, page 2, box 20 codes at this link.

You would have to look back at the 2018 K-1 to see if it also reported two separate entities (the partnership itself and the pass-through entity) with Section 199A information.

The reason for the two separate K-1s is that QBI information gets tracked year to year by entity so as to track losses that carry forward to future years to offset QBI income.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where to enter data from schedule K-1 section 199A information, Box 20, Code Z STMT?

The Unadjusted Basis of Assets amount goes on the "....has UBIA of qualified property" line.

Thankyou! I don't know why TurboTax doesn't just use the phrase on the form instead of the acronym. This is exactly what I needed to know!

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

mellynlee1

Level 3

justine626

Level 1

leo-jyz

Level 1

RMD20201

Level 3

cecastillo

New Member