- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- Where does TT Premier capture all the information from the sale of a rental?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where does TT Premier capture all the information from the sale of a rental?

I sold a rental last year. I clicked on the box that said I sold this rental, but it has not queried me about commissions, inspection fees, escrow fees, etc?

I "disposed" of the the items that were being depreciated.

I am running Windows desktop.

Thank you, Fred

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where does TT Premier capture all the information from the sale of a rental?

Assuming the last occupant to move out of the property prior to closing on the sale, report the sale in the SCH E section of the program, using the guidance below.

Reporting the Sale of Rental Property

If you qualify for the "lived in 2 of last 5 years" capital gains exclusion, then when prompted you WILL indicate that this sale DOES INCLUDE the sale of your main home. For AD MIL personnel who don't qualify because of PCS orders, select this option anyway, because you "MIGHT" qualify for at last a partial exclusion.

Start working through Rental & Royalty Income (SCH E) "AS IF" you did not sell the property. One of the screens near the start will have a selection on it for "I sold or otherwise disposed of this property in 2019". Select it. After you select the "I sold or otherwise disposed of this property in 2019" you continue working it through "as if" you still own it. When you come to the summary screen you will enter all of your rental income and expenses, even it it's zero. Then you MUST work through the "Sale of Assets/Depreciation" section. You must work through each individual asset one at a time to report its disposition (in your case, all your rental assets were sold).

Understand that if more than the property itself is listed in your assets list, then you need to allocate your sales price across all of your assets. You will only allocate the structure sales price; you will NOT allocate the land sales price, since the land is not a depreciable asset. Then if you sold this rental at a gain, you must show a gain on all assets, even if that gain is $1. Likewise, if you sold at a loss then you must show a loss on all assets, even if that loss is $1

Basically, when working through an asset you select the option for "I stopped using this asset in 2019" and go from there. Note that you MUST do this for EACH AND EVERY asset listed.

When you finish working through everything listed in the assets section, if you ever at any time you owned this rental you claimed vehicle expenses, then you must also work through the vehicle section and show the disposition of the vehicle. Most likely, your vehicle disposition will be "removed for personal use", as I seriously doubt you sold your vehicle as a part of this rental sale.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where does TT Premier capture all the information from the sale of a rental?

Hi Carl,

I have done all that, but I haven't made it to the the dialog where it captures real estate commissions, title insurance, inspections, etc. It dropped out of the rental section and is on to the next topic.

I'm wondering when does it do the "final closing costs"?

Thanks, Fred

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where does TT Premier capture all the information from the sale of a rental?

They're called sales expenses (for you the seller), and there's a box for "Sales Expenses" on every screen where you have a Sales Price box. Typically, the only sales expenses a seller has, are the commission fees. All other fees are usually (but not always) paid by the buyer.

Expenses associated with the acquisition of the loan (which the seller will not have) are capitalized and depreciated over the life of the loan. One (of many) example would be the survey fee if required by the lender as part of the loan approval process.

Expenses associated with acquisition/disposition of the property are added to/subtracted from the cost basis of the property. Typically, the only cost the seller would have for this, would be the commission paid to the real estate agent. But there most certainly could be others, such as listing fees if *you* paid the listing fees yourself, outside of the commission. All such expenses are sales expenses, and the program has a box for that on each individual asset in the Sale of Assets/Depreciation section.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where does TT Premier capture all the information from the sale of a rental?

From your reply:

"All such expenses are sales expenses, and the program has a box for that on each individual asset in the Sale of Assets/Depreciation section."

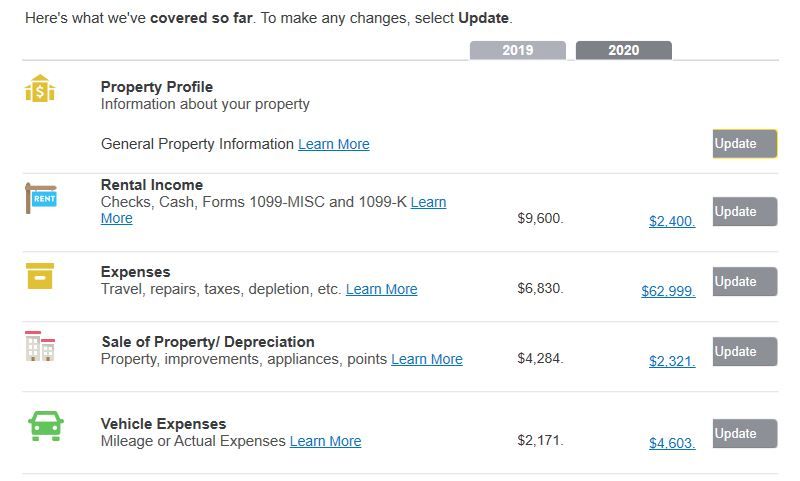

Is that the topic called "Sale of Property/Depreciation" in 2020, under "Review Your XXXX Rental Summary?

Thanks, Fred

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where does TT Premier capture all the information from the sale of a rental?

Yes.

If the topic is titled "Assets/Depreciation" then that means you did not select the option for "I sold or disposed of this property in 2020", which is a checkbox you see on one of the screens about 3 screens in, when you elect to edit the rental property.

If the topic is titled "Sale of Assets/Depreciation" then that means you did (correctly) select the option to indicate you sold or otherwise disposed of the property in 2020.

When you click/edit the Sale of Assets/Depreciation section, you'll be shown a list of all assets entered. *You may have to select the "go straight to my asset summary" radiobox, then continue* to get to that list. At an absolute minimum, you will see the property itself listed there. You have to edit and work through each individual asset one at a time to report your sale or disposition of that asset.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where does TT Premier capture all the information from the sale of a rental?

I just verified, I did check the box "I sold or disposed of this property in 2020., third page in under "Property Profile".

I entered all of the repairs/improvements/etc. under Expenses.

At which point I have the following main screen

I'm not finding either of the two topics you mentioned, "Assets/Depreciation" nor "Sale of Assets/Depreciation".

The only two assets I have are the loan origination fee and the property. Everything else was depreciated. The $2,321 is this years allowance of depreciation.

I am obviously missing something.

Sorry, Fred

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where does TT Premier capture all the information from the sale of a rental?

I entered all of the repairs/improvements/etc. under Expenses.

Ummmm... property improvements are entered in the "Sale of Assets/Depreciation" section.

If the property improvements were done after the last renter moved out and therefore never placed "in service", they do not get depreciated. But adding them in the depreciation section increases your cost basis in the property, thus reducing your taxable gain on the sale. It is wrong to enter property improvements in any section other than the "sale of assets/Depreciation" section. Being that you sold the property after the improvements were done, there is no tax advantage to using the "safe harbor" option that allows you to deduct those improvements in the expenses section, if the improvement qualifies for safe harbor.

When entering those property improvements, make the "in service" date the date you closed on the sale. Then make the business use percentage 0% or as low as you can. That way, no depreciation will be taken since you don't depreciate assets that were never placed in service.

You'll have to work through the "Sale of assets/Depreciation" section twice. The first time is to enter the property improvements. Then the 2nd time is to report the sale of everything listed in that section.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where does TT Premier capture all the information from the sale of a rental?

You keep referring to "Sale of Assets/Depreciation" section.

I can not find it. Where is it?

The renter was moved to a nursing home. While at the nursing home he passed away. He had two small dogs and did not do his part in keeping the property properly maintained. I had to entirely gut the house and while doing so, I updated the flooring, kitchen counters, blinds, landscaping, new A/C, etc. Are those repairs or improvements? Also there is material cost and labor cost.

I understand

"Ummmm... property improvements are entered in the "Sale of Assets/Depreciation" section.

If the property improvements were done after the last renter moved out and therefore never placed "in service", they do not get depreciated..."

Thanks, Fred

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where does TT Premier capture all the information from the sale of a rental?

@Fey42 wrote:

You keep referring to "Sale of Assets/Depreciation" section.

I can not find it. Where is it?

The section is in the screenshot in your post.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where does TT Premier capture all the information from the sale of a rental?

Since I"m not familiar with the online version, all I can tell you is to start working through the rental property from the beginning of the Rental & Royalty Income (SCH E) section of the program. You will eventually come to it. You *HAVE* to come to it, if you work through everything *AS* *IF* you never sold the property.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where does TT Premier capture all the information from the sale of a rental?

I am not using the online version, I am using the Windows desktop version.

I sort of assumed you were referring to the section you highlighted, but the words were not identical, that is why I kept asking.

So it leaves the question.

@Fey42 "I had to entirely gut the house and while doing so, I updated the flooring, kitchen counters, blinds, landscaping, new A/C, etc. Are those repairs or improvements?"

Or does it even matter, since they will not be depreciated?

Also what about division between materials and labor?

When going down the Sales Information rabbit hole, the first thing it wants is Sales Information on the Loan Origination Fee. At which point I reached a conclusion. Although I consider myself reasonably intelligent, I am swimming in technical jargon that is eluding me. Does TT "Live Help" have the ability to help me, or do I need outside local services?

Thanks, Fred

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where does TT Premier capture all the information from the sale of a rental?

I see on your screen it's called "Sale of Property/Depreciation". I just checked my desktop version of Home & Business, and turns out it reads the same as yours. Apparently, TurboTax made this change in wording with no warning. Of course, for something as simple as that, I wouldn't expect a warning. But since you are the first to point it out, I assume that 2020 is the first tax year they made this change. I checked the desktop version for 2019, and it also has "property" instead of assets. No one called me on that last year. So I have no idea when that change was made.

But it's okay for one to have a self-induced thought to figure that out themselves. Even if that self-induced thought is wrong, it's not like the IRS is going to send an unmarked black helo to hog tie one and carry them to the IRS dungeon because they had the audicity to think for themselves. 🙂

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where does TT Premier capture all the information from the sale of a rental?

@Fey42 You are apparently in the wrong section. You should see a screen identical to the screenshot below.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where does TT Premier capture all the information from the sale of a rental?

I agree, since I can not find that screen.

I'm not sure how to proceed. I can take screen shots and post them in this conversation or I can take a video of my steps and post a link to that video.

What is your preference?

Thanks, Fred

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Fran D

Level 2

Feelenjoy

Level 2

parkertm93

New Member

DA960

Level 2

slorentzen

New Member