- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- Where do I enter information for form 3921? When I go to the "Stocks, Bonds, Mutual Funds" area which is supposed to cover 3921, it only allows me to enter 1099-B stuff.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter information for form 3921? When I go to the "Stocks, Bonds, Mutual Funds" area which is supposed to cover 3921, it only allows me to enter 1099-B stuff.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter information for form 3921? When I go to the "Stocks, Bonds, Mutual Funds" area which is supposed to cover 3921, it only allows me to enter 1099-B stuff.

In the same Investment Income section, scroll down to ISO Exercise and Hold and Start. TurboTax will ask if you bought the Incentive Stock Options in 2020 and whether or not they were sold during 2020 through the interview.

For more information about incentive stock options, see 2020 Publication 525: Taxable and Nontaxable Income beginning on page 12, Column 2.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter information for form 3921? When I go to the "Stocks, Bonds, Mutual Funds" area which is supposed to cover 3921, it only allows me to enter 1099-B stuff.

In that section, after going through the wizard about buying/selling in the same year, it says "Since you sold this ISO stock in the same year you bought it, you don't need to report anything here. Make sure to report the ISO stock sale as an Investment Sale."

There is no way to enter a 3921 here...

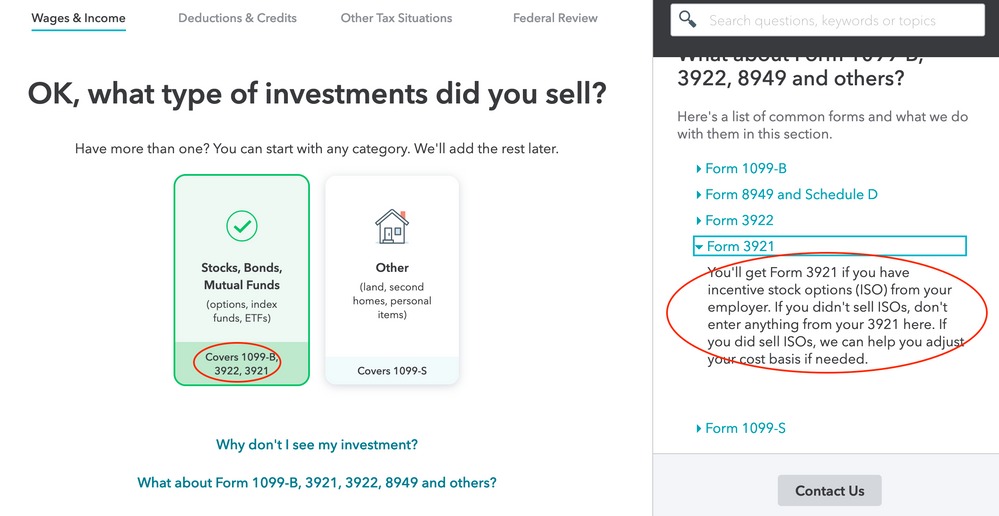

The "Stocks, Bonds, Mutual Funds" section says that it "Covers 1099-B, 3922, 3921," but when you continue it only gives you a chance to enter information from a 1099-B.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter information for form 3921? When I go to the "Stocks, Bonds, Mutual Funds" area which is supposed to cover 3921, it only allows me to enter 1099-B stuff.

In TurboTax Online, use the search feature in the upper right section of the screen and type in 3921.

Click on Form 3921 and then select Jump to form 3921 below the search box.

Follow the prompts.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter information for form 3921? When I go to the "Stocks, Bonds, Mutual Funds" area which is supposed to cover 3921, it only allows me to enter 1099-B stuff.

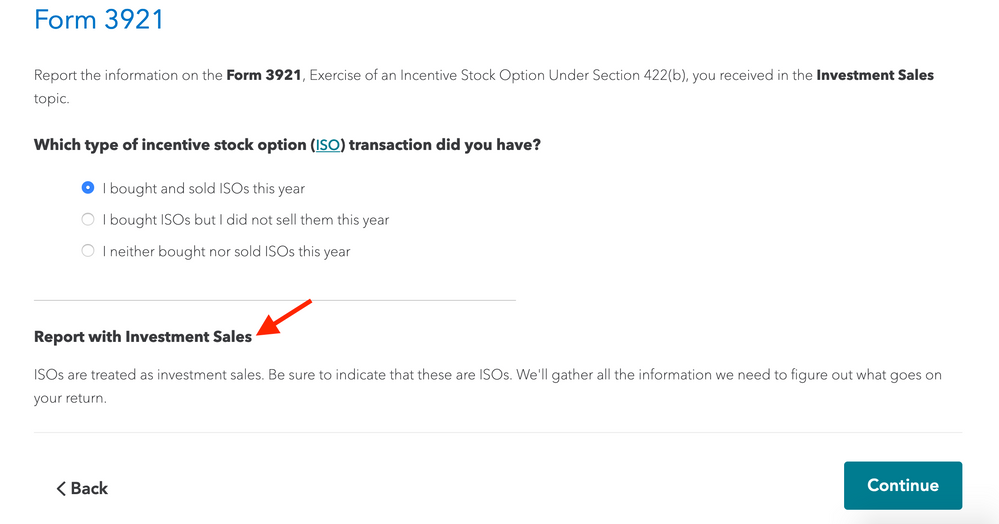

Yes, this does take me to form 3921, however the first interview question is this, which directs me to "Report with Investment Sale"

It then takes me to this screen and assures me that 3921 will be take care of:

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter information for form 3921? When I go to the "Stocks, Bonds, Mutual Funds" area which is supposed to cover 3921, it only allows me to enter 1099-B stuff.

[forum seems to only allow 1 screenshot]

It then takes me to this screen and assures me that 3921 will be take care of:

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter information for form 3921? When I go to the "Stocks, Bonds, Mutual Funds" area which is supposed to cover 3921, it only allows me to enter 1099-B stuff.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter information for form 3921? When I go to the "Stocks, Bonds, Mutual Funds" area which is supposed to cover 3921, it only allows me to enter 1099-B stuff.

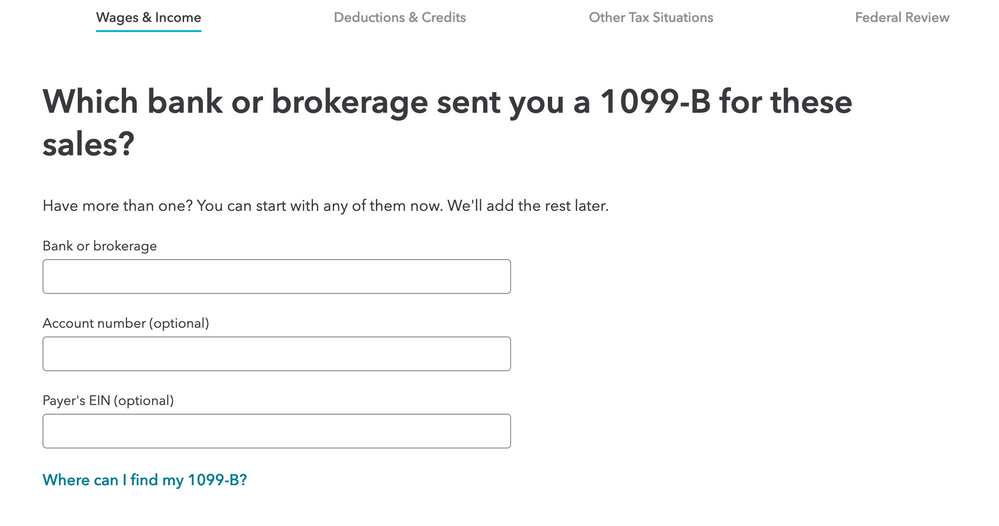

And then it moves into 1099-B language, which I don't have...

What am I missing?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter information for form 3921? When I go to the "Stocks, Bonds, Mutual Funds" area which is supposed to cover 3921, it only allows me to enter 1099-B stuff.

3921 is an informational form only. It is generally not entered on your tax return unless you then sold the stock, or if you could be subject to alternative minimum tax (AMT).

When you receive form 3921, this means that your employer transferred stock to you because you exercised an incentive stock option (ISO). Because this is a statutory stock option, there are generally no tax consequences for having exercised the option.

To be on the safe side, you can enter the information contained in form 3921 in case you are subject to AMT or to have the information available for future sale of the stock.

Please follow these steps:

- While in your federal return, click the Search icon in the top right of your screen.

- Type 3921 in the box and click the magnifying glass.

- In the search results, click the Jump to 3921 hyperlink.

- Continue through the interview, entering the requested information.

Answer adapted from IreneS

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter information for form 3921? When I go to the "Stocks, Bonds, Mutual Funds" area which is supposed to cover 3921, it only allows me to enter 1099-B stuff.

Necromancing this post cause the same thing was pissing me off for a whole afternoon, and I'm sure to forget and end up Googling this again next year.

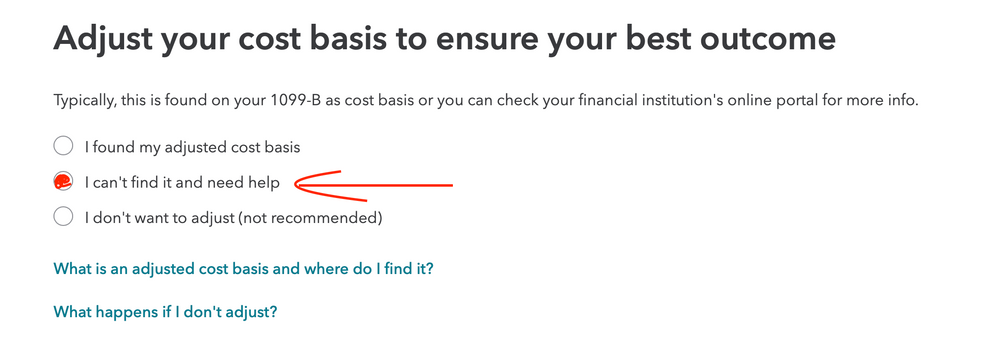

From memory last year there was some other obscure option to enter 3921 info for your 1099-b ISO sale. For this year you click the option below and it takes you through an interview to add 3921 info so you can report your AMT cost basis correctly. That makes perfect sense, as "I can't find it and need help" is exactly where you end up after looking everywhere else in the app for two hours.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter information for form 3921? When I go to the "Stocks, Bonds, Mutual Funds" area which is supposed to cover 3921, it only allows me to enter 1099-B stuff.

After looking for an hour, I can pretty confidently say that the searching for form 3921 doesnt bring up any helpful information about filing this form.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter information for form 3921? When I go to the "Stocks, Bonds, Mutual Funds" area which is supposed to cover 3921, it only allows me to enter 1099-B stuff.

Form 3921 is an IRS form that reports the exercise of an employee Incentive Stock Option (ISO). It is an informational form only. It is generally not entered on your tax return unless you then sold the stock, or if you could be subject to alternative minimum tax (AMT).

For more details, here is a help article on Incentive Stock Options.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter information for form 3921? When I go to the "Stocks, Bonds, Mutual Funds" area which is supposed to cover 3921, it only allows me to enter 1099-B stuff.

Hi @FangxiaL ! Thanks for the quick reply.

I fall in category 1 of the document you linked and am looking for a way to make an AMT adjustment that includes my Bargain Element

I exercised and held ISOs this year, and would like to file my form 3921 to see if Im liable for the AMT. The 'stocks, bonds, and mutual funds' option lists form 3921, but does not have an option to enter this information. AMT tabs likewise don't have a place to disclose 3921. I also wasn't able to find the button linked above in 1099-B forms.

Im using turbotax premier to file 2021 taxes. Could you please tell me the buttons I should click to file the form 3921? If not, Ill have to use different tax software.

Thanks!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter information for form 3921? When I go to the "Stocks, Bonds, Mutual Funds" area which is supposed to cover 3921, it only allows me to enter 1099-B stuff.

As a follow-up to previous posts, you won't be preparing and/or filing a Form 3921 and neither will TurboTax generate such form for you. Your Employer had an obligation to send you Form 3921 when they transferred their stock to you pursuant to your exercise of an incentive stock option (ISO). You must recognize (report) gain or loss on your tax return for the year in which you sell or otherwise dispose of the stock; however, in your case there is no gain or loss to report because you did not sell your ISOs. IRS instructions also provide that employees should keep Form 3921. Thus, you will not be submitting Form 3921 with your return. Your employer would have already filed such form with the IRS.

To determine what, if any, AMT you may owe, and if you are using TurboTax Premier online, then to enter your ISO information follow these steps:

- Go to Income & Expenses

- Scroll down to the category Stocks, Cryptocurrency, Mutual Funds, etc.

- Click on the drop-down arrow to open the window if necessary

- Select ISO Exercise and Hold

As you enter your information in this section, your AMT, if any, will be displayed and if you must pay the AMT, TurboTax will include this tax on your return.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter information for form 3921? When I go to the "Stocks, Bonds, Mutual Funds" area which is supposed to cover 3921, it only allows me to enter 1099-B stuff.

I'm having a similar issue here - I did receive a 3921 BUT I exercised AND SOLD these options at the same time. I'm having the same trouble as those above - I said I bought/sold in same year so it's telling me to report as an investment sale, but not finding any place to enter that sale as I did not receive 1099b. Do I just enter in the sale under Investment Income / Stocks, Mutual Funds, Bonds, Other (I'm using Home & Business) and enter manually the information I have?

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

nrmheath

New Member

DavidRaz

New Member

hickmond38

New Member

az148

Level 3

reneesmith1969

New Member