- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- Unable to file Robinhood taxes due to the sale of a free Robinhood Stock

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Unable to file Robinhood taxes due to the sale of a free Robinhood Stock

Hello,

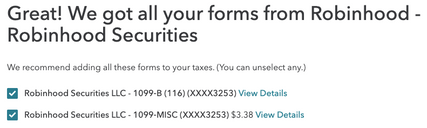

I am desperately hopeful someone can help me with this issue. After uploading my Robinhood trading history in TurboTax Premier, I am shown two separate forms, Robinhood Securities LLC - 1099-B, and Robinhood Securities LLC - 1099-MISC.

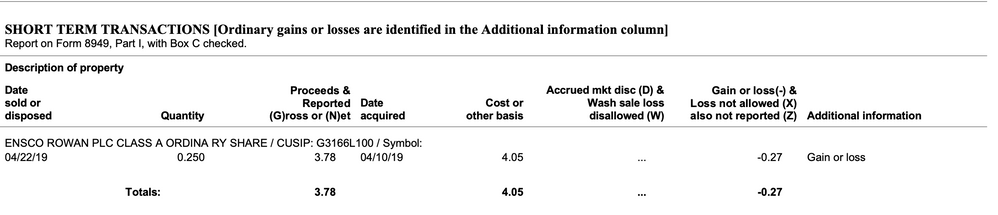

The 1099-MISC is for a free share I sold that was given to me by Robinhood for signing up, here is the description of the property.

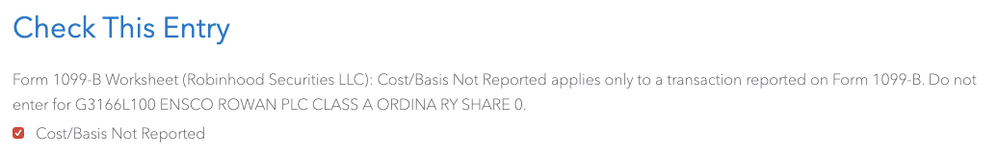

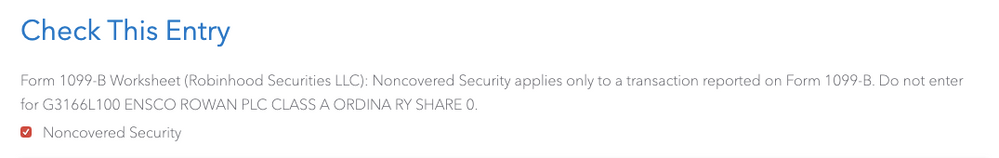

When finalizing my taxes, I am struck with three 'Check This Entry' pages, all of which using technical jargon pertaining to the free stock issued to me by Robinhood, in relation with my 1099-B. See below:

I cannot for the life of me figure out what needs to be changed to prevent these 'Check This Entry' pages from arising before finalizing my taxes.

Please help!!!

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Unable to file Robinhood taxes due to the sale of a free Robinhood Stock

Try deleting the 1099-B import and then entering it again manually.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Unable to file Robinhood taxes due to the sale of a free Robinhood Stock

Check to see if the 1099-MISC was entered as a 1099-MISC.

If that 1099-MISC is associated with a Schedule C (self-employment income for a trader business you operate) you could double-click that box and you should be able to select your Schedule C.

If on the other hand it is a promotional payment associated with personal investing, that 1099-MISC is not self-employment income, and when you enter the 1099-MISC you should designate it a "Robinhood incentive", and on the next screen designate it as either "prize winnings" or "manufacturer's incentive" depending on which you consider it to be.

You go to the Wages and Income>>Income from Form 1099-MISC section to check the entry of your 1099-MISC.

If you also sold that stock during the year, you have a "basis" in the promotional stock equal to the amount you reported from the 1099-MISC as income when you received the stock (which is equal to the fair market value when you receive the stock). So, when you sell the stock, the difference between what you received (proceeds) and that cost basis is a gain or loss.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

whalkides

Level 2

yvonne-uq

New Member

alexherrera00

New Member

Alisha1976

New Member

MKW31

Level 1