- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- TurboTax - Depreciation Not Being Calculated at All

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax - Depreciation Not Being Calculated at All

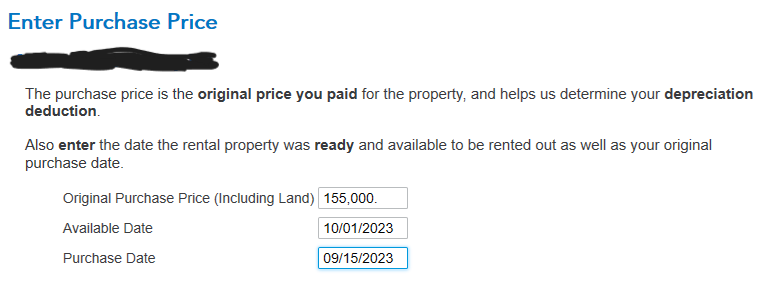

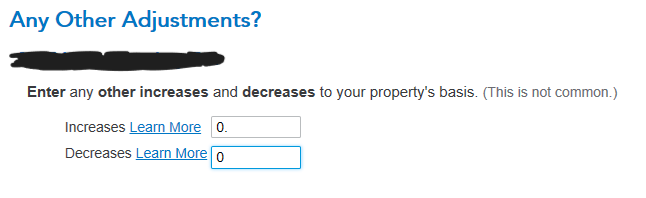

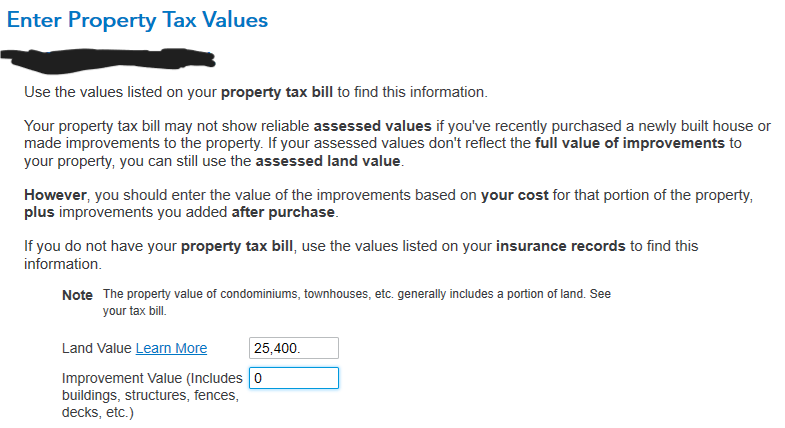

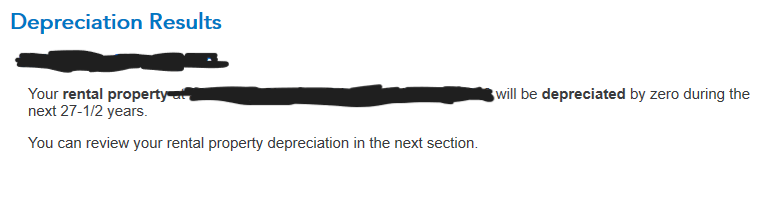

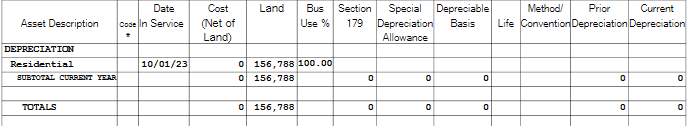

I entered all of my rental property information and Turbo Tax has incorrect information on the Depreciation Report as well as not calculating any depreciation. My purchase price was $155,000 and the land value is $25,400. On the Depreciation Report the land value field has $156,788 and nothing in the Cost (Net of Land) field. This is obviously why my depreciation is zero, but I have no idea where it's getting this value from and why the Cost field has nothing in it.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax - Depreciation Not Being Calculated at All

My purchase price was $155,000 and the land value is $25,400

The most common reason this occurs, is because the user misinterpreted the information being asked for. Easy to do with the way things are worded.

COST - For you, enter $155,000

COST OF LAND - Enter $25,400

You also most likely entered a number greater than zero, for the number of days of personal use. Again, easy to do if one misinterprets the small print on that screen. You may have entered less than 100% business use too, which is usually incorrect. Also, use the information below to check all of your entries pertaining to the data for that asset, that you enter in the Assets/Depreciation section for the property.

Rental Property Dates & Numbers That Matter.

Date of Conversion - If this was your primary residence or 2nd home before, then this date is the day AFTER you moved out, or the date you decided to lease the property – whichever is later.

In Service Date - This is the date a renter "could" have moved in. Usually, this date is the day you put the FOR RENT sign in the front yard.

Number of days Rented - the day count for this starts from the first day a renter was contracted to move in, and/or "could" have moved in. That would be your "in service" date or after if you were asked for that. Vacant periods between renters do not count for actual days rented. Please see IRS Publication927 page 17 at https://www.irs.gov/pub/irs-pdf/p527.pdf#en_US_2020_publink1000219175 Read the “Example” in the third column.

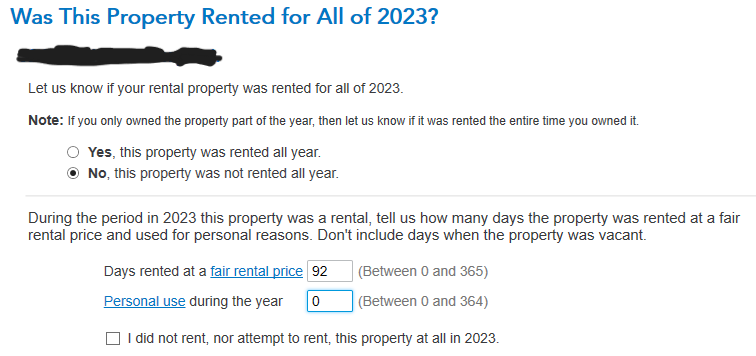

Days of Personal Use - This number will be a big fat ZERO. Read the screen. It's asking for the number of days *YOU* lived in the property AFTER you converted it to a rental. I seriously doubt (though it is possible) that you lived in the house (or space, if renting a part of your home) as your primary residence, 2nd home, or any other personal use reasons after you converted it to a rental.

Business Use Percentage. 100%. I'll put that in words so there's no doubt I didn't make a typo here. One Hundred Percent. After you converted this property or space to rental use, it was one hundred percent business use. What you used it for prior to the date of conversion doesn't count.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax - Depreciation Not Being Calculated at All

Carl,

Thanks for the quick reply and detailed information. Unfortunately, all of the things you pointed out I have done. That's why I'm baffled by it not being correct. Playing around with it some more...the only way I can get it to calculate depreciation is if I enter a non-zero amount of time for personal use (weird I know). Then I change it back to 0 and the depreciation stays there but is not the correct amount either. I even deleted the entire property entry and started over and still get the same result. I'm hoping I'm missing something simple, but I have done everything you suggested.

Ryan

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax - Depreciation Not Being Calculated at All

I've no doubt you're missing something, and it's probably simple. Otherwise, if it was a program issue there would be hundreds, if not thousands of posts about it, this far into the tax season. Another common cause is that folks don't read "all" of the small print on each and every screen, before entering data or making selections.

Delete the asset entirely and re-enter it again, using the details I provided above and make sure you read all of the small print.

Is there are reason why your personal use days would not be zero? If so, then an explanation may help me understand.

If the amount of deprecation you're getting is not zero, and it's not correct, then what makes you conclude it's not correct? (I suspect you're using simple math, while the tax laws don't make it that simple.)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax - Depreciation Not Being Calculated at All

Yeah, I completely agree. However, I have went through everything step by step and even deleted the entry and reentered everything slowly and still get the same result.

The only reason I entered some personal use time was when I was experimenting to see how it worked.

If I enter personal use time, then it calculates depreciation, but if I have 0 in the personal use time then nothing gets calculated. It's all pretty straightforward.

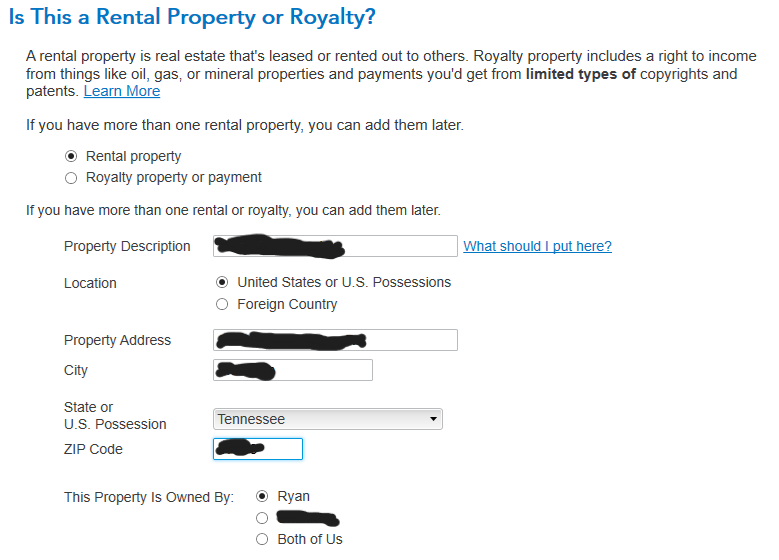

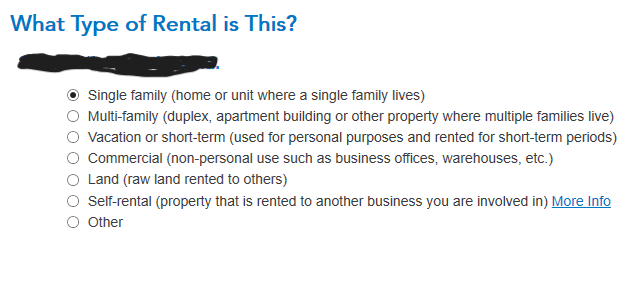

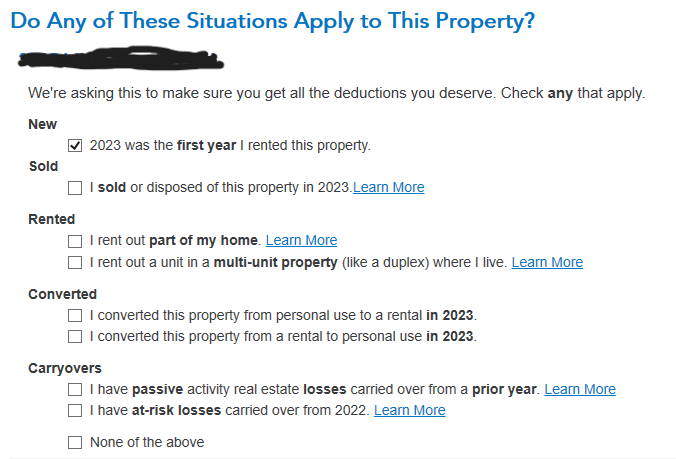

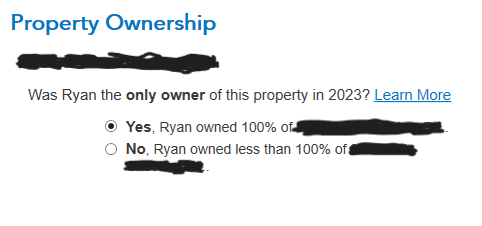

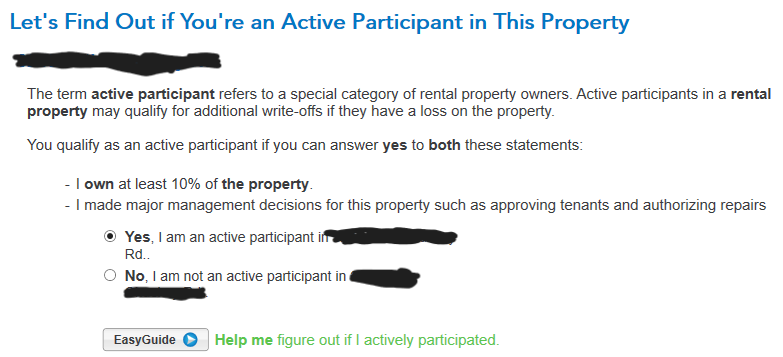

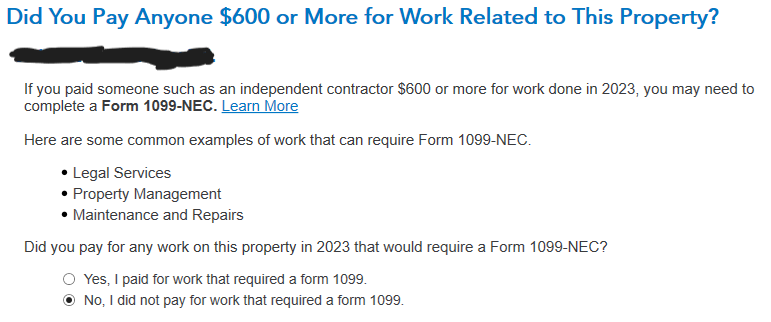

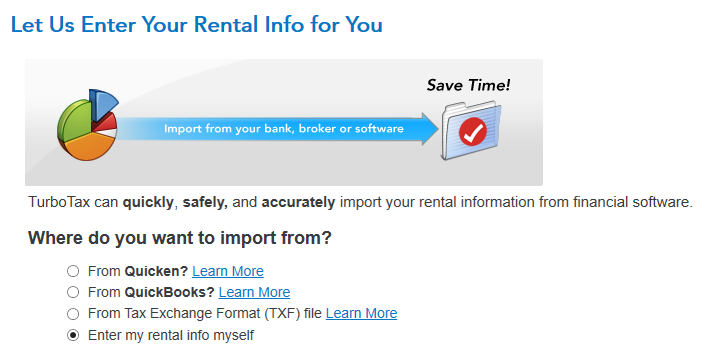

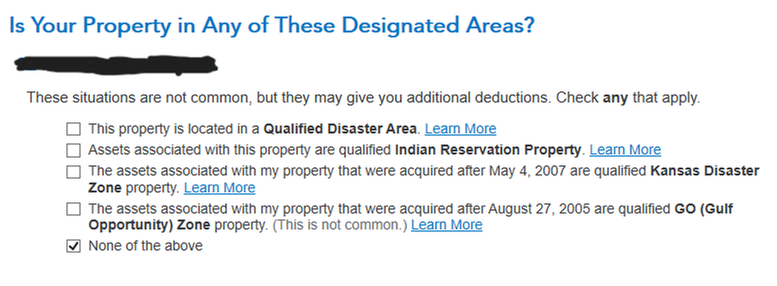

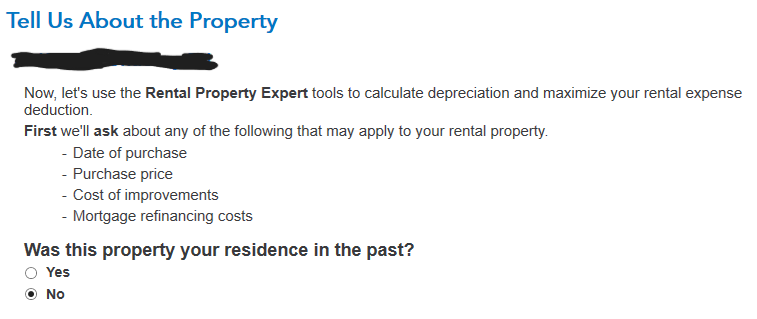

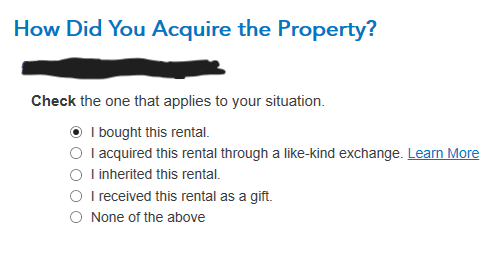

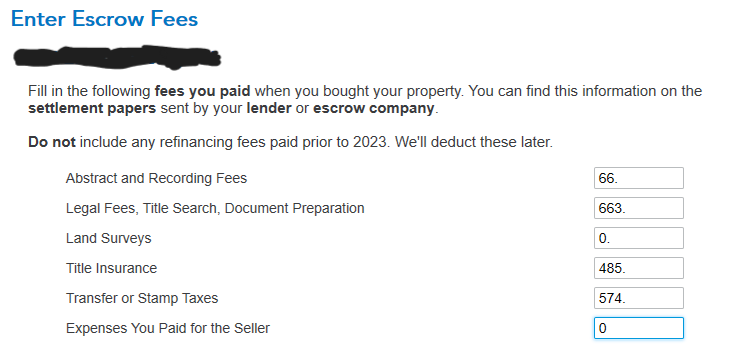

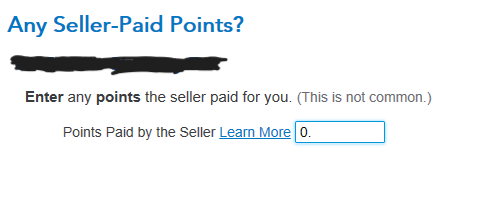

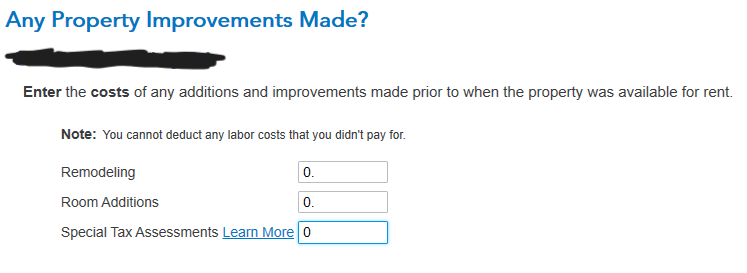

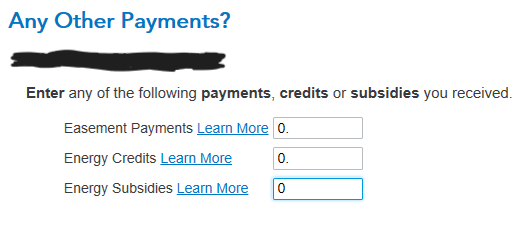

I have taken screenshots of each step and attached to this post.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax - Depreciation Not Being Calculated at All

My problem was that I didn't go through the Assets/Depreciation section after entering the same information in the property profile. Once I filled out the Assets/Depreciation section correctly, the form 4562 is now correct.

USER ERROR.

Thanks for the replies, Carl.

Ryan

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax - Depreciation Not Being Calculated at All

Hi,

I have exactly the same issue as you do and my screens show the same info as yours where i entered the cost of purchase, usage dates etc etc.. I get zero depreciation. In form 4562, it takes the net cost as what i entered under 'Describe this Asset' under 'Assets/Depreciation' and added the cost of appliances that i added.

Do i have to separately add the asset separately with the cost of the home? This does not seem intuitive if the info is already entered once under property profile.

Thanks for your help.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax - Depreciation Not Being Calculated at All

That is correct. I made the same assumption that entering the info in the profile was sufficient.

I never thought that the same info would have to be entered again in the "Assets/Depreciation" section.

Once I entered the info in that section as well everything worked.

One thing to note: In the "Assets/Depreciation" section there was an incorrect number put in by turbo tax for the value of the house (not sure where it came from). I had to correct that as well.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax - Depreciation Not Being Calculated at All

In the "Assets/Depreciation" section there was an incorrect number put in by turbo tax for the value of the house (not sure where it came from). I had to correct that as well.

Just to clarify something here.

The program (not the user) determines the value of the structure to be depreciated. If that number is wrong, then it's highly likely the user entered incorrect numbers in an earlier screen. The earlier screen I'm talking about ask for two figures:

COST: This is what you paid for the property in it's entirety.

COST OF LAND: This is that part of COST that is assigned to the value of the land.

With the above, the program (not the use) will subtract COST OF LAND from COST, and the answer to that equation is the value of the structure to be depreciated. If that value to be depreciated is not correct, then the user entered an incorrect value for one of the two aforementioned items.

Now in some cases, after entering those values the program will ask you for the cost of any property improvements. If it's an improvement classified the same under MACRS, then they get added to the value of the structure.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax - Depreciation Not Being Calculated at All

The number for the cost of the house in form 4562 is correct but it calculated a depreciation of about 6800 yearly over 27.5 years for a 345k house cost. Total depreciation over 27.5 yrs is just a bit more than half of the cost of the house. IS that correct?

Thanks,

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax - Depreciation Not Being Calculated at All

The first year's depreciation will almost "always" be lower, because it prorated for that first year using the mid-month convention, based on the date you placed it in service. So if you placed it in service on Jan 1, depreciation is figured for that first year from Jan 15.

If you place it in service on Jan 31, depreciation is figured from Jan 15.

If placed in service on Feb 1, depreciation is figured from Feb 14 or 15.

If you like, you can check the numbers yourself. Just be aware that because of "rounding" as allowed by the IRS, the number may be a few bucks off, and that's perfectly okay. Over time, it all "works out in the wash". To figure it yourself, go to IRS Pub 946 at https://www.irs.gov/pub/irs-pdf/p946.pdf and use the MACRS worksheet that starts on page 36. For line 6 of that worksheet use table A-6 on page 71. Now keep in mind that it's perfectly fine for your manual figure to be off by $1-$5 or so from what the program figures, and that's perfectly fine.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax - Depreciation Not Being Calculated at All

Thanks.

So you mean that since I bought this in June 23, first year would be low and form next year it would increase?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax - Depreciation Not Being Calculated at All

Correct. Typically, the first year and last year depreciation will be different. From the 2nd year to the 26th or 27th year, depreciation will be the same every year. That is, assuming it's 100% business use with absolutely no personal use at any time during those years.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

user17557017943

New Member

sonia-yu

New Member

SB2013

Level 2

Idealsol

New Member

jjon12346

New Member