- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- Turbo Tax Premier: 1031 Exchange, exchanging 1 rental for 2 new rentals

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo Tax Premier: 1031 Exchange, exchanging 1 rental for 2 new rentals

I found the following information quoted below while searching for answers. And while its helpful I still have some related questions if anyone can help answer. I now understand that I will enter each new property as a separate exchange and divide my original basis of the single property I sold proportionally between the two new properties. Should the land value be included in this adjusted basis or the remaining prop value after deducting all depreciation? I assume this is where I divide my original basis, but do I also divide the fair market value and the value of the mortgage?

Also there is a question about entering "any sales expenses paid as part of this exchange". Not sure if I am supposed to include both the selling of the former property as well as the expenses of acquiring the new property here, anyone know? If I include the former property I assume I need to prorate that amount as well for each acquired property?

Lastly when I get to the end it tells me the exchange results in a deferred gain. The information states "the deferred gain reduces your basis or the like-kind property you received in the exchange" and should result in smaller future depreciation deductions. Based on that I am assuming somehow I need to incorporate this deferred gain amount into the depreciation component of the new properties when I add them to my rental income section but not sure how to incorporate this amount. Do I just reduce the price of the property?

<blockquote><hr /><li-user login="view2" uid="86330"></li-user> wrote:<br />

<p>You must apportion your original basis in the relinquished property,under the Treasury Regulations, an exchanger must generally allocate basis among replacement multiple replacement properties ratably, in proportion to their relative respective values.</p>

<p>Each replacement property would receive a basis equal to 1/2th of your original adjusted basis</p>

<p>TurboTax search box and enter like kind and press the Enter key, then click on the Jump to like kind link.</p>

<p>After you have entered your first like kind exchange, you will be given the option of adding additional like kind exchanges you might have. Click on the Add an Exchange button and follow the prompts to add the next like kind exchange.</p>

<p> You may file only a summary Form 8824 and attach your own statement showing all the information requested on Form 8824 for each exchange. Include your name and identifying number at the top of each page of the statement. On the summary Form 8824, enter only your name and identifying number, "Summary" on line 1, the total recognized gain from all exchanges on line 23, and the total basis of all like-kind property received on line 25.</p>

<p>Mail in to the IRS with your tax return.</p>

<hr /></blockquote>

<p> </p>

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo Tax Premier: 1031 Exchange, exchanging 1 rental for 2 new rentals

1. Land value is part of the basis. Don't make this hard, keep this part simple.

You know how much you paid for the property originally. That is $x.

You know how much you spent on improvements to the property $y.

You know how much you paid to sell the property with realtor fees, etc, $z.

You know how much depreciation has been claimed $D

Your adjusted basis is $x +$y + $z minus $D

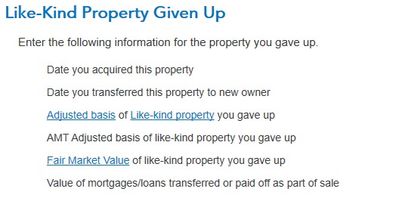

2. Your picture shows: Property given up, date purchased, sold, adjusted basis answer from #1, AMT basis, FMV (sales price), and mortgage info.

3. Sales expenses as part of the exchange- usually you pay a broker an extra fee for handling the 1031 exchange. You can put that $1,000 or whatever into the basis of the sold property to keep things simple. That way the gain prorates to the new properties.

4. Reduce new property Using 1031 Exchange - Internal Revenue Service

Cost basis of the new property = cost of new property - deferred gain from original property.

For example:

- Buy building A, original cost $250,000, depreciated $150,000, sold $400,000

- if sold, A would have gain of $300,000 but instead did a 1031 exchange.

- Buy building B for $500,000.

- Cost basis for new property B is $500,000 - prop A gain $300,000 = $200,000

The adjusted basis of building A is the exchange basis.

Excess basis = cost basis for new property - adjusted basis of building A

For example:

- Building A adjusted basis is $250,000 -dep $150,000 = $100,000 = exchange basis

- Building B $500,000 purchase price

- Excess basis = purchase -exchange

- Excess = $500,000 - $100,000 = $400,000 excess basis

The adjusted cost basis is the purchase price minus the deferred gain from the property sold.

From my example above:

Cost basis for new property B is $500,000 - prop A gain $300,000 = $200,000

If you have two properties, you will want to allocate the deferred amount based on prices. If building B above plus building C were purchased then:

- Building B purchase price $500,000

- Building C purchase price $300,00

- Then building B is 500/800 =62.5% of replacement to take that portion of the deferred gain.

- Building C is 300/800 = 37.5% of the deferred

References:

- Another post of mine with pictures to help with entry.

- What is a like-kind (Section 1031) exchange?

- IRS 8824 Instructions

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo Tax Premier: 1031 Exchange, exchanging 1 rental for 2 new rentals

1. Land value is part of the basis. Don't make this hard, keep this part simple.

You know how much you paid for the property originally. That is $x.

You know how much you spent on improvements to the property $y.

You know how much you paid to sell the property with realtor fees, etc, $z.

You know how much depreciation has been claimed $D

Your adjusted basis is $x +$y + $z minus $D

2. Your picture shows: Property given up, date purchased, sold, adjusted basis answer from #1, AMT basis, FMV (sales price), and mortgage info.

3. Sales expenses as part of the exchange- usually you pay a broker an extra fee for handling the 1031 exchange. You can put that $1,000 or whatever into the basis of the sold property to keep things simple. That way the gain prorates to the new properties.

4. Reduce new property Using 1031 Exchange - Internal Revenue Service

Cost basis of the new property = cost of new property - deferred gain from original property.

For example:

- Buy building A, original cost $250,000, depreciated $150,000, sold $400,000

- if sold, A would have gain of $300,000 but instead did a 1031 exchange.

- Buy building B for $500,000.

- Cost basis for new property B is $500,000 - prop A gain $300,000 = $200,000

The adjusted basis of building A is the exchange basis.

Excess basis = cost basis for new property - adjusted basis of building A

For example:

- Building A adjusted basis is $250,000 -dep $150,000 = $100,000 = exchange basis

- Building B $500,000 purchase price

- Excess basis = purchase -exchange

- Excess = $500,000 - $100,000 = $400,000 excess basis

The adjusted cost basis is the purchase price minus the deferred gain from the property sold.

From my example above:

Cost basis for new property B is $500,000 - prop A gain $300,000 = $200,000

If you have two properties, you will want to allocate the deferred amount based on prices. If building B above plus building C were purchased then:

- Building B purchase price $500,000

- Building C purchase price $300,00

- Then building B is 500/800 =62.5% of replacement to take that portion of the deferred gain.

- Building C is 300/800 = 37.5% of the deferred

References:

- Another post of mine with pictures to help with entry.

- What is a like-kind (Section 1031) exchange?

- IRS 8824 Instructions

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo Tax Premier: 1031 Exchange, exchanging 1 rental for 2 new rentals

@AmyC this is great and so helpful, I need some time to go through it in detail and read the other links you referenced but I believe I should be able to get this done now. I have what I think is an initial quick question though. Since the proration occurs when applying the gain to the new properties basis, do I even need to enter the 2 properties separately when completing the 8824? I can just enter the numbers in total against the original I gave up I should get the same answer. Just not sure if the IRS wants to see both properties listed out on the form or just the summary totals.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo Tax Premier: 1031 Exchange, exchanging 1 rental for 2 new rentals

You need to list each property on the 8824. You want everything to be easily tracked and traced and so does the IRS. Glad I could help.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo Tax Premier: 1031 Exchange, exchanging 1 rental for 2 new rentals

Hello Amy

3 concerns on your answer:

1) Wondering if you can double check the 2nd half of your example posted.

I found the concern when I ran your equations and found 2 different results, both can NOT be true:

Taken from your response:

" Excess Basis = purchase -exchange

Excess Basis = cost basis for new property - adjusted basis of building A"

2) The TurboTax Desktop Help when clicking on Excess Basis amount entry box seems to me to imply the NEW Mortgage Loan of Bldg B to cover acquired property amount due is Excess Basis. Seems a LOT MORE straight forward and logical.

As stated in the Desktop App copied here:

"Excess Basis Amount

When you trade in a business asset for similar property, it is considered a like-kind exchange, reportable on Form 8824.

In addition to determining whether you must report any gain this year on the disposition of the old asset, Form 8824 also computes your basis in the new asset.

Here, we're just asking how much cash you paid to acquire the item, above and beyond any other costs associated with the item. Also include any loans taken out on the item. This is the excess basis amount."

For those of us still learning about Depreciation Recapture & Depreciation on the NEW Acquired property, this google source is helpful to inform getting EXCESS BASIS value is very important to get accurate!

"The excess basis is the resulting increase in basis from the taxpayer's trading up in value. The excess basis will be treated as newly acquired property and will be depreciated over 27.5 years for residential property or over 39 years for nonresidential real property using a new straight line depreciation schedule."

3) The Carryover Basis is ok to depreciate over the remaining MACRS period, say 17.5 years, if the relinquished property was depreciated for 10 years?

Maybe I am lost, but this question Excess basis amount under "Tell Us More About This Rental Asset" is non-trivial if the calculation you provided is required and deserves more TT user help/support/documentation.

QUESTION: Due to the concern #1 above I went cross-eyed trying to understand excess basis with 2 equations and what I found online indicating additional basis/Excess Basis is simply the new money (eg Mortgage Loan). For Excess Gain, what are we really trying to solve for relative to the desktop app help explanation #2 above? Also, what specific IRS Forms and what LINE# are impacted by this Excess Basis answer result?

Found this external reference that is VERY close to my 1031 Like for Like scenario and now seems to mirror your explanation, I think 🤔 Depreciationof1031.pdf

Depreciation Scenarios:

EXAMPLE B - ELECT OUT--> Mark 8582 ELECTION MADE UNDER SECTION 1.168(i)-6T(i).

Thank you for your help!

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

knownoise

Returning Member

jaydriggz1437

New Member

762714e65ca1

New Member

cparke3

Level 4

rjs55

Returning Member