- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo Tax Premier: 1031 Exchange, exchanging 1 rental for 2 new rentals

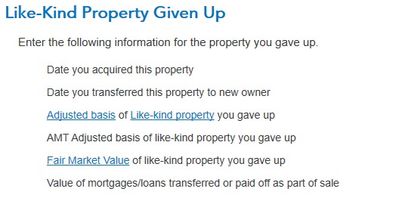

I found the following information quoted below while searching for answers. And while its helpful I still have some related questions if anyone can help answer. I now understand that I will enter each new property as a separate exchange and divide my original basis of the single property I sold proportionally between the two new properties. Should the land value be included in this adjusted basis or the remaining prop value after deducting all depreciation? I assume this is where I divide my original basis, but do I also divide the fair market value and the value of the mortgage?

Also there is a question about entering "any sales expenses paid as part of this exchange". Not sure if I am supposed to include both the selling of the former property as well as the expenses of acquiring the new property here, anyone know? If I include the former property I assume I need to prorate that amount as well for each acquired property?

Lastly when I get to the end it tells me the exchange results in a deferred gain. The information states "the deferred gain reduces your basis or the like-kind property you received in the exchange" and should result in smaller future depreciation deductions. Based on that I am assuming somehow I need to incorporate this deferred gain amount into the depreciation component of the new properties when I add them to my rental income section but not sure how to incorporate this amount. Do I just reduce the price of the property?

<blockquote><hr /><li-user login="view2" uid="86330"></li-user> wrote:<br />

<p>You must apportion your original basis in the relinquished property,under the Treasury Regulations, an exchanger must generally allocate basis among replacement multiple replacement properties ratably, in proportion to their relative respective values.</p>

<p>Each replacement property would receive a basis equal to 1/2th of your original adjusted basis</p>

<p>TurboTax search box and enter like kind and press the Enter key, then click on the Jump to like kind link.</p>

<p>After you have entered your first like kind exchange, you will be given the option of adding additional like kind exchanges you might have. Click on the Add an Exchange button and follow the prompts to add the next like kind exchange.</p>

<p> You may file only a summary Form 8824 and attach your own statement showing all the information requested on Form 8824 for each exchange. Include your name and identifying number at the top of each page of the statement. On the summary Form 8824, enter only your name and identifying number, "Summary" on line 1, the total recognized gain from all exchanges on line 23, and the total basis of all like-kind property received on line 25.</p>

<p>Mail in to the IRS with your tax return.</p>

<hr /></blockquote>

<p> </p>