- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- Started an Amended Return for 2022 - Expected $0 Fed Refund and $0 State Refund at Start

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Started an Amended Return for 2022 - Expected $0 Fed Refund and $0 State Refund at Start

Greeting TurboTax Experts, please advice.

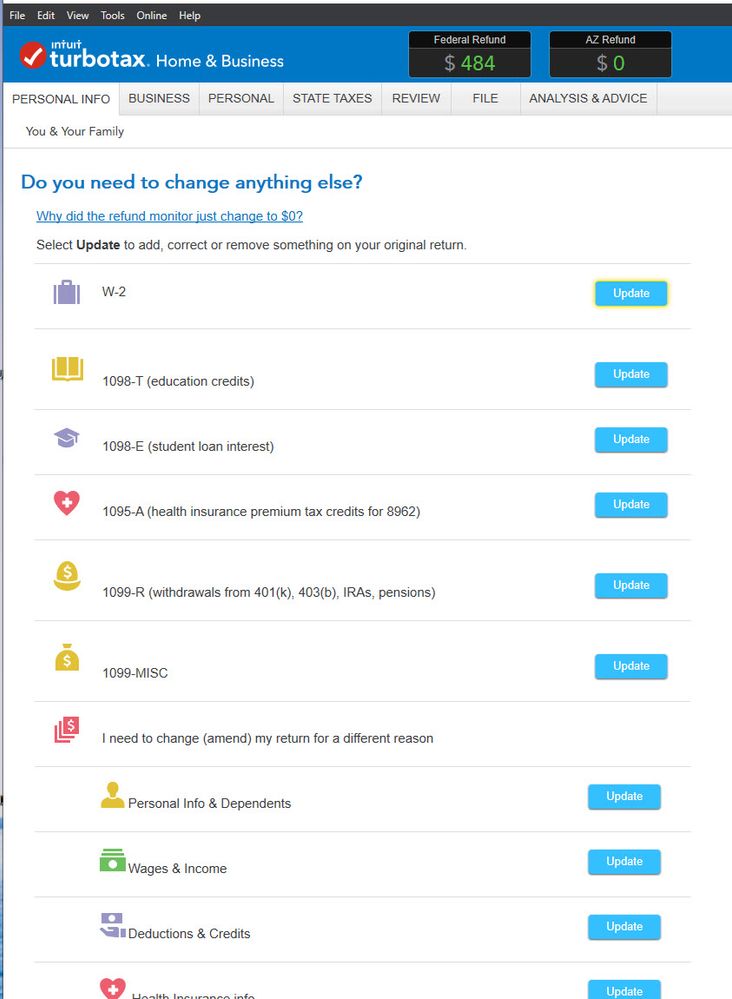

I initiated a 2022 Amended return. Based on software documentation, the starting values for both Federal and State should be $0. In my case, the Federal amount came up as a $484 refund, and State was $0. Nothing yet has been added in to the amended return. Why is the Federal value not zero?

Best regards, - jwgnle

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Started an Amended Return for 2022 - Expected $0 Fed Refund and $0 State Refund at Start

Are the amounts in column A right for the original return? Open the 1040 and see what income items changed from the original 1040. Did you save a copy before you hit amend?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Started an Amended Return for 2022 - Expected $0 Fed Refund and $0 State Refund at Start

It depends. It's important to follow the instructions carefully so that all the numbers are understood by TurboTax. This video may be useful but if you walk through the amendment.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Started an Amended Return for 2022 - Expected $0 Fed Refund and $0 State Refund at Start

Thank you Diane for your reply. I'm using TurboTax Business (2022) via Windows Desktop installation. When I run the software I get the initiation window which shows the completed returns from 2022 (was submitted via eFile). 3/4 of the way down I have the choice to select "Amend a Filed Return", which I do. The next screen shows available returns with "Amend" (big blue button). I click on that for the appropriate return - That's it. Nothing additional is done. The following window is the next thing to appear. $484 Refund vs expected $0 value (since nothing was added). The original tax return was eFiled on March 10th, 2022. It almost seems like software updates were made between March 10th forward that had some impact on the return that was filed.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Started an Amended Return for 2022 - Expected $0 Fed Refund and $0 State Refund at Start

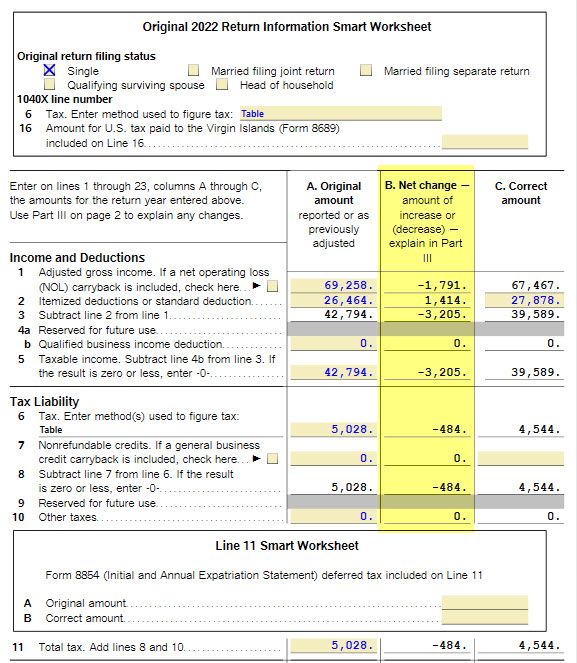

I pulled up the worksheet that TurboTax had initially created (1040-X) after I selected "Amend" this return. I did not enter any changes. Refund amount should have started at $0. Mine started at $484. This is why (screen shot). But the question is WHY? NOTHING yet has been entered for the Amended Return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Started an Amended Return for 2022 - Expected $0 Fed Refund and $0 State Refund at Start

Are the amounts in column A right for the original return? Open the 1040 and see what income items changed from the original 1040. Did you save a copy before you hit amend?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Started an Amended Return for 2022 - Expected $0 Fed Refund and $0 State Refund at Start

Thank you for your reply. Now that you asked that way... I pulled up the PDF file that was created after filing dated March 10th. The numbers in the PDF file align/match to Column C. Weird. But then I looked at the TurboTax file date stamp for 2022 and it now shows February 24, 2024. So somewhere on the 24th, it appears I resaved (I never do that) the file. But still, I hadn't made any changes to it. But yes, column C aligns with what was actually submitted on March 10th, so that's GOOD! Now I just need to figure out how to re-update my 2022 TurboTax file back to the original March 2022 values so I can re-start the amend process and get to a $0 starting place. Many, many thanks VolvoGirl. 😁 Regards, -jwgnle

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Started an Amended Return for 2022 - Expected $0 Fed Refund and $0 State Refund at Start

I think I know where I screwed up! Working with both 2022 and 2023 software/files. I may have been cross-wired when I was entering 2023 data for 2023 return... I might very well have had the 2022 file/software open and entered data there meant for 2023. Oops! Thanks again. - jwgnle

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

rhett-hartsfield1

New Member

michelleroett

New Member

jmeza52

New Member

britneydibble

New Member

CWP2023

Level 1