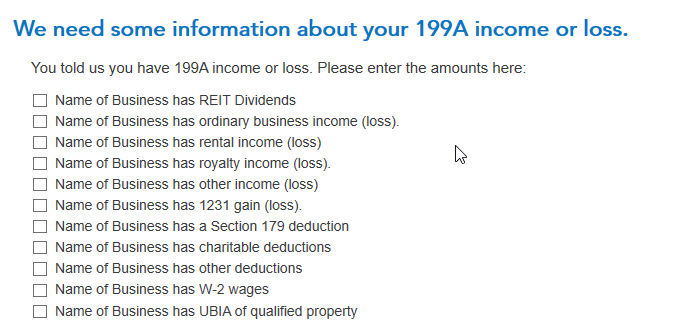

Enter the code Z on the box 20 screen for that K-1, but you don't need to enter an amount on that screen, you can leave it blank. Instead, Continue on, and you'll find two screens to enter your Section 199A information on the Statement that came with your K-1. When you check the box next to a category on those screens, a place will open up to enter your amounts. These applicable items on these screens must be completed in order for your box 20 code Z information to be correctly input into TurboTax.

You can see screenshots of the TurboTax screens you need below. For your "Qualified property" you will need the last item on the first screen, "[Name of Business] has UBIA of qualified property".

More detail about the Column A, B, C, D, and E might be helpful to understand whether or not these amounts should be totaled for entry in the UBIA "box".

Here are those screenshots:

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"