- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- Sale of second home

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of second home

I agree, the instructions in the search box for "sold a second home" don't work for TurboTax Deluxe download version. It was difficult to figure it out, no way to easily enter a 1099S. Thanks to the online posts here. I've been using TurboTax for years, I'm very disappointed in this glitch for an important item.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of second home

I've been using TurboTax for years, began back in 80s when it was MacInTax. I'm not happy with not having a 1099-S for sale of second home. This workaround that folks are forced to use is awkward and not satisfactory. TurboTax is normally very good, but not this year. How about a software update to fix this???

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of second home

I can't find any 2nd home form on my downloaded Deluxe version. When I do a search for "sold second home" in Search there is no "Jump to" link in the search results as described. TurboTax, please fix this problem, along with allowing a 1099-S for sale of a second home!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of second home

You will enter this information into TurboTax in the federal interview section as follows:

- Select Income & Expenses

- Scroll down through all income until you see Investment income

- Select Stocks, Mutual Funds, Bonds, Other

- Select Add more sales

- Be sure to select No when asked if you received a 1099-B form.

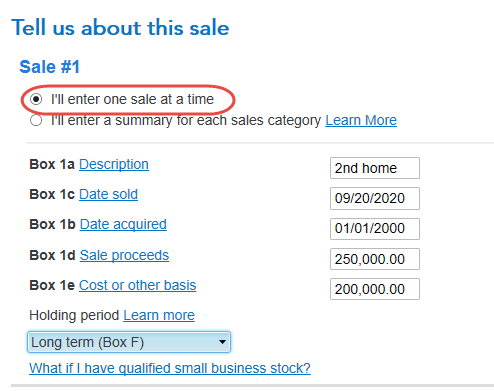

You will be able to enter all of the sale proceeds, cost basis, date sold, and any other applicable information in this section. (see sample below)

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of second home

The form for 1099-S is located in the "Wages and Income" tab; "Less Common Income; "Sale of Home (gain or loss)". Even though it looks like the sale of the primary home it contains the 1099-S if you just keep following the prompts.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of second home

If you follow this instruction, you will also have the option to reduce your taxes if you lived in your second home for more than 24 consecutive, or 24 non-consecutive months during the past 5 years.

The form for 1099-S is located in the "Wages and Income" tab; "Less Common Income; "Sale of Home (gain or loss)". Even though it looks like the sale of the primary home it contains the 1099-S if you just keep following the prompts.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of second home

A sale of a second home is considered a sale of an investment. To report this in TurboTax, please follow these steps:

TurboTax Online

- Click on Federal > Wages & Income

- In the Investment Income section click on the Start/Revisit box next to Stocks, Mutual Funds, Bonds, Other. If you have already entered some investment sales, you will see a screen Here's the investment sales info we have so far. Click on the Add More Sales link.

- If you haven't yet entered some investment sales, you will see a screen Did you sell any investments in 20XX? Click the Yes box.

- On the screen, OK, what type of investments did you sell? mark the Other box and click Continue.

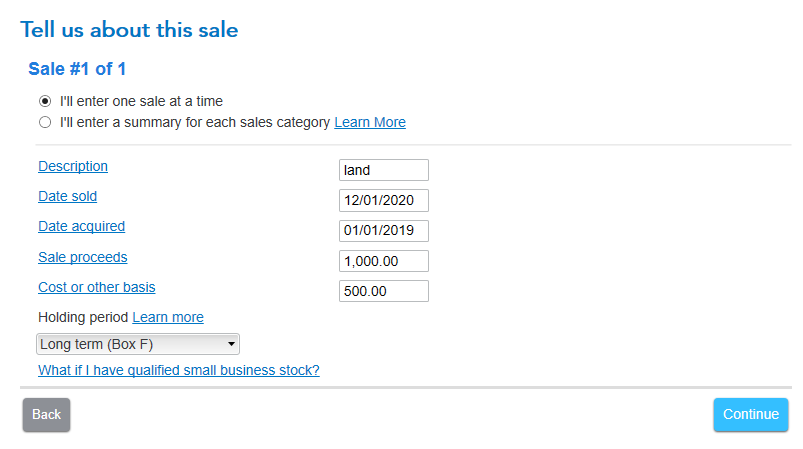

- When you get to the screen, Now we’ll walk you through entering your sale details enter the details of the sale. You will be able to select the type of investment in the first box [second home, land, etc.] [See Screenshot #1 below.]

- Enter the requested information and click Continue when done.

TurboTax CD/Download

- On the Wages & Income screen, in the Investment Income section click on the Start/Revisit box next to Stocks, Mutual Funds, Bonds, Other. If you have already entered some investment sales, you will see a screen Here's the investment sales info we have so far. Click on the Add More Sales link.

- If you haven't yet entered some investment sales, you will see a screen Did you sell any investments in 20XX? Click the Yes box.

- On the screen, Did you get a 1099-B or brokerage statement... click the No box.

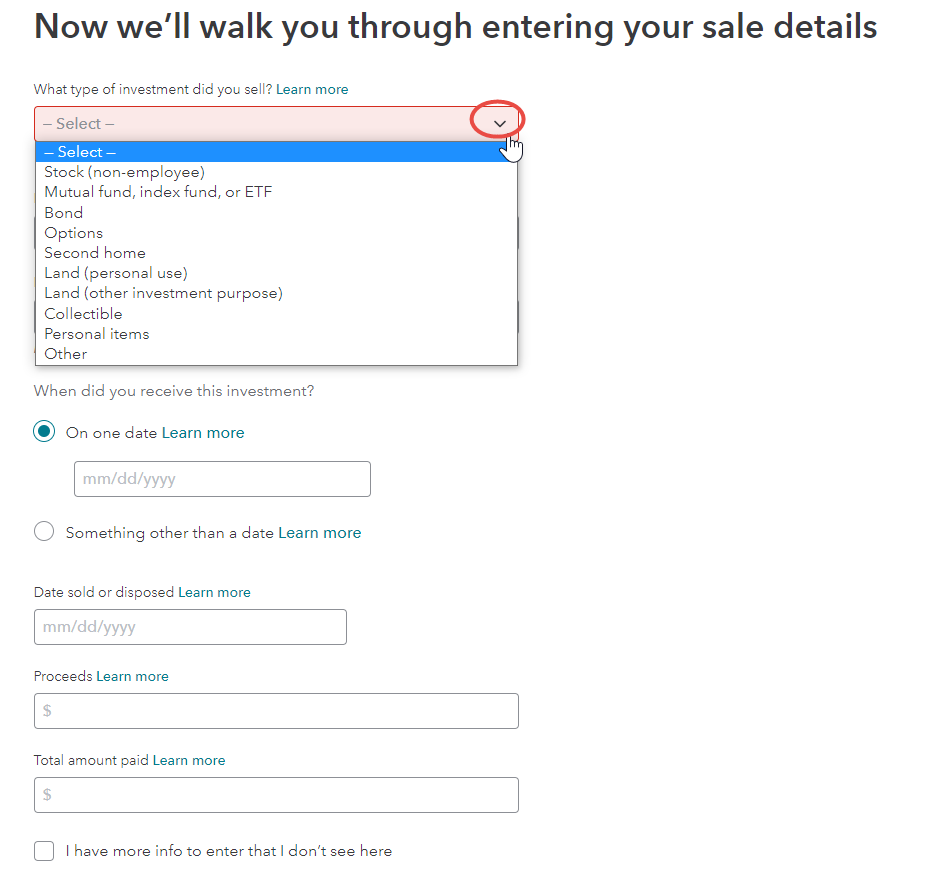

- On the screen, Tell us about this sale, mark the radio button, I'll enter one sale at a time.

- Enter the information in the boxes that appear. You will have to type in Second Home in box 1a.

- Enter the total sales proceeds as well as the other information requested. [Screenshot #2]

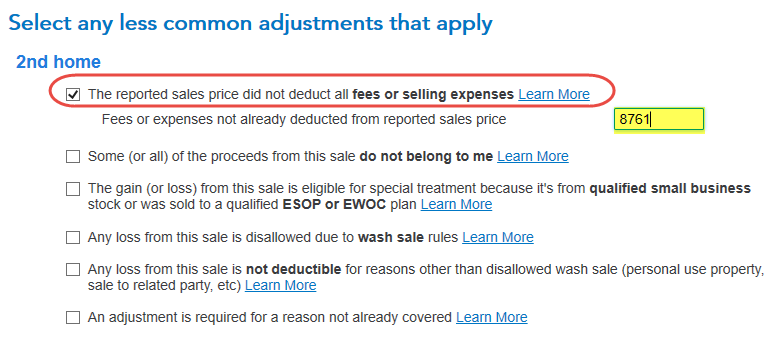

- Continue to the screen, Select any less common adjustments that apply.

- Mark the first box The reported sales price did not deduct all fees or selling expenses. [Screenshot #3]

- Enter the sales expenses not deducted from the sales price entered earlier.

Screenshot #1

Screenshot #2

Screenshot #3

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of second home

If really want to enter a 1099-S follow these instructions. The following (of any TurboTax version), can be used for the sale of a second home, but is confusing because it looks like the sale of your primary home. It is not ONLY for the sale of your primary home and this has ALL of the information for selling a second home.

- Select Wages and Income tab

- Scroll down through all income until you see Less common Income

- Select Sale of a Home (profit and loss)

- Follow prompts to enter Ownership and Address of the Home - Select continue

- The next form asks you if you have a 1099-S - Fill this out and then follow the prompts for more detail about the sale of your home

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of second home

It's dismaying to see how hard TurboTax makes it to enter sale of a second home in the downloaded Premier version of the software. TurboTax is the sort of software that I expect to ask me questions like, "How much did you spend on repairs to this home?" It's hard for me to believe that the sale of a house is the same thing as sale of a stock with the same annual expenses. That's so counter-intuitive, I'd expect it to say that somewhere explicitly.

I expected better from them and next year will be the first year I look for a competitor. I will read and reread the thread and try to distill it for anyone using Premier, though if I find such instructions I'll link there here too.

It's just such a weird contrast to the rental section, where you get asked about things as detailed as what your property management expenses are and what you paid on taxes. It seems very weird to me that all that matters in the sale of inherited property or any second home is how much you paid and how much you sold. Wouldn't it be nice if the tax code was that simple, but I'm doubting it is.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of second home

it depends. was the sale of the second home also a personal residence? if so, you can enter this also in Turbo Tax. I will show that to you at the conclusion of this post.

First of all, to answer your question on why is the sale of a home handled like a stock transaction. A personal residence is a capital asset. Capital assets are significant pieces of property such as homes, cars, investment properties, stocks, bonds, and even collectibles or art that you personally hold for investment purposes. So the sale of a personal residence can result in a capital gains depending on how long you owned the house (ownership test) and how long you lived in it(use test). Please read more in this IRS publication. The only thing different between the sale of a home vs sale of stock is that you cannot claim a capital loss on a sale of a house.

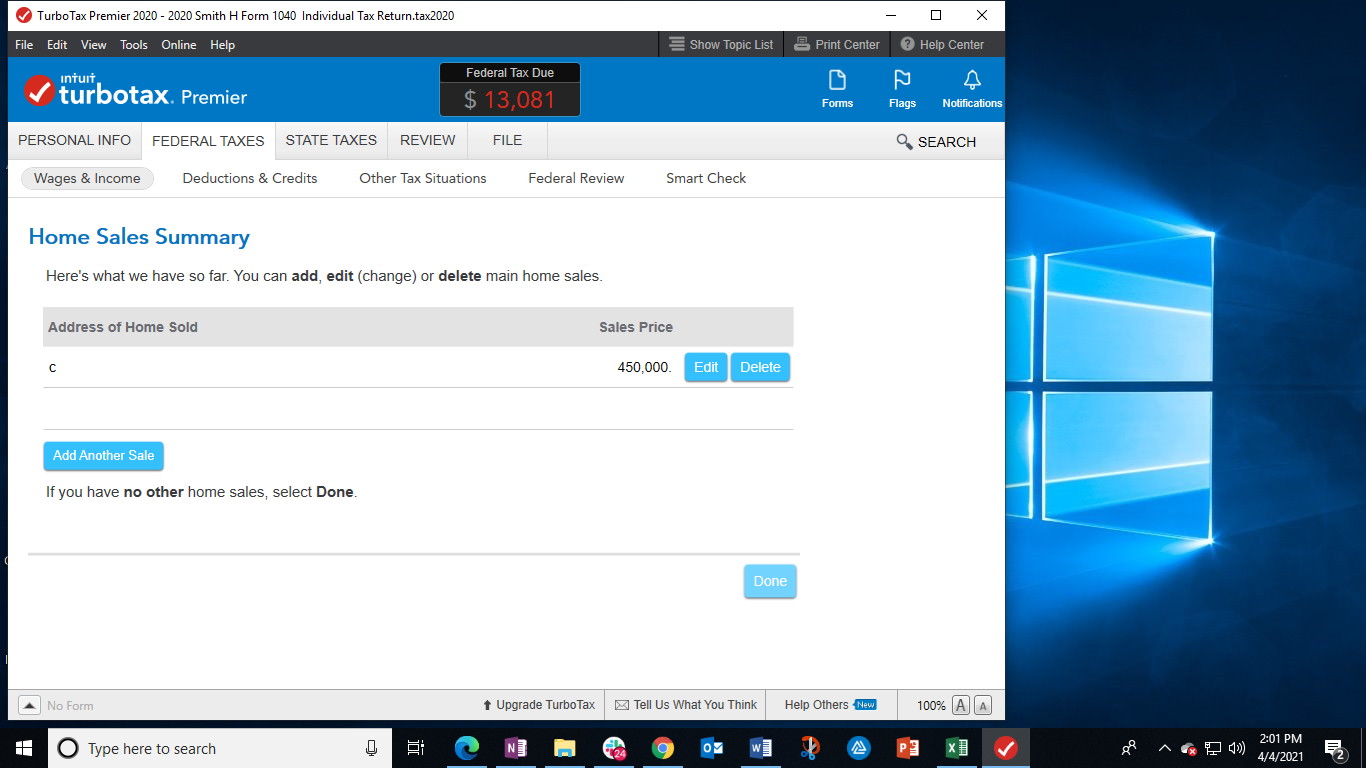

Now here is the treat I promised all of you who couldn't add another sale. At the conclusion of entering the sale of the first house, you should arrive at the Home Sales Summary page. There is a button in blue to add another sale. Select it.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of second home

We have "Home and Business" edition. These screens do NOT exist! There is NO dropdown for a "second home". Also, it appears we need to enter ALL of our 26 years of ownership information such as depreciation! Seriously, WTH?!

Also, as this house was in the process of being sold from fall 2019 to early 2020, the house was not rented or up for rent. So when you check the box under rental section "NO - was this house rented or up for rent" ALL the information disappears, no way to get it back without reloading or retyping.

'

You need an UNDO button. I would rather have treated the property as a rental until selling whether or not it was rented or up for rent.

AND the screens still don't match! Why am I paying a premium for the most expensive version of Turbo Tax yet I don't have all the bells and whistles?

EXTREMELY DISAPPOINTED!!!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of second home

TurboTax could have handled Sale of a Second Home better. I'm disappointed.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of second home

I didn't see this, and used the clunky bodge that was suggested for Sale of a Second Home. It should have been easier and simpler. I'm disappointed. Please fix this next year for others (its too late for me).

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of second home

Have you corrected this section yet. We have Turbo Tax Deluxe and I can not seem to find the screens that you have on your screen shot. I need to enter this as a second home, not as a brokerage item. It is on a 1099-S.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of second home

There is no correction. If you can scroll up to see the answer from Irene2805, she explains how to enter, complete with screenshots.

- On the Wages & Income screen, in the Investment Income section click on the Start/Revisit box next to Stocks, Mutual Funds, Bonds, Other. If you have already entered some investment sales, you will see a screen Here's the investment sales info we have so far. Click on the Add More Sales link.

- If you haven't yet entered some investment sales, you will see a screen Did you sell any investments in 20XX? Click the Yes box.

- On the screen, Did you get a 1099-B or brokerage statement... click the No box.

- On the screen, Tell us about this sale, mark the radio button, I'll enter one sale at a time.

- Enter the information in the boxes that appear. You will have to type in Second Home in box 1a.

- Enter the total sales proceeds as well as the other information requested. [Screenshot #2]

- Continue to the screen, Select any less common adjustments that apply.

- Mark the first box The reported sales price did not deduct all fees or selling expenses. [Screenshot #3]

- Enter the sales expenses not deducted from the sales price entered earlier

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

misschristian0711

New Member

priestleydave

New Member

tzupoomom

New Member

KarenL

Employee Tax Expert

noodles8843

Level 1