- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Investors & landlords

it depends. was the sale of the second home also a personal residence? if so, you can enter this also in Turbo Tax. I will show that to you at the conclusion of this post.

First of all, to answer your question on why is the sale of a home handled like a stock transaction. A personal residence is a capital asset. Capital assets are significant pieces of property such as homes, cars, investment properties, stocks, bonds, and even collectibles or art that you personally hold for investment purposes. So the sale of a personal residence can result in a capital gains depending on how long you owned the house (ownership test) and how long you lived in it(use test). Please read more in this IRS publication. The only thing different between the sale of a home vs sale of stock is that you cannot claim a capital loss on a sale of a house.

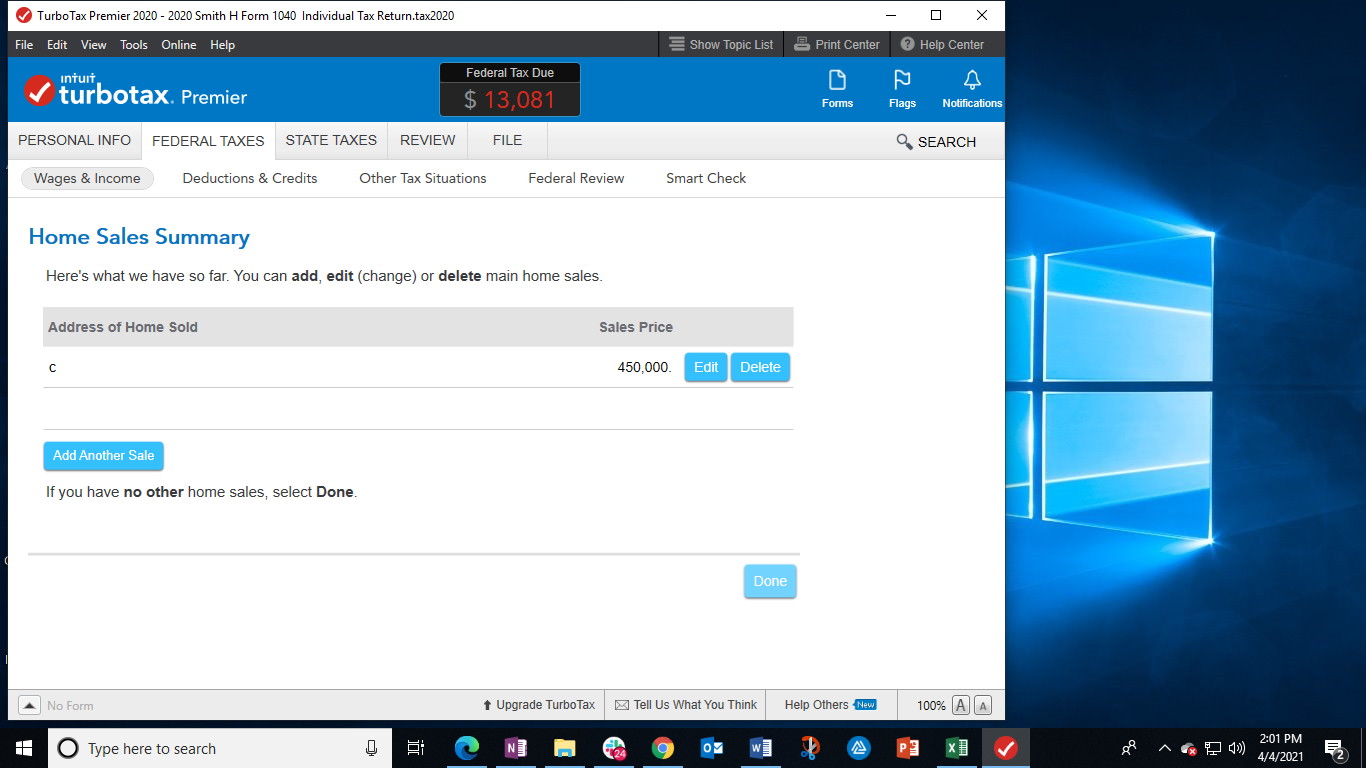

Now here is the treat I promised all of you who couldn't add another sale. At the conclusion of entering the sale of the first house, you should arrive at the Home Sales Summary page. There is a button in blue to add another sale. Select it.

**Mark the post that answers your question by clicking on "Mark as Best Answer"