- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- sale of rental property previously primary residence

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

sale of rental property previously primary residence

We purchased a townhouse at the end of 2018 as a primary residence. In Dec 2021 we bought a new home and moved in, placing the townhouse in service as a rental early 2022. Sold the property in Jan 2023.

Based on the TT walk-through, it seems I am being hit for $60k in capital gains. I thought there was an exemption if I lived at least 3 of the last 5 years in the home, which we did. How do I get TurboTax to recognize this detail?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

sale of rental property previously primary residence

It depends. There will be a recapture of the depreciation expense for the rental period.

If the home is currently set up as a rental on your return at the time of sale, then you need to complete the sale in the rental asset or assets.

- Search > Type rentals > Click the Jump to.. link > Edit beside the rental and select Update beside Assets

You will need to answer "No" to Special Handling to answer the questions about using it as a home On the next screen you will be asked 'Was this asset included in the sale of your main home?'. Select Yes and then follow the screens to finish the reporting of your sale. You will need to count the number of days it was used as a rental.

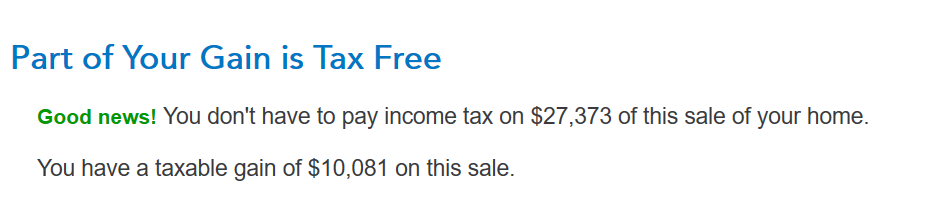

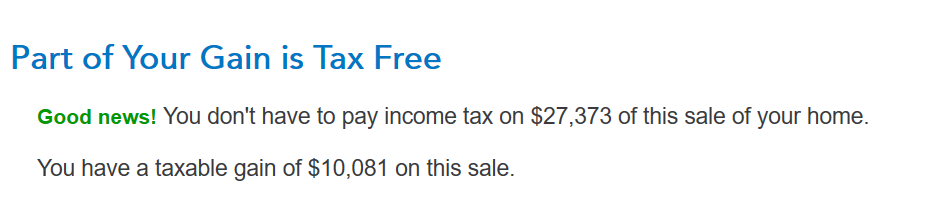

TurboTax will allocate the proper taxable amount due to the depreciation from the gain on the sale, only gain that exceeds this will be eligible for the exclusion. You will not see 100% of the gain excluded, even if the total gain is below $500,000 for married taxpayers.

Most of your gain will be excluded but you will have some taxable gain for the period it was rented. TurboTax will show you the excluded and taxable gain. See the image below from my example.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

sale of rental property previously primary residence

It depends. There will be a recapture of the depreciation expense for the rental period.

If the home is currently set up as a rental on your return at the time of sale, then you need to complete the sale in the rental asset or assets.

- Search > Type rentals > Click the Jump to.. link > Edit beside the rental and select Update beside Assets

You will need to answer "No" to Special Handling to answer the questions about using it as a home On the next screen you will be asked 'Was this asset included in the sale of your main home?'. Select Yes and then follow the screens to finish the reporting of your sale. You will need to count the number of days it was used as a rental.

TurboTax will allocate the proper taxable amount due to the depreciation from the gain on the sale, only gain that exceeds this will be eligible for the exclusion. You will not see 100% of the gain excluded, even if the total gain is below $500,000 for married taxpayers.

Most of your gain will be excluded but you will have some taxable gain for the period it was rented. TurboTax will show you the excluded and taxable gain. See the image below from my example.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

tharrill77

Returning Member

meade18

New Member

mpannier1968

New Member

CaPattie4

Level 1

Iris99

Returning Member