- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- Renting out part of home, depreciation and sqft vs room method

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Renting out part of home, depreciation and sqft vs room method

I purchased a house in June of 2021. In the first two months I rented it back to the previous sellers (part of the sale contract). As soon as I moved in I rented out one room to a roommate. The apartment is a 2bed with 1 living room. I have read many articles online and threads in these forums and still cannot understand what portion of the apartment I can define as "rental" (for the roommate, I think the first two months are 100%.) I chose a multi-family (unit in multiunit) and wrote in ~180 days, starting basically from when I purchased the apartment.

The room is about 200sqft out of a total of 950 sqft, that would be 21%. If it's rooms out of total rooms, that would be 1/3, so 33%. If it's out of bedrooms, or % of people, it's 50%. Here's what the help page on the relevant page says:

"You can use any reasonable method to determine the percent of your home being rented. Most commonly, you can base it on the number of rooms rented to total rooms, or based on the square footage of the rental space compared with total square footage. You could also base it on the number of people in the rented portion compared to the non-rented portion."

The IRS publication 527 states:

"It may be reasonable to divide the cost of some items (for example, water) based on the number of people

using them. The two most common methods for dividing an expense are (1) the number of rooms in your home, and (2) the square footage of your home."

However, in various posts experts and champs have said that the only reasonable way is sqft. For example:

I am not sure I understand why though -- my roommate often brings friends, and uses the living room such that I can't use it. For example, we divide weekends for hosting in the living room. Etc. I am maintaining and furnishing all these spaces for his use as well. Trash removal, elevator maintenance, building common spaces maintenance, which are paid through HOA fees would reasonably be %50 for him, since he uses all these services on an equal basis to me. (So I think are similar to the water example given in the IRS publication 527, page 16.)

So I guess my first question is why is it unreasonable to deduct 50% since I we essentially co-live in all the same places, and my room is equal in size to his? Or 33% based on the room method? (which is explicitly mentioned in the IRS publication...)

My second question relates to the depreciation part. This is a condo with no land rights, and the city calculates its land value as 0. So I put in the full cost basis: $780,000. TurboTax calculates this years depreciation at about 15,000 (both rounded for anonymity), or about 1.8% of the cost basis. I think that's the correct depreciation since I only had it for six months.

What I don't understand is this: when I check the actual SCH-E TurboTax prepares it divides my HOA, repairs, etc according to % I entered as being rented out. Except for the depreciation. It includes the full value of the depreciation: -15,000. I therefore show a significant loss that seems excessive, and meaningfully reduces my taxes and even my gross income.

I tried following this:

https://ttlc.intuit.com/community/investments-and-rental-properties/discussion/if-i-am-renting-one-r...

But TurboTax never asks me "I purchased this asset new" - it asks if I purchased the asset, and the other option is "No, I acquired it in a different way" - which is clearly false, since I certainly purchased it. If I do click "No", it offers a number of other "ways", such as inheritance.

Third, does anyone know how I account for the period in which I rented to the sellers (arrangement was called "use and occupancy" and was part of the sale contract)

Finally, if anyone knows what are the implications of these depreciation deductions for capital gains taxes and the homeowner capital gains exemption and could provide any clarity, that would be super appreciated. (@Carl would highly appreciate your input!)

Thanks!!

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Renting out part of home, depreciation and sqft vs room method

I purchased a house in June of 2021. In the first two months I rented it back to the previous sellers (part of the sale contract).

That's referred to as a leaseback since it was part of the sales contract. Generally, you just have to reduce your cost basis by the amount paid to you during the leaseback period. Nothing concerning this gets reported on SCH E or any other part of the tax return really.

The IRS has many views on this and it seems that it's dependent on the specifics of a given situation. To see what I mean, see https://nysba.org/NYSBA/Coursebooks/Fall%202018%20CLE%20Coursebooks/Commercial%20Real%20Estate%20Le... and read "all" of it. That is, if you can before your head starts swimming in a sea of confusion.

For your room rental, it's the percentage of square footage that is exclusive to the renter, based on total square footage of the structure.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Renting out part of home, depreciation and sqft vs room method

Thanks! Very useful, I'll deduct that from the cost basis.

About the room rental... I don't understand it The IRS publication clearly offers multiple ways - for example the publication 527 (page 16) explicitly list water expenses that should be split equally, and not by sqft:

"It may be reasonable to divide the cost of some items (for example, water) based on the number of people using them"

Surely then at least water can be "reasonably" split according to how many people use it. Why not trash removal? Why would the IRS doc explicitly mention splitting by rooms if sqft is the only way? It seems like a particularly rigid interpretation of what is otherwise pretty flexible language... Is there some court cases that established that?

But I guess my biggest concern right now is how to correctly account for depreciation in the software (because I'm pretty sure that whether it's 20% or 35% - it's not 100% of depreciation...)

Thanks again!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Renting out part of home, depreciation and sqft vs room method

Ah, I see what you're referring to now. When it comes to the percentage of space being rented, that's fairly fixed. It's the "other stuff" where you have choices. Lets use utility expenses for example.

If you have a 3 bedroom house and there's just you and your spouse living there with no kids, that's fair to say you have 2 "vacant" bedrooms. So you rent out one of the bedrooms to a married couple. At this point you have 4 people living in the house. You have two ways to claim the rental portion of your utility expenses.

1) With four people living in the house you can split them "per-person". With 2 of the four occupants being renters, you can allocate 50% of your utility expenses (water, gas, electric, cable) to the rental.

2) With only one bedroom being rented, lets say that's 10% of your total floorspace allocated as the rental portion. You can claim choose to allocate your utility expenses the same way and claim 10% of your total utility expenses to the SCH E for the rental portion.

You can do whichever works best for you. Some other things to keep in mind too.

Let's say you have 2 full baths in the house, and one of those baths can only be access from the bedroom being rented. That makes the floorspace for the bath "exclusive to the renter" also. Therefore it can be included in the percentage of floor space being rented.

Let's say you only have one wired land line telephone in your house. This is weird, but the IRS says you can't allocate that. Not even if there's a phone drop in the room being rented out. You'd have to have a 2nd phone line.

If you have cable or satellite TV, then you have to have a drop for that in the room being rented. Then you can claim a portion for the rental weather the renter uses it or not. Typically you'd need a separate cable/satellite box at the drop for that room. So the cost you pay for that box would be a SCH E deduction with no problem, weather it's a one time fee or a monthly fee you pay for that extra box.

Most folks around my area that rent rooms have a completely separate satellite TV setup with it's own separate dish antenna, and they just cancel the subscription when the renter vacates. Sometimes the renter will choose to activate it in their name and their own account, which is fine too. Then it's no concern of the landlord. Just make sure they don't take it with them when they vacate. 🙂

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Renting out part of home, depreciation and sqft vs room method

Did you discover how to correctly depreciate your bedroom rental with TurboTax. I am in the same boat renting two rooms and have the same issue with depreciation wiping out the rental income. I am using TurboTax premier. There is a page for depreciation I specific the business use start date and business use percentage in 2021. I specified 100% for the business use thinking possibly related to my issue. If you fixed your issue and can provide some insight that would be great.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Renting out part of home, depreciation and sqft vs room method

There is one issue I'm aware of if you are renting out "a part of" your residence. This issue will cause the amount of depreciation taken in that first year to be flat out wrong. Again, this is only an issue if you are renting out "A part of" your residence.

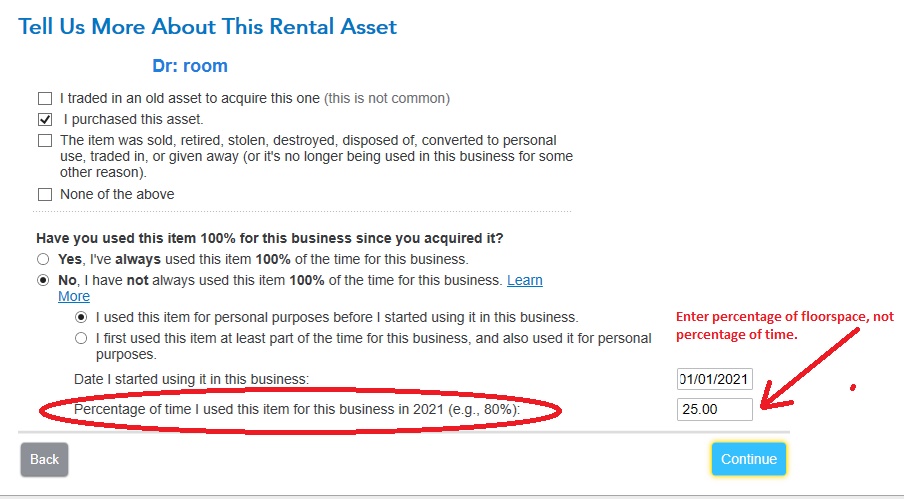

As you are working through your property in the Assets/Depreciation section you will come to the below screen. What you see pictured below is from the CD/Desktop version of TurboTax. It may look different in the online version. (I do not use the online version.)

Take note of what's circled in red above. The question is asking you for percentage of time. When you are renting out "a part of" your residence, that question should be asking you for percentage of floor space. If you enter percentage of floor space, then the depreciation figured by the program will be correct. Otherwise, it will be wrong.

If you want to double-check the program (and I highly encourage you to do so) then see IRS Publication 946 at https://www.irs.gov/pub/irs-pdf/p946.pdf Use the worksheet that starts on page 37. For line 4 of the worksheet, it's 27.5 years. For line 6 of that worksheet, table A-6 on page 72 applies.

Note that what you figure manually may be off by a buck or two, and that's find. The reason the program may be a few bucks off is because the program incorporates IRS "round to the nearest dollar" requirements.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Renting out part of home, depreciation and sqft vs room method

Thanks so much this clarified it for me. To other readers in the same boat I asked a similar question here. I'm going to redo this section following the instructions there and here

https://ttlc.intuit.com/community/investments-and-rental-properties/discussion/re-renting-bedrooms-t...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Renting out part of home, depreciation and sqft vs room method

Hello,

I have a few questions related to this topic:

I understand that “Percentage of time I used this item for this business” should be based on square footage. You explained that it is reasonable to divide utility expenses by the number of people living there (in addition to a square footage approach). I’m trying to understand what methods can be used for expensing real estate taxes, mortgage interest, and insurance premiums. My home has three bedrooms. If I rent two of them out, is it reasonable to expense one third of the aforementioned expenses prorated based on the rental of bedroom 1 and another third prorated based on the rental of bedroom 2 and add these two numbers for a final expense cost? All other spaces are shared (laundry, kitchen, living, etc.).

Additionally, in this other post in which two rooms are rented, you suggest listing one property and each room as an asset of that property. If one room was rented May-august and the other May-November, should I still take this approach or should I mark them as completely separate rental properties? In particular, the number of days rented is different between the two. With the one property + 2 assets approach, I used the longer duration of the number of day rented. It’s unclear to me if number of days rented is just used by turbo tax to aid in prorating expenses (in which case it doesn’t matter since I opted to calculate expenses manually) or if it’s also used elsewhere, such as in depreciation.

On the “Tell us more about this rental asset” page, it has a place to enter a day in which the asset begins use in the business, but not a date to specify termination. One thought is to add an additional multiplier to the “percentage of time I used this item for this business” field. As an example, let’s say bedroom 1 is 10% of the floor space. The whole property was purchased 4/25/2022, and the lease agreement started 5/1/2022. 4/25/2022-12/31/2022 is 251 days that I owned the property in 2022. If it was rented 05/01/2022-11/30/2022, it was rented for 214 days. 214/251 = 85% of the duration that I owned the property. 10% * 85% = 8.5%. Should 8.5% be the input for “percentage of time I used this item for this business”? But then using this would affect depreciation of the room in future years. So, I’m not sure how to express that a lease was terminated before the end of the year for depreciation deduction purposes—unless it’s based on the number of days rented, which is a property-level value rather than an asset-level value, hence I am unsure if I should do the one property with two assets approach or two property (one for each bedroom) approach.

Thank you so much for your guidance!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Renting out part of home, depreciation and sqft vs room method

Paragraph 1 - Yes, if you have three bedrooms and rent two of them, then it could be that 2/3rds of the expenses can be allocated as rental expenses. This assumes that the bedrooms are all the same size. If the bedrooms are all the same size, then the remaining third of expenses appears to be your personal use and thus, not deductible as a rental expense. However, that 1/3rd that is not deductible as a rental expense may be deductible as an itemized deduction e.g. property taxes, mortgage interest, assuming you can itemize. If the bedrooms are not the same size, then calculate the percentage of each bedroom relative to the square footage of the house and allocate expenses accordingly.

Paragraph 2 - Because the bedrooms do not appear to be separate dwelling units, i.e. with their own bathroom and cooking facilities, then the better approach appears to be listing the property as one rental property with each bedroom as a separate asset of the property.

Paragraph 3 - Your approach seems reasonable. First, calculate the percentage of square footage to prorate the expenses from the entire house.

Then, divide your days the individual bedroom was rented by the total number of days in the year, the resulting number will be your business use of that room. Finally, multiply the percentage of business use for the bedroom by the prorated home expenses.

@wag1

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Renting out part of home, depreciation and sqft vs room method

Paragraph 1:

The three bedrooms aren't exactly the same size; there is one larger one and two smaller ones. The two smaller ones are roughly the same size, and I rented out the larger room and one of the smaller ones. So, the splitting into thirds approach seems fair given that I stayed in one of the smaller rooms.

"If the bedrooms are not the same size, then calculate the percentage of each bedroom relative to the square footage of the house and allocate expenses accordingly." Can I split common spaces into thirds still? So let's say bedroom 1 is 10% of the square footage, and the other two are 8% each. Then 26% of the square footage is bedrooms; the rest is shared common space. 100-26 = 74/3 = 24.66%-- the common space square footage divided by three. 24.66 + 10 = 34.66% for bedroom 1, and 24.66 + 8 = 32.66 for the smaller rooms. Is this an accurate way of divvying up expenses?

Paragraph 2:

Thanks for clarifying!

Paragraph 3:

Since I didn't own the house until April 25th, 2022, would I divide the days the individual bedroom was rented by a) the total number of days in the year, b) the number of days that I owned the property out of the year, or c) the number of days between the "Date I started using it in this business" and the end of the year?

So, If I purchased the property April 25th and began renting a room May 1 and the room was rented for 214 days (til Nov 30), would I do:

a) 214/365

b) 214/251

c) 214/245

(and then multiplying by the square footage pro-rated for the room)

Given that TurboTax has a "Date I started using it in this business" field, I suspect they are prorating depreciation from this date through the end of the year, in addition to using the “percentage of time I used this item for this business” field. In that case, I believe (c) would be the correct answer.

Also, I would be able to just adjust the “percentage of time I used this item for this business” field on the same asset in subsequent years to reflect the amount of time it's been rented, correct?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Renting out part of home, depreciation and sqft vs room method

Paragraph 1 calculation is fine.

For the paragraph three the 'amount of time that you used this for business' does not refer to the number of days it was rented but to the number of days it was available for rent. If you had the rooms ready to go and available to move in on May 1 then it doesn't matter when the tenants actually moved in, it matters when they could have. You can prove this with online ads or however you found your tenants.

So that makes option C the most viable calculation. (If it was available earlier than May 1 you can adjust your number).

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Renting out part of home, depreciation and sqft vs room method

I would like to use the method where I divide up the common space into thirds for calculating expenses since there are three bedrooms. However, this thread with @Carl and @ColeenD3 suggests that common areas should be considered personal use, so now I'm unsure if my method in which I divide the common space into three will work.

And just to confirm--I would be able to just adjust the “percentage of time I used this item for this business” field on the same asset in subsequent years to reflect the amount of time it's been rented, correct? In other words, the depreciation this year may look different than next year based on how long the room is rented?

Lastly, I just input all of my calculations (using the method where I divide the common space into three), and it looks like my expenses + depreciation exceed the rental costs by $423, so it shows up in turbo tax as -$423. Since I use the rental property as a home, my expenses + depreciation cannot exceed the rental costs. What should I do? Should I just pick a category, say mortgage interest, and decrease it by $423?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Renting out part of home, depreciation and sqft vs room method

1. Divide by 3 may be an option - if that is a reasonable method. . The bedroom is the rental property but you have rooms that are mixed use, like the kitchen and living room

The IRS states in pub 527 on page 16: If an expense is for both rental use and personal use, such as mortgage interest or heat for the entire house, you must divide the expense between rental use and personal use. You can use any reasonable method for dividing the expense. It may be reasonable to divide the cost of some items (for example, water) based on the number of people using them. The two most common methods for dividing an expense are (1) the number of rooms in your home, and (2) the square footage of your home.

2. Yes. If the bedroom sits there not being used by you and waiting for a tenant, it is still rental property. Should you decide to use the room, then it is personal use for those days. See chapter 5 of pub 527.

3. No. You can have a loss. Certain expenses are limited for you as your main home. Page 19 of pub 527 states: However, if you had a net loss from renting the dwelling unit for the year, your deduction for certain rental expenses is limited. To figure your deductible rental expenses and any carryover to next year, use Worksheet 5-1.

The worksheet is page 20 and it will show what is allowed, what is carried over, etc.

Be sure to document your thoughts in your tax file. If the IRS sends you a letter in 3 or 4 years, you will need to be able to explain your reasoning.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Renting out part of home, depreciation and sqft vs room method

I would like to use the method where I divide up the common space into thirds for calculating expenses since there are three bedrooms. However, this thread with @Carl and @ColeenD3 suggests that common areas should be considered personal use, so now I'm unsure if my method in which I divide the common space into three will work.

For depreciation, mortgage interest and property insurance you use the percentage of square footage that is exclusive to the client. You can not change this in future years. Otherwise, depreciation *will* be wrong.

For all other expenses (like utilities) the IRS says you can use "any reasonable method". There's two basic methods.

Method 1: use the percentage of expenses that equals the percentage of square footage exclusive to the client. So if 15% of your floor space is exclusive to the renter, 15% of your expenses are deductible on SCH E.

Method 2: Use the percentage of people living in the property as a whole. So if you have 5 occupants living in the property and 2 of them are renters, 2/5 (which is 40%) of your expenses would be deductible on SCH E. You *can* change this between method 1 and 2 each year, as an example.

I'm sure there are other methods, as the IRS says any "reasonable" method is acceptable.

-I would be able to just adjust the “percentage of time I used this item for this business” field on the same asset in subsequent years to reflect the amount of time it's been rented, correct?

Don't do that. There's a programming limitation with the TTX program that "WILL" screw things up bad. There's two places where you are asked for "percentage of time". The 2nd place you're asked that is the problem.

As you work through the rental asset in the assets/depreciation section, you are asked for "percentage of time". You were already asked this question before, and answered it. But in the assets/depreciation section, while this is the correct question to ask when the property is 100% rental use, it's the wrong question when renting out a part of your residence. The question should be "percentage of space that is exclusive to the renter". If you answer with percentage of time, the depreciation will be wrong. So answer that 2nd one (in the asset/deprecation section) with your response to "percentage of space". That one must be the same every year. Ohterwise, depreciation gets screwed up.

looks like my expenses + depreciation exceed the rental costs by $423, so it shows up in turbo tax as -$423

It is not common for residential rental real estate to show a profit "on paper" at tax filing time. In fact, it's more common to show a loss with each passing year. Now when renting a part on your residence, it's about 50-50. You may show a slight gain, or a loss. It just depends on the numbers. Either way is fine, and there's nothing to be concerned about, except to make sure you answered "that question" I referenced above, the way I advised you to answer it.

Since I use the rental property as a home, my expenses + depreciation cannot exceed the rental costs. What should I do?

If you do not use that space that is "exclusive to the renter" for any personal use "AFTER" you converted it to a rental, and you are charging FMRV, then what you say does not apply.

Should I just pick a category, say mortgage interest, and decrease it by $423?

Nope. If you don't qualify for carry over losses, then the program will not carry over the loss to next year and you won't be allowed to deduct your losses from other ordinary income. the program (not you) does the math. So leave it alone.

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

mishelk

New Member

jraybe1

Level 1

roger622

New Member

RaineB

Level 2

terimac4

Level 3