- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Investors & landlords

There is one issue I'm aware of if you are renting out "a part of" your residence. This issue will cause the amount of depreciation taken in that first year to be flat out wrong. Again, this is only an issue if you are renting out "A part of" your residence.

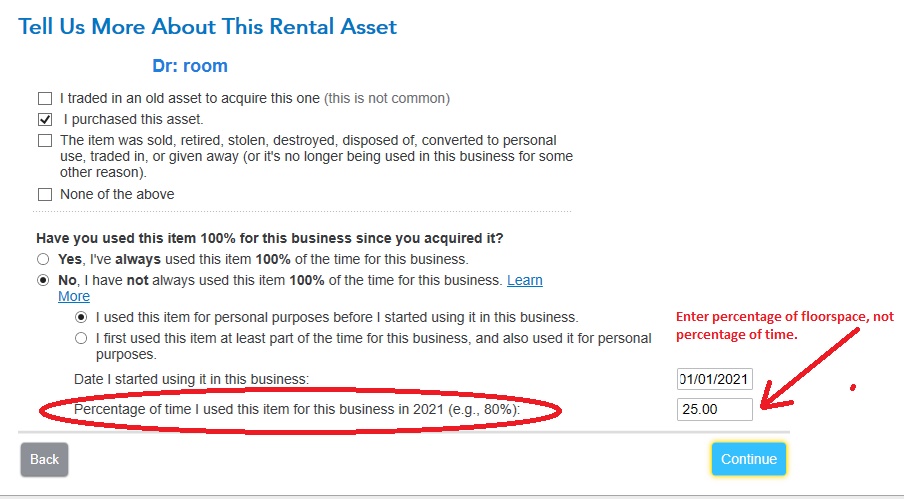

As you are working through your property in the Assets/Depreciation section you will come to the below screen. What you see pictured below is from the CD/Desktop version of TurboTax. It may look different in the online version. (I do not use the online version.)

Take note of what's circled in red above. The question is asking you for percentage of time. When you are renting out "a part of" your residence, that question should be asking you for percentage of floor space. If you enter percentage of floor space, then the depreciation figured by the program will be correct. Otherwise, it will be wrong.

If you want to double-check the program (and I highly encourage you to do so) then see IRS Publication 946 at https://www.irs.gov/pub/irs-pdf/p946.pdf Use the worksheet that starts on page 37. For line 4 of the worksheet, it's 27.5 years. For line 6 of that worksheet, table A-6 on page 72 applies.

Note that what you figure manually may be off by a buck or two, and that's find. The reason the program may be a few bucks off is because the program incorporates IRS "round to the nearest dollar" requirements.