- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- If I am renting one room (100 sq out of 3127 sq house), do I need to specify somewhere that depreciate only one room and not the whole house?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If I am renting one room (100 sq out of 3127 sq house), do I need to specify somewhere that depreciate only one room and not the whole house?

Thanks

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If I am renting one room (100 sq out of 3127 sq house), do I need to specify somewhere that depreciate only one room and not the whole house?

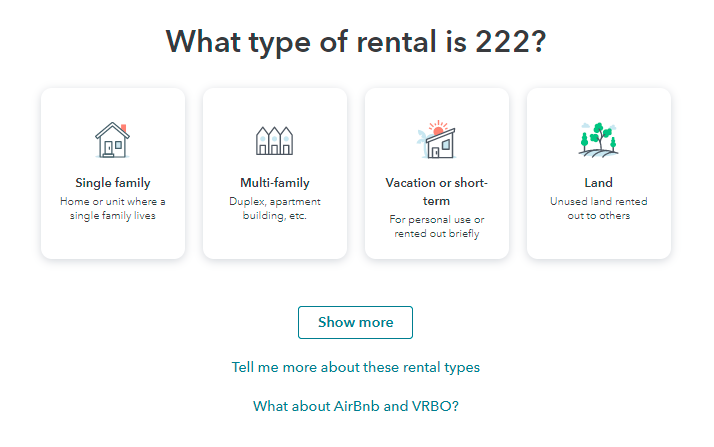

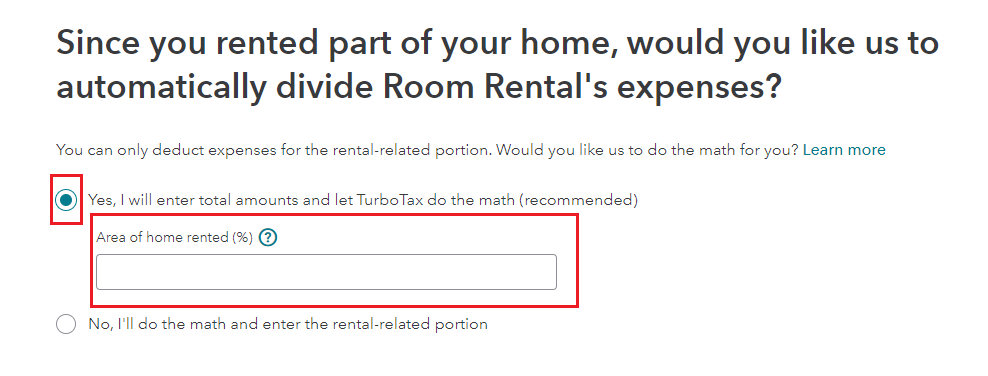

Once the multi-family home is chosen, the next selection should be "Rented a unit in the multi-unit where I live. Next you answer the questions about the rental portion percentage of the home. You will divide to arrive at the rental portion percentage (100/3127 = 3.20%).

You do have the option of entering the correct percentage of every single item yourself, which is what you need to do if not all of the expenses are equally prorated between you.

You should enter only the Rental portion (one room) percentage of the cost when you enter the cost of the asset. Land is not needed because the room would not include any land in this rental situation.

Continue to follow the screens and you should arrive at the correct depreciation amount for the rental portion of your home.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If I am renting one room (100 sq out of 3127 sq house), do I need to specify somewhere that depreciate only one room and not the whole house?

Yes, you do. Did you indicate at the beginning of the Rental section that you had a multi-family situation?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If I am renting one room (100 sq out of 3127 sq house), do I need to specify somewhere that depreciate only one room and not the whole house?

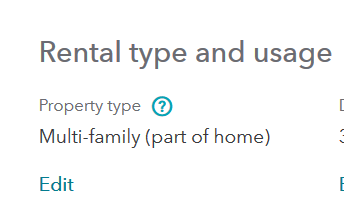

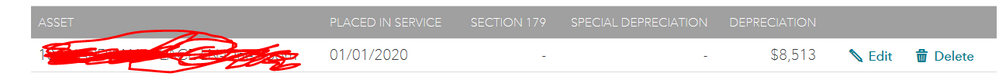

Thanks for reply. I did select it but it still calculates as $9K depreciation

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If I am renting one room (100 sq out of 3127 sq house), do I need to specify somewhere that depreciate only one room and not the whole house?

Once the multi-family home is chosen, the next selection should be "Rented a unit in the multi-unit where I live. Next you answer the questions about the rental portion percentage of the home. You will divide to arrive at the rental portion percentage (100/3127 = 3.20%).

You do have the option of entering the correct percentage of every single item yourself, which is what you need to do if not all of the expenses are equally prorated between you.

You should enter only the Rental portion (one room) percentage of the cost when you enter the cost of the asset. Land is not needed because the room would not include any land in this rental situation.

Continue to follow the screens and you should arrive at the correct depreciation amount for the rental portion of your home.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If I am renting one room (100 sq out of 3127 sq house), do I need to specify somewhere that depreciate only one room and not the whole house?

Oh, I see.I did put the % in the screen you showed here but I put the full cost of my house in the value of asset. Thanks for the detail answer. I will try with proportionate cost of the room.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If I am renting one room (100 sq out of 3127 sq house), do I need to specify somewhere that depreciate only one room and not the whole house?

I don't know where the reference to multi-family housing is coming from, as it has not been referred to as such by @nbadhe2020 Per the IRS, in order for a structure to be considered multi-family, it must contain 2 or more units where each unit is an accommodation containing separate and complete facilities for living, sleeping, eating, cooking and sanitation. An example would be an apartment containing a living area, sleeping area, bathing and sanitation facilities, and cooking facilities equipped with a cooking range, refrigerator, and sink, all of which are separate and distinct from other units.

https://www.irs.gov/tax-exempt-bonds/qualified-residential-rental-property-multifamily-housing-bonds

I entered rent $6000/yr and it is showing depreciation as 9720 which doesn't make sense.

What you received for rent has absolutely nothing to do with the depreciation in any way, shape, form or fashion. Depreciation is based on the cost basis of the structure (or percentage of the structure in your case) that is classified as residential rental rental estate. Period. So it's highly likely that your depreciation of $9.,720 is spot on.

Now You've already told me you rent out 100 sq ft of a house that has 3127 sq ft of floor space. So that's 3.19% of the total floor space. So to confirm your numbers are in fact correct, on what date did you place the room "in service" as a rental? Also need to know the cost basis of the structure. Do not include the cost basis of the land, as land is never depreciated.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If I am renting one room (100 sq out of 3127 sq house), do I need to specify somewhere that depreciate only one room and not the whole house?

I agree that I have single family house and not multi family. So I did select single family house first but per - DianeW777 I changed it to multi family but that didn't change my depreciation as you had pointed out.

I purchased the house in 2008 for 280K, the land is 45K. I put the room on rent starting from 1/1/2020.

So you are saying I don't need to specify the proportionate cost for that one room, right? I really appreciate your reply and help with this.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If I am renting one room (100 sq out of 3127 sq house), do I need to specify somewhere that depreciate only one room and not the whole house?

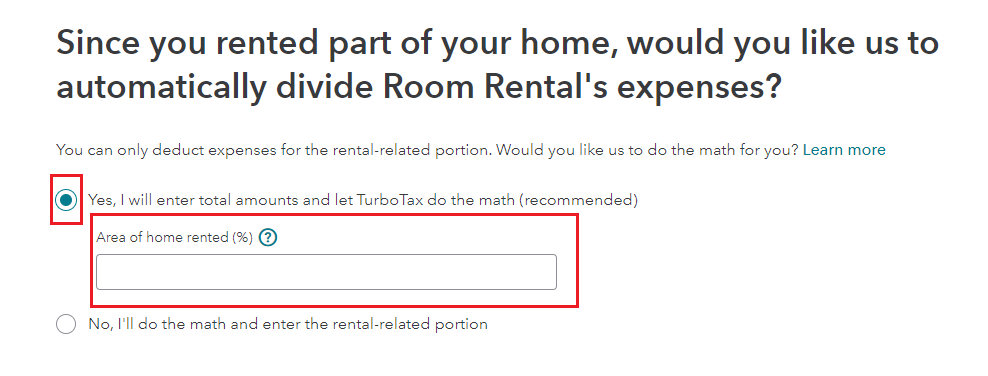

You're entering something wrong, or incorrectly selecting/not selecting something you should in the program. That comes as no surprise, because the program itself is asking you for incorrect information on one of the screens. The information asked for is incorrect only for your specific situation.

The program "does" figure the depreciation correctly when you enter the correct data and make the correct selections. At least, my desktop/CD version of Home and Business does. One thing to point out is that for those who are renting a portion of their primary residence, there is a screen where one of the questions is worded wrong for "that" specific situation and only "that" specific situation.

As you work through the asset, you have a screen titled "Tell us more about this asset". On that screen select "I purchased this asset new" and select "no, I have not always used this item 100% of the time for this business." Then select "I used this item for personal purposes before I started using it in this business".

Now here's where the disparity is. For you the "date I started using it in this business" will be 1/1/2020 of course. But the next entry, "Percentage of time I used this item for this business in 2020", would be correct to answer 100% in your case if you had converted the entire property to a rental in 2020 with a conversion/in-service date of 1/1/2020. But for you that question should ask "percentage of floor space used in this business in 2020". If you enter 3.19% in that box and click next, your first year depreciation will be darn near spot on.

Here's how it works manually, per the IRS instructions.

Using the IRS worksheet on page 38 of publication 946 at https://www.irs.gov/pub/irs-pdf/p946.pdf

Depreciation period: 27.5 years

Cost basis to be depreciated: $245,000

Business/investment use: 3.19%

Adjusted cost to be depreciated:$7,815 (thats 3.19% of $245,000)

Depreciation period: 27.5 years

Then table A-6 on page 72 applies to you. Since you placed the property in service on 1/1/2020 you multiply your adjusted cost basis of $7,815 by 3.485% and you get a first year depreciation amount of $272.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If I am renting one room (100 sq out of 3127 sq house), do I need to specify somewhere that depreciate only one room and not the whole house?

Yes, that is correct. The question asked is wrong in my case :)...I did put % in that box and it calculated correct depreciation.

Thanks for your help.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If I am renting one room (100 sq out of 3127 sq house), do I need to specify somewhere that depreciate only one room and not the whole house?

Make absolutely certain you take note of this, for next year's tax return. Otherwise, you'll be right back here with the same issue. 🙂

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If I am renting one room (100 sq out of 3127 sq house), do I need to specify somewhere that depreciate only one room and not the whole house?

Thanks for the answer ran into the same issue I initially put 100 in the box but now I realize from your response should be 12.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

c0ach269

New Member

Idealsol

New Member

teewilly1962

New Member

SB2013

Level 2

realestatedude

Returning Member