- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- rental room in condo

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

rental room in condo

I have a question for the live-in landlord(3 rooms, 2 rents), how does the live-in landlord file the blank 2 of the personal use days?(If I write more than 14, it could not deducate; but if I write 0, the address is the same as my mailing address)

and what the type of property for the condominium? (there is only single family / multi family.) Do I also need to file the schedule A for my own partial mortgage interest deduction?

And I and my husband are both of the owner of the property, also both are listed in mortagate. Could we separate the mortgage interest/depreciation and rental income randomly or equally?

Thank you so much for any help!

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

rental room in condo

1) how does the live-in landlord file the blank 2 of the personal use days? You don't. You are dividing by space, not by time. This is not a vacation home.

2) and what the type of property for the condominium? (there is only single family / multi family.) Multi family.

3) Do I also need to file the schedule A for my own partial mortgage interest deduction? Yes and the property taxes, too.

4) Could we separate the mortgage interest/depreciation and rental income randomly or equally? Divide by the square footage. Any common areas count as personal space.

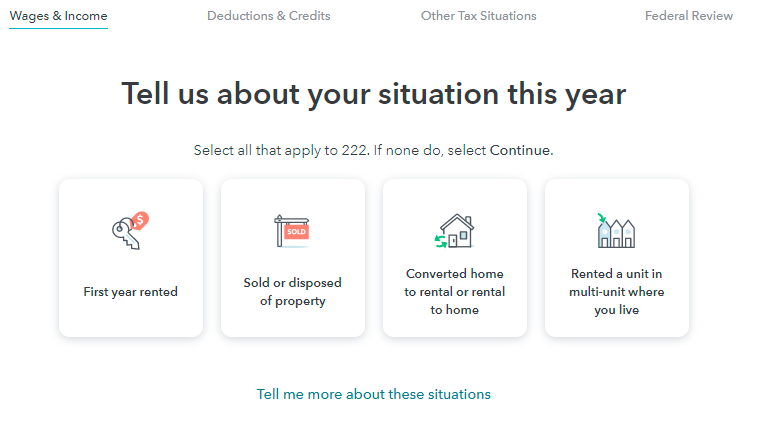

If the screenshot below appears, choose the fourth option.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

rental room in condo

1) how does the live-in landlord file the blank 2 of the personal use days? You don't. You are dividing by space, not by time. This is not a vacation home.

2) and what the type of property for the condominium? (there is only single family / multi family.) Multi family.

3) Do I also need to file the schedule A for my own partial mortgage interest deduction? Yes and the property taxes, too.

4) Could we separate the mortgage interest/depreciation and rental income randomly or equally? Divide by the square footage. Any common areas count as personal space.

If the screenshot below appears, choose the fourth option.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

rental room in condo

Hi ColeenD3,

Thank you so much for your help. the first 3 answers are clear! I think I describe the last question unclearly.

Because I and my husband are also on the title and also responsible for the mortgage payment. Could we separate the loss and income randomly or equally with my husband's tax form(we are reporting the tax separately)? Appreciated for the help so much!!!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

rental room in condo

See this reply from DianeW:

If the rental property is in both names and you file separately you can split the rental income and all expenses in half if a joint account is used to receive rents and pay expenses. You could also decide to choose who will claim the rental property on their return.

If an account owned by only one of you is used for the rental activity and/or the rental is only in one of your names, that person should claim the rental activity.

If you live in a community property state, you will be required to provide additional information regarding your spouse’s income.

- Community property states: AZ, CA, ID, LA, NV, NM, TX, WA, WI

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

syounie

Returning Member

user17526056324

Level 1

in [Event] Ask the Experts: Investments: Stocks, Crypto, & More

taxbadlo

Level 1

dheyrend

Level 1

ratrod94

New Member