- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Investors & landlords

1) how does the live-in landlord file the blank 2 of the personal use days? You don't. You are dividing by space, not by time. This is not a vacation home.

2) and what the type of property for the condominium? (there is only single family / multi family.) Multi family.

3) Do I also need to file the schedule A for my own partial mortgage interest deduction? Yes and the property taxes, too.

4) Could we separate the mortgage interest/depreciation and rental income randomly or equally? Divide by the square footage. Any common areas count as personal space.

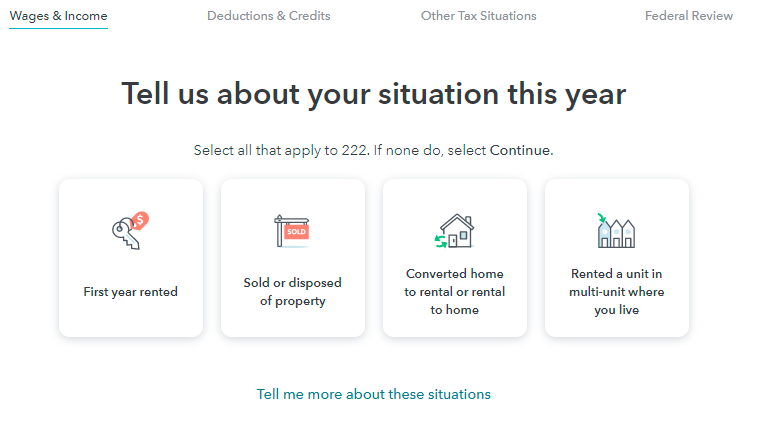

If the screenshot below appears, choose the fourth option.

March 10, 2021

2:21 PM