- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- Rental property vacant for part of year because of fire. Can I claim it to be rented for the entire year?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Rental property vacant for part of year because of fire. Can I claim it to be rented for the entire year?

I own a rental unit in a building which caught fire in May 2023. I haven't been able to rent the unit since work is going on in the building. I didn't live in the property during 2023 and had a tenant lease going into 2024.

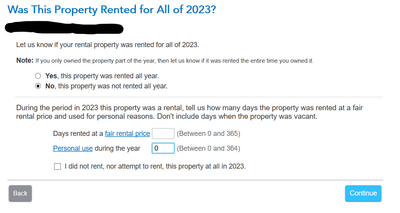

- How does this affect the question "Was this property rented for all of 2023?". It was intended to be rented for all of 2023 but couldn't be.

- Also what would the answer for "Days rented at a fair rental price" be? The number of days it was actually rented or the entire year?

- The insurance paid a certain amount for loss of use. Should I add that to the rental income I received?

- Finally, if the property is not in livable condition in 2024, can I still claim it as "Rented" and claim depreciation etc.?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Rental property vacant for part of year because of fire. Can I claim it to be rented for the entire year?

If your intention is to rent out the property again "and" you actually do rent out the property again once all work is complete, it's best to keep it classified as a rental. Otherwise, if you convert it to personal use, you will lose a lot of deductible expenses. For example, restoration is going to be using water and electric which *you* pay the bills for. Those expenses are not deductible for personal use property. But they are deductible for business/rental use property. So leave it classified as a rental.

There's nothing wrong with entering the actual number of days rented (and telling the truth) vs. saying it was rented the whole year. Now a part of your insurance payout was for lost rental income. Generally, that's for anywhere from 6 months to a year of rental income. You will include that amount of the insurance payout designated for lost rent, in the total rental income received for the entire year. Note that the insurance portion for loss of rent is typically for 85% of the actual rent, or less. That's common.

For your "days rented" and "days of personal use" questions, understand that vacant periods during the year (common between renters) do not count against you. However, personal use days *DO* count against you. Therefore, make sure you enter ZERO for days of personal use.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Rental property vacant for part of year because of fire. Can I claim it to be rented for the entire year?

@Carl Thank you for your response.

I do intend to keep this as a rental and not convert it to personal use.

Sounds like there are no adverse effects of claiming the property as not rented thru the entire year (and marking the exact amount of days it was rented).

Does this mean that I could have the property not rented thru the entire year (while not using it personally either) but still claim all deductions/depreciation etc. on it? I would think I may be in this scenario for 2024.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Rental property vacant for part of year because of fire. Can I claim it to be rented for the entire year?

I would expect you to have it rented out by the end of 2024, or at least "available for rent" by the end of the year. If not, I really don't see a problem. However, if audited on it you would need to explain/prove to the IRS why it's taking more than a year to rebuild it. If it really is taking more than a year to rebuild, an explanation shouldn't be a problem or an issue really.

There are advantages and disadvantages to both of your possibilities here.

If you keep it classified as a rental, depreciation continues and all expenses for things like utilities and lawn care are a valid rental expense. (Your cost of rebuilding will be a part of your new cost basis on the property when you are done.)

If you convert it to personal use, then the regular SCH E expenses are not deductible anywhere on your tax return. Of course, depreciation also stops on the date you convert to personal use. Mortgage interest on the property is a SCH A itemized deduction and when included with the mortgage on your primary residence you may be limited by the $750K cap on mortgage interest deduction on SCH A. All other expenses incurred after converting to personal use are also not deductible anywhere on your tax return. There's other nit-picky things too. But since you do intend to rent it out again once rebuilding is complete, it's really not worth getting into.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

mjtax20

Returning Member

misschristian0711

New Member

margomustang

New Member

janetcbryant

New Member

noodles8843

Level 1