- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- Rental Property Tax Questions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Rental Property Tax Questions

Background

I purchased property A on May 28 of 2010. I purchased property B on July 15 of 2023. I continued to live in Property A from July 16 to Aug 3 (20 days) while minor renovations were done to Property B. Tenants moved into property A on Aug 4 of 2023 (which means they occupied property A for 150 days in 2023).

Questions

1.) Property Taxes on Property A: I paid 2022 property taxes ($7.2k) in January of 2023 and I paid 2023 property taxes ($6.8k) in December of 2023. Is the applicable expense period 150 days or 170 days (150+20)? Is the rental property expense $6.8k*(150/365) or is it $14k*(150/365)?

2.) Solar Panels & Back Up Batter: Purchased in October of 2020 for $28,238.69. Ten-year loan (2.99%) on $25264.82 with monthly payment of $243.84. Can the monthly loan payments be classified as an expense (if yes how to account for the 25% tax credit)? Or do I have to classify as a depreciating asset? Or do I do both?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Rental Property Tax Questions

Here are the answers to your questions in order.

- The property taxes ratio for the rental period begin on the day it was converted to 100% rental property, August 4th through the end of the year for all taxes paid in 2023.

- (150/365 or 41%)

- No, the monthly loan payments are not an expense. This was the purchase of a capital improvement to the property. The real question is what is my cost basis for the home and land at the time it was converted to a rental property. This includes original purchase, purchase expenses, any capital improvements over the years. You must compare that to the current fair market value (FMV) on the day you began to rent it and use the lesser of the two. Once this is determined you will enter the home asset cost basis or FMV then the land portion. The county or city tax assessment records can help you determine the home and the land portion.

- Example: land value/total value = land percentage -- home value/total value = home percentage

Note: You must answer that the property was 100% rental because it was on the day it was converted to rental use. You will be asked what date the rental was purchased and the day it was rented. And it must be rented at fair rental value (FRV). You will need to enter only the rental percentage of expenses paid for the whole year such as home owners insurance, property taxes, interest and then only the expenses paid specifically for the rental property such as utilities, if applicable, for the rental period.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Rental Property Tax Questions

Thank You Dianne,

Item 1 (tax ratio); it is clear.

Item 2 (depreciation); I have more questions.

Background

I purchased "Property A" on May 28 of 2010 (30 yr), refinanced May 30 of 2012 (30 yr), and refinanced again Aug 24 of 2016 (15 yr).

Question (s)

1.) Can I depreciate the "closing costs" of these "intangible assets"? If yes, then would each one be a separate item with its own useful life? For example, 2010 mortgage would have a useful life of 2 years. 2012 refinance would have a useful life of 4 years, and the 2016 refinance would have a useful life of 15 years.

2.) When depreciating the solar panels and back-up battery, does it have to be rolled it into the house? Or can it be a separate item (classified as an "Applicance") with useful life of 5 years?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Rental Property Tax Questions

There is a difference between loan fees and other closing costs.

- See the following difference between loan charges and closing costs.

- Loan charges - Loan charges are part of the loan and not added to cost basis

- -Application fees

- -Lender fees

- -Appraisal Fee

- -Inspection Fee

- -Condo Questionnaire

- -Credit Report

- -Debt Report

- You can't include in your basis the fees and costs for getting a loan on property.

- Government Recording and Transfer Charges

- -Recording fees

- Title Charges

- -Lenders Tile Policy

- -Settlement or Closing Fee

- -MLC - Assuming it means Municipal Lean Certificate

- -Title Exam

- -Owners title policy

- Loan charges - Loan charges are part of the loan and not added to cost basis

- See the information for each item below.

- I would guess the useful life the solar panels is significant so you can use a separate asset but still 27.5 year recovery for residential rental if you want to track it separately.

- For the battery backup the life may be different and shorter so for this item you can use a different recovery period.

Loan Fees are actually amortized which is similar to depreciation: See the instruction on how to enter those below.

- Sign into your TurboTax Account > Search (upper right) > Type rentals > Press enter > Click on the Jump to .... Link

- Edit beside the rental you want to work on > Scroll to Assets > Edit

- Select Yes to go directly to the asset summary >

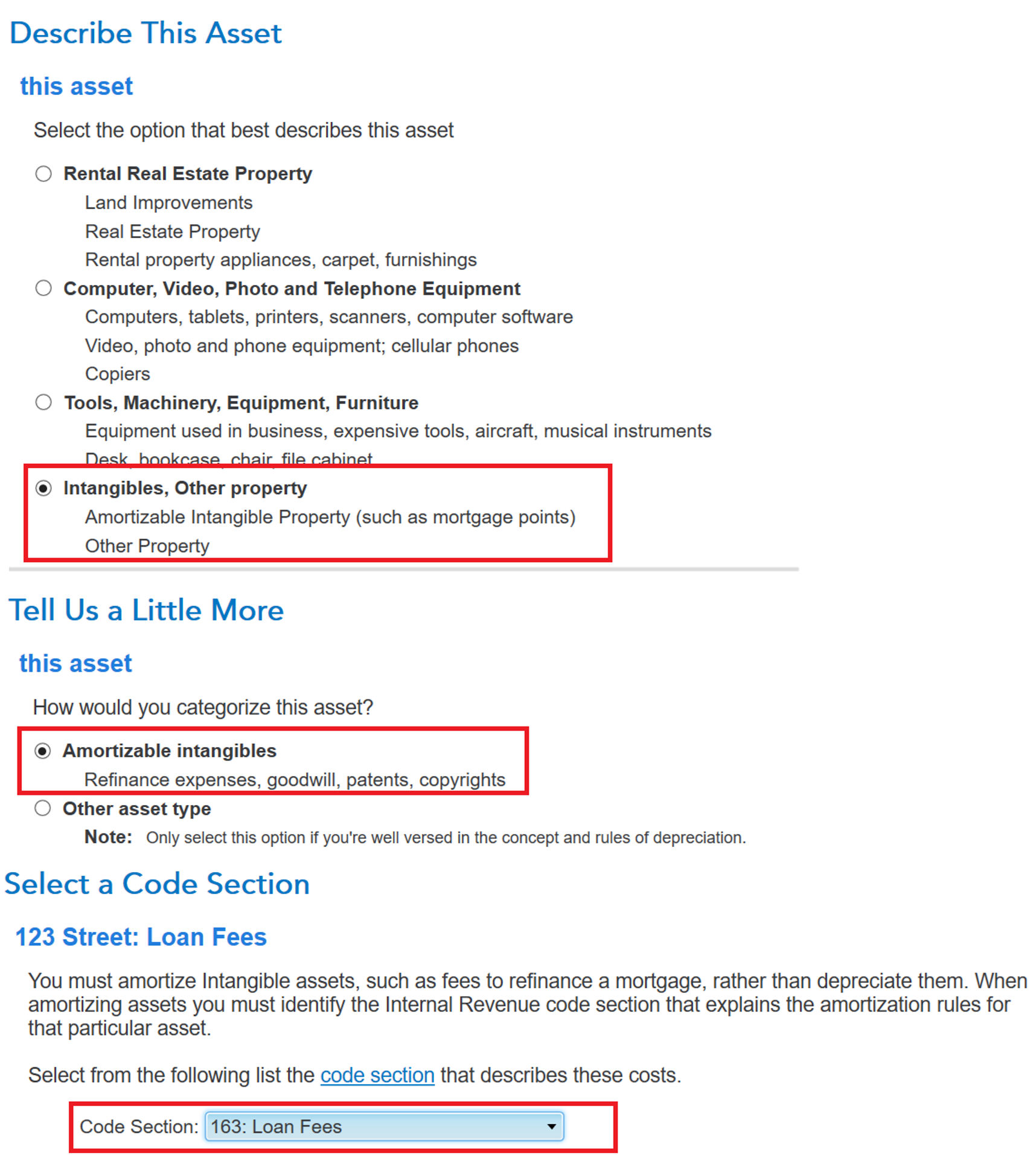

- Add or Edit the asset for the loan refinance costs > Select Intangibles, Other Property > Continue

- Select Amortizable intangibles > Continue > Enter the details about your costs including the refinance date

- Continue > Select the Code Section 163 for loan fees > Enter the useful life (number of months of the loan)

- The final screen will show the deduction.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Rental Property Tax Questions

Thank You

The loan initiated in May of 2010 was a 30 year mortgage. I refinanced this loan in May of 2012 to a 30 year mortgage with a lower rate. So is the useful life of the loan taken in May of 2010 considered as 2 years (or is it considered as 30 years)?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Rental Property Tax Questions

Loan Fees (as opposed to property fees):

You will use only the refinanced loan that began in 2012 and all loan fees prior to the rental would be personal expense. Beginning in July, 2023 you would amortize the remainder of the loan fees for the remainder of years/months of the loan.

- 2012 + 30 years = 2042 (May)

- 2022-2012 = 10 years (120 months) and 6 months are done at the point rental

- 19.5 years remaining on the loan taken out in 2012 or 234 months. Enter 19.5 years in the asset for loan fees or 19 if that's easier. Feel free to check the math.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

syounie

Returning Member

ramseym

New Member

DallasHoosFan

New Member

eric6688

Level 2

alvin4

New Member