- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Investors & landlords

There is a difference between loan fees and other closing costs.

- See the following difference between loan charges and closing costs.

- Loan charges - Loan charges are part of the loan and not added to cost basis

- -Application fees

- -Lender fees

- -Appraisal Fee

- -Inspection Fee

- -Condo Questionnaire

- -Credit Report

- -Debt Report

- You can't include in your basis the fees and costs for getting a loan on property.

- Government Recording and Transfer Charges

- -Recording fees

- Title Charges

- -Lenders Tile Policy

- -Settlement or Closing Fee

- -MLC - Assuming it means Municipal Lean Certificate

- -Title Exam

- -Owners title policy

- Loan charges - Loan charges are part of the loan and not added to cost basis

- See the information for each item below.

- I would guess the useful life the solar panels is significant so you can use a separate asset but still 27.5 year recovery for residential rental if you want to track it separately.

- For the battery backup the life may be different and shorter so for this item you can use a different recovery period.

Loan Fees are actually amortized which is similar to depreciation: See the instruction on how to enter those below.

- Sign into your TurboTax Account > Search (upper right) > Type rentals > Press enter > Click on the Jump to .... Link

- Edit beside the rental you want to work on > Scroll to Assets > Edit

- Select Yes to go directly to the asset summary >

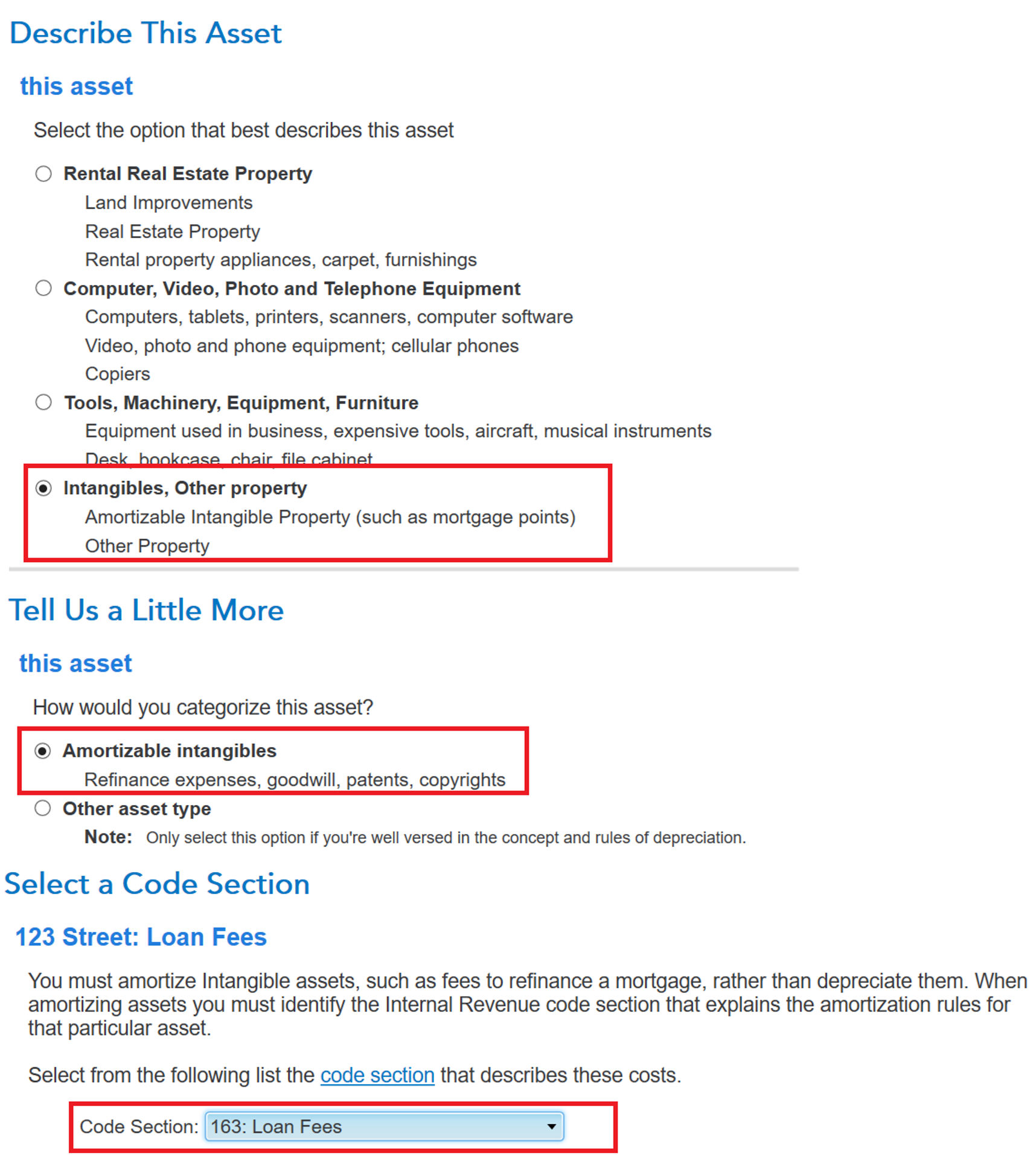

- Add or Edit the asset for the loan refinance costs > Select Intangibles, Other Property > Continue

- Select Amortizable intangibles > Continue > Enter the details about your costs including the refinance date

- Continue > Select the Code Section 163 for loan fees > Enter the useful life (number of months of the loan)

- The final screen will show the deduction.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

March 13, 2024

1:36 PM