- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- Rental Properties

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Rental Properties

On 11/2020 and 12/2020, I purchased two out-of-state rental properties in Nevada. One as a second home (11/2020) and one as a rental/investment property (12/2020).

I received 1098 for the second home and nothing for the investment property (purchased 12/2020). When I called the mortgage co., for 1098 for the investment property, they advised me that since no payments were made in 2020, no 1098 is generated.

None of the properties got rented till Jan 2021. I also spent $16,000 in upgrades (in 2020) to the properties to make them rental-ready.

Additionally, I also have the Settlement Statements from the Title Company.

I am using 2020 Turbo Tax Home and Business version of the software.

My questions are:

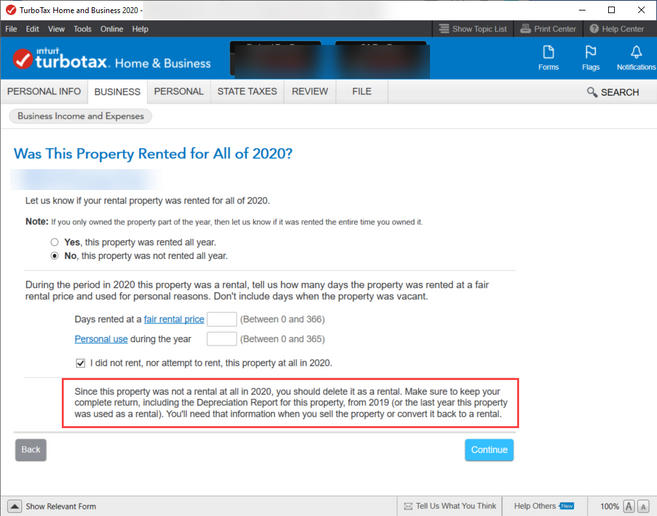

- It appears I will be entering the Rental Property Purchase information in the Business section (please see attached image). However, as I started to enter the property information, TT gave an advisory that since none of the properties were rented in 2020, that I must delete the rental.

So where exactly am I entering my cost basis, and out-of-pocket cost from the Settlement Statements and the one 1098? - I have read in other threads, I need to separate the land from the structure values...

Here is a snippet from the thread with the URL below for the complete thread...depreciation on your rental property is the based on the original cost of the rental asset less the value of the land (because land is not depreciable). The original cost can include various expenses related to the purchase of the property. If you make a capital improvement to the rental property, you will depreciate it using the same useful life of the underlying property. If you don't know the original house and land separate costs, you can use the percentage of house and land to total value listed on your property tax bill to allocate the original cost.

So for example, if you bought a rental property (house and lot) for $148,000, had capitalized purchasing expenses of $2,000 and the cost allocated to the land part of the purchase was $50,000, then your depreciable basis in your rental property is $100,000 ($148,000 + $2,000 - $50,000).

Solved: Calculate depreciation for rental property? (intuit.com) - Not sure if I am missing anything else as I am stuck on this screen (as shown in the attached image), but does the upfront tax payment, insurance, etc. go in the business income and expense section as well as I advance through the screens?

Thank you for your assistance and have a blessed day.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Rental Properties

I purchased two out-of-state rental properties in Nevada. One as a second home (11/2020) and one as a rental/investment property (12/2020).

the first property would be a second home since it was not rented until 2021. (not really sure by what you mean by rental property/second home). a rental that is used as a second home can be limited in what can be deducted based on days of personal usage. so for 2020, you would be entitled to home mortgage interest deduction and real estate tax deduction on schedule A. this would require. since it was not rented you may need to enter the cost and other info for rental on schedule E in 2021. the rental property also would not be entered until 2021 when it was rented.

see this link regarding personal use of rental property

https://www.irs.gov/taxtopics/tc415

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Rental Properties

Thank you for your response. Here is additional clarification.

So of the two homes, none of them are primary residences. Both properties were purchased in Nov and Dec of 2020.

One of them is an investment property with the sole purpose of rental. I have not received 1098 for it. The second home was purchased as a 2nd home, so it too is not a primary residence; however, for this one, I did receive 1098.

Both properties did not get rented out till Jan 2021.

So if I gather correctly, for the 2nd home, for which I do have 1098 from the Mortgage company, and which did not get rented till Jan, 2021, for the period of Nov-Dec, 2020 I will enter it as a primary residence, since it was not rented, correct? However, for 2021 tax year, I will enter it under the business section of TT as it was rented as of Jan 2021.

If the above is true, while I have not gone through the entire interview under the personal section, but I would imagine it would prompt me to enter the information such as 1098 at some point in the interview process. Is there a place to enter the prepaid taxes and other expenses from the Settlement Statement as well?

I'm just trying to figure out if it is under the personal or business section and if both the 1098 and information from the Settlement Statement would be captured. Thank you.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Rental Properties

It depends on whether the rental property was available for rent in 2020. Whether or not it was actually rented.

If it was, then on the screen asking if the property was rented for all of 2020, you would either check yes, it was rented all year (if it was available for rent the entire time that you owned it) or if not, enter the number of days that the property was available for rent in 2020. You would also enter zero for the amount of rental income received in 2020. You would start depreciating the property in 2020 and claim the interest and taxes for the year on the rental Schedule E.

If the property was not available for rent in 2020, then you wouldn't enter anything in the rental section. You could claim the interest paid in 2020 as an itemized deduction (for your main residence and one other property as Home Mortgage Interest, and the real estate taxes paid at closing under Property Taxes.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Rental Properties

Where do you enter mortgage payment (rent expense) on the Schedule E " Rent and Royalties?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Rental Properties

Only the mortgage interest payment is entered into Schedule E for the rental property.

This TurboTax help article will guide you through entering income and expenses for rental property.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

syounie

Returning Member

ramseym

New Member

DallasHoosFan

New Member

eric6688

Level 2

William--Riley

New Member