- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Rental Properties

On 11/2020 and 12/2020, I purchased two out-of-state rental properties in Nevada. One as a second home (11/2020) and one as a rental/investment property (12/2020).

I received 1098 for the second home and nothing for the investment property (purchased 12/2020). When I called the mortgage co., for 1098 for the investment property, they advised me that since no payments were made in 2020, no 1098 is generated.

None of the properties got rented till Jan 2021. I also spent $16,000 in upgrades (in 2020) to the properties to make them rental-ready.

Additionally, I also have the Settlement Statements from the Title Company.

I am using 2020 Turbo Tax Home and Business version of the software.

My questions are:

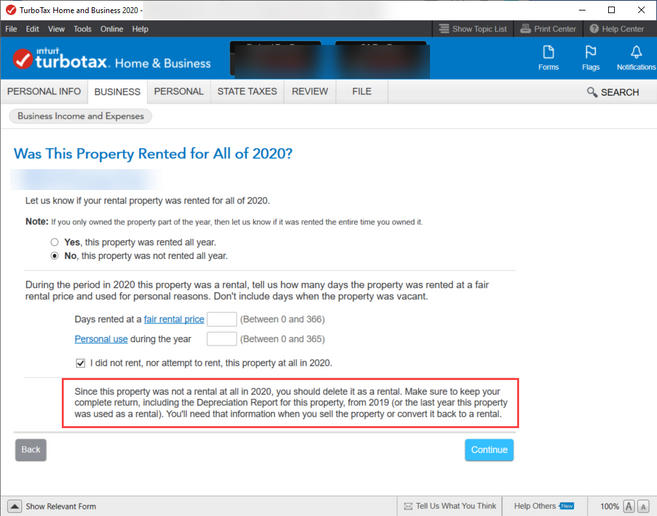

- It appears I will be entering the Rental Property Purchase information in the Business section (please see attached image). However, as I started to enter the property information, TT gave an advisory that since none of the properties were rented in 2020, that I must delete the rental.

So where exactly am I entering my cost basis, and out-of-pocket cost from the Settlement Statements and the one 1098? - I have read in other threads, I need to separate the land from the structure values...

Here is a snippet from the thread with the URL below for the complete thread...depreciation on your rental property is the based on the original cost of the rental asset less the value of the land (because land is not depreciable). The original cost can include various expenses related to the purchase of the property. If you make a capital improvement to the rental property, you will depreciate it using the same useful life of the underlying property. If you don't know the original house and land separate costs, you can use the percentage of house and land to total value listed on your property tax bill to allocate the original cost.

So for example, if you bought a rental property (house and lot) for $148,000, had capitalized purchasing expenses of $2,000 and the cost allocated to the land part of the purchase was $50,000, then your depreciable basis in your rental property is $100,000 ($148,000 + $2,000 - $50,000).

Solved: Calculate depreciation for rental property? (intuit.com) - Not sure if I am missing anything else as I am stuck on this screen (as shown in the attached image), but does the upfront tax payment, insurance, etc. go in the business income and expense section as well as I advance through the screens?

Thank you for your assistance and have a blessed day.