- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- Rental income from a LLC and Cash distribution from the LLC. Do I need to file New Hampshire state tax?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Rental income from a LLC and Cash distribution from the LLC. Do I need to file New Hampshire state tax?

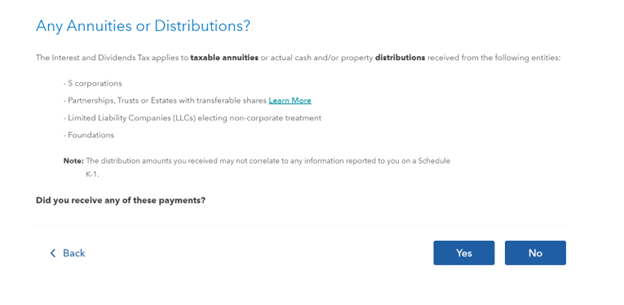

My spouse and I have rental property in an LLC and we are the only members of LLC. The rental property is in New Hampshire and generated gross income of $22,250. Schedule K-1 was received from the LLC, and for the 2023 tax year turbo tax triggered a state tax filing because our Dividends and Interest Income are more than $4800 for married filling jointly. $35 bank interest was generated by the LLC and others were generated through the personnel brokerage account and savings account. My understanding is that I will have to pay state tax for all types of dividends and interest income. While going through the state filling questions, distributions from LLC question got me confused. LLC generated profit, so I distributed cash to my spouse and I which is reported in K-1. Should I select Yes to this question?

I have had this LLC for 4 years and turbo tax never triggered a state tax filling for cash distributions.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Rental income from a LLC and Cash distribution from the LLC. Do I need to file New Hampshire state tax?

This has been a confusing area of NH tax law for 10 or 20 yrs. I look forward to the I&D tax going away in 2027.

NH seems to tax actual distributions from LLCs/partnerships/s-corps (cash or property). It is unrelated to any number on a K-1. It is not a profits tax (the is a separate NH tax that only applies if gross income > $103k). Below are the details from the NH DP-10 instructions, but I find this confusing and would welcome thoughts of anyone who has carefully read the statues or regulations.

https://www.gencourt.state.nh.us/rsa/html/NHTOC/NHTOC-V-77.htm

https://www.gencourt.state.nh.us/rules/state_agencies/rev900.html

The DP-10 instructions ( https://www.revenue.nh.gov/forms/2023/documents/dp-10-instructions-2022.pdf ) page 3 says (emphasis added):

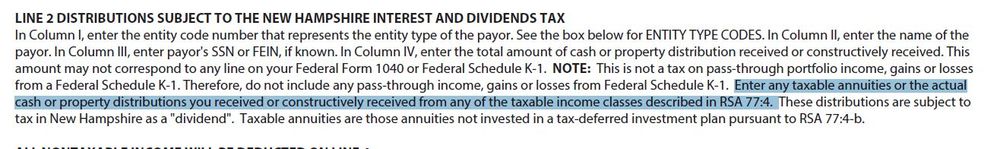

LINE 2 DISTRIBUTIONS SUBJECT TO THE NEW HAMPSHIRE INTEREST AND DIVIDENDS TAX

In Column I, enter the entity code number that represents the entity type of the payor. See the box below for ENTITY TYPE CODES. In Column II, enter the name of the

payor. In Column III, enter payor's SSN or FEIN, if known. In Column IV, enter the total amount of cash or property distribution received or constructively received. This

amount may not correspond to any line on your Federal Form 1040 or Federal Schedule K-1. NOTE: This is not a tax on pass-through portfolio income, gains or losses from a Federal Schedule K-1. Therefore, do not include any pass-through income, gains or losses from Federal Schedule K-1. Enter any taxable annuities or the actual cash or property distributions you received or constructively received from any of the taxable income classes described in RSA 77:4. These distributions are subject to tax in New Hampshire as a "dividend". Taxable annuities are those annuities not invested in a tax-deferred investment plan pursuant to RSA 77:4-b.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Rental income from a LLC and Cash distribution from the LLC. Do I need to file New Hampshire state tax?

@jtax I am well under the Business Profit Tax (BPT), so I don't have to pay state BPT taxes.

Reading through the DP-10 instructions (page 3), It look like I will have report the dividend/interest cash distribution (which is taxable income class described in RSA 77:4) from the LLC and not to include rest of the cash distribution.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Rental income from a LLC and Cash distribution from the LLC. Do I need to file New Hampshire state tax?

Why do you conclude that? Line 2 says "enter the total amount of cash or property received?"

I do not think this is only related to portfolio interest/dividends passed thru from LLC investments/bank accounts., if that's what you're thinking.

Looking at the regulations Rev. 901.09 a "dividend" is amount distributed to members because of their owners from current or past profits.

It seems that the issue is whether the distribution is from profits (i.e. a dividend paid to owners) or from capital (non-taxable return of capital).

Glad you are aware of and below the BT and BET thresholds.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Rental income from a LLC and Cash distribution from the LLC. Do I need to file New Hampshire state tax?

@jtax I am looking at RSA77:4 based on what is said in Line 2

77:4 What Taxable. – https://www.gencourt.state.nh.us/rsa/html/V/77/77-4.htm

Income of the following described classes is taxable:

I. Interest from bonds, notes, money at interest, and from all debts due the person to be taxed, except interest from notes or bonds of this state and notes or bonds of any political subdivision of this state.

II. Dividends, other than stock dividends paid in new stock of the company issuing the same, on shares in all corporations and joint stock companies organized under the laws of any state, territory, or nation.

III. Dividends, other than stock dividends paid in new stock of the partnership, limited liability company, or association issuing the same, on shares in partnerships, limited liability companies, or associations the beneficial interest in which is represented by transferable shares.

IV. Dividends, other than that portion of a dividend declared by corporations to be a return of capital and considered by the federal internal revenue service to be such, the exemption of which is permitted by RSA 77:7.

V. Amounts reported and taxed federally as dividends or interest to a holder of an ownership interest in a qualified investment company as defined in RSA 77-A:1, XXI, a mutual fund, or a unit investment trust.

RSA does not talk about distribution from the profit but only the interest and dividends.

Rev 901.09 “Dividend” means an amount of property distributed, with respect to their ownership interest, other than in liquidation of the organization, to shareholders or interest-holders of an organization from : (a) Current year profit; or (b) Accumulated profits of such entity.

What is confusing to me in the 901.09 is that it specifies only property distribution but not cash distribution but at the end it says current year profit or accumulated profit. My understanding is that property distribution is different from cash distribution.

I am totally confused now between RSA77: 4 and 901.09

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Rental income from a LLC and Cash distribution from the LLC. Do I need to file New Hampshire state tax?

I have some more thoughts for you below. I don't understand this enough to give you a definitive answer. The I&D tax for entities has been hard to understand. Perhaps you should seek the advice of a NH attorney or CPA (who does this all the time not now and then). Should only take a half hour consultation. I quick google will get you several lawyers who have written articles, especially when the state modified the I&D law to clearly tax LLCs distributions that were not reasonable compensation. (You might be able to reduce your distribution by reasonable compensation, but for a rental property as opposed to an operating business, I would think that would be minimal.)

RSA does not talk about distribution from the profit but only the interest and dividends.

But by definition a dividend is a profit distribution from an entity. In addition to Rev 901.09, see the first google definition of dividend "a sum of money paid regularly (typically quarterly) by a company to its shareholders out of its profits (or reserves)."

So I would ask isn't your distribution described in RSA 77:4 III or IV?

It seems to me that your LLC is paying you dividend when makes a distribution and that appears to be taxed unless an exemption applies (like return of capital, i.e. not a profit distribution).

Rev 901.09 “Dividend” means an amount of property distributed, with respect to their ownership interest, other than in liquidation of the organization, to shareholders or interest-holders of an organization from : (a) Current year profit; or (b) Accumulated profits of such entity.

What is confusing to me in the 901.09 is that it specifies only property distribution but not cash distribution but at the end it says current year profit or accumulated profit. My understanding is that property distribution is different from cash distribution.

For most purposes in tax law there is no difference between property and cash distributions. Property has more issues (basis, how to value, etc.), but the basic idea is that you can't take cash and buy, say, a car and distribute the car and get out of paying a tax.

Also cash, legally, is personal property.

I am totally confused now between RSA77: 4 and 901.09

One thing that might help, if you don't already know, is that legally the statutes (RSAs in NH) are a high level description of the law. The agencies promulgate more detailed regulations to flesh out how the statute is going to work. E.g. the statute might say an annual tax return is required. The regulations might say it is due on April 15 and the required form is the XYZ-NN. The regulation is binding law unless someone challenges it in court for being contradicting the statute (or other reason) and wins. Or the agency changes it.

Also note that instructions are not law. Instructions cannot change the law. The statue and regs (as interpreted by administrative or court cases) are law.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

megan0956

Returning Member

Ret28

Level 1

JDH13

Level 1

ashleyhudd229

New Member

rjs55

Returning Member