- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Rental income from a LLC and Cash distribution from the LLC. Do I need to file New Hampshire state tax?

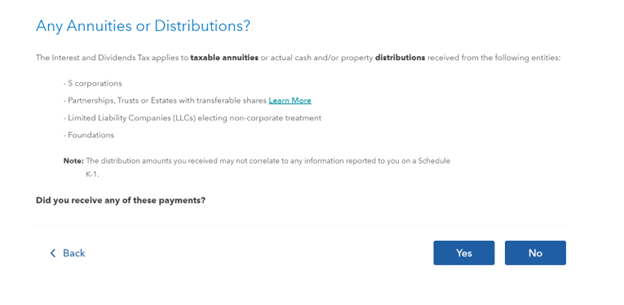

My spouse and I have rental property in an LLC and we are the only members of LLC. The rental property is in New Hampshire and generated gross income of $22,250. Schedule K-1 was received from the LLC, and for the 2023 tax year turbo tax triggered a state tax filing because our Dividends and Interest Income are more than $4800 for married filling jointly. $35 bank interest was generated by the LLC and others were generated through the personnel brokerage account and savings account. My understanding is that I will have to pay state tax for all types of dividends and interest income. While going through the state filling questions, distributions from LLC question got me confused. LLC generated profit, so I distributed cash to my spouse and I which is reported in K-1. Should I select Yes to this question?

I have had this LLC for 4 years and turbo tax never triggered a state tax filling for cash distributions.