- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- Re: What is passive loss carryover

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What is passive loss carryover

Sorry for the misunderstanding, but I'm talking about a passive loss in 2019 that can offset taxable income earned in 2019. This is not a carryover situation. Has Turbo been updated to calculate this based on the CARES Act?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What is passive loss carryover

Just to confirm and or clarify in the new Cares Act my passive loss carryover can be applied to my earned income? My CPA is telling me that I can only use a business loss not my K1 loss from passive investments.

Thanks

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What is passive loss carryover

No. The CARES Act updates applies only to NOL (net operating losses), not passive losses. Passive losses continue the same tax treatment. If you have passive losses, they may be used to offset passive income. Passive loss limitations apply.

The CARES Act permits NOLs from the 2018, 2019, and 2020 tax years to be carried back to the previous five tax years (beginning with the earliest year first) and suspends the 80% of taxable income limitation through the 2020 tax year. The NOL carryback can result in an immediate refund of taxes paid in prior years.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What is passive loss carryover

Where are the screenshots?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What is passive loss carryover

In May-June of 2019, the old AnswerXchange system was moved to a new platform (this one). In that migration, the screenshots were not carried over, so there are no screenshots.

In the future, screenshots will appear inline in the answer, not attached below as before.

What screenshot did you need?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What is passive loss carryover

Hi, I'm trying to figure out what to put for the regular tax for passive loss carryovers. I've been going over the 2018 forms and haven't been able to figure out what the losses have been. I really need some help.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What is passive loss carryover

I have same questions as Dorothy above.

My 2018 taxes were done professionally. I have sch E,D and worksheets.

I don't know where to find 2018 at-risk (or passive) losses "Regular Tax Carryover" and "AMT Carryovers" on sch E

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What is passive loss carryover

The regular and AMT passive loss carryovers will be on the Form 8582 and Form 8582-AMT worksheets from your 2018 tax return.

Note that if your property qualified for Qualified Business Income (QBI) deduction in 2018, the QBI carryover loss is only the 2018 loss amount. For TurboTax returns, that QBI carryover is shown on the Federal Carryover Worksheet.

Typically, entering these amounts is only necessary when you are using TurboTax for the first time (or using a different TurboTax Online account than was used in 2018).

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What is passive loss carryover

If I do not have 8582 AMT form, should I put $0 in question about passive loss carryovers AMT box? Thank you

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What is passive loss carryover

Where can I enter passive loss carryover from 2018 8582-

Worksheet 5 ' Allocation of Unallowed Losses in this year turbotax

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What is passive loss carryover

on mine, TT shows it entered it on schedule E Line 28A...I am not 100% sure that's correct. I've had a lot of issues with TT this year and transferring relevant info from 2018.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What is passive loss carryover

Schedule E, line 28 is the correct place for a suspended loss that is realized on the sale of a rental property to appear.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What is passive loss carryover

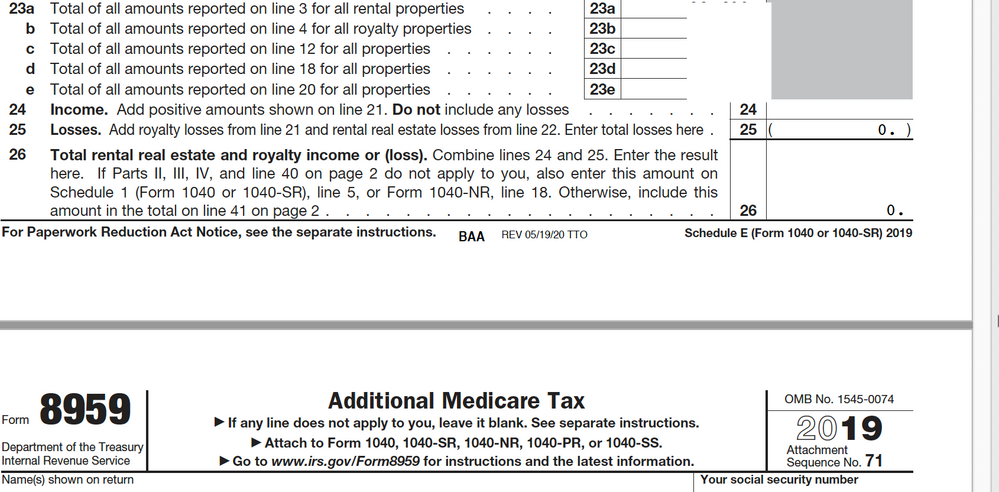

I don't see line 28 in Schedule E. My form ends at line 26

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What is passive loss carryover

Line 28 is on page 2 of Schedule E, your screenshot is of page 1 only. @esha123

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What is passive loss carryover

Page 2 of Schedule E does not exist for me.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

barnabyf

Level 3

alex1907

Level 2

drewdippold

Level 1

naokoktax

Level 1

midtowncpa

Level 2