- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- Re: Turbotax calculation error if selling home which was partly depreciated

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbotax calculation error if selling home which was partly depreciated

If you sell a home which was previously used either as a business or a rental there is a significant problem with Form "Home Sale Worksheet" and "Home Adjusted basis". I redid the calculations using IRS Pub 532 worksheets 2 and 3. Results are very different. TT is subtracting the depreciation previously taken from the exclusion rather than the gain and completely ignoring the steps 5&6 in the IRS form. The final check doesn't pick this up.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbotax calculation error if selling home which was partly depreciated

I am working on this scenario and wondered if you would like to share your file. Please tag me by using @DianeW777.

You can send us a “diagnostic” file that has your “numbers” but not your personal information. If you would like to do this, here are the instructions:

TurboTax Online:

Go to the black panel on the left side of your program and select Tax Tools.

- Then select Tools below Tax Tools.

- A window will pop up which says Tools Center.

- On this screen, select Share my file with Agent.

- You will see a message explaining what the diagnostic copy is. Click okay through this screen and then you will get a Token number.

- Reply to this thread with your Token number. This will allow us to open a copy of your return without seeing any personal information.

TurboTax CD/Download:

If you like, you can send a copy of your return that will be scrubbed to eliminate your personal data by using these steps:

- Click on Online in the top left menu of TurboTax CD/Download for Windows

- Select 'Send Tax File to Agent'

- Write down or send an image of your token number then place in this issue.

- We can then review your exact scenario for a solution.

- Please also tell us any states included in the return.

We will then be able to see exactly what you are seeing and we can determine what exactly is going on in your return and provide you with a resolution.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbotax calculation error if selling home which was partly depreciated

The total taxable gain is being included in your total capital gains on Schedule D and then carried to your Form 1040, Line 7. It does not double your depreciation portion of the gain as part of your income. The depreciation recapture portion is separately stated on your Schedule D, Line 19 to specifically identify this as the part of the taxable gain that is taxed as ordinary income so that it will not be confused with special capital gain treatment.

When the tax for your total income is calculated beginning on the Schedule D tax worksheet line 11, shows the breakdown of the different incomes and applies the correct tax to each type. This is always used when capital gains are part of the return so that you get the lowest tax possible. The depreciation recapture must be taxed at your regular tax rate and the remainder of the taxable gain is taxed at the special capital gains rates which are maxed at 20% in your case.

Your home sale exclusion is fully tax free as you know. Please update here if you have more questions and one of our tax experts will help.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbotax calculation error if selling home which was partly depreciated

If your rental was still in service in 2022, enter everything in the Rental section. You will still be able to get the exclusion and the depreciation will be handled correctly.

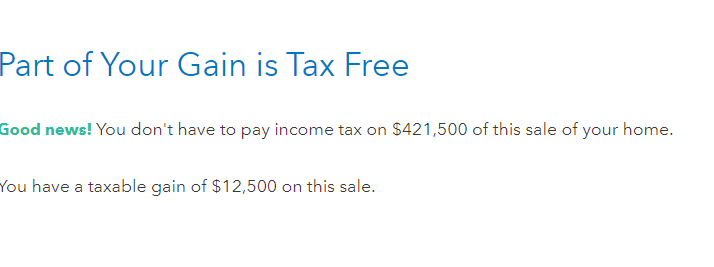

On a gain of $424K your screen in Sale of Home would look like this:

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbotax calculation error if selling home which was partly depreciated

TT is subtracting the depreciation previously taken from the exclusion

Recaptured depreciation is not included in the exclusion. It's taxable no matter what. IRS publication 523 at https://www.irs.gov/pub/irs-pdf/p523.pdf on page 11 states: If the space you usedfor business or rental purposes was within the living area of the home, then your usage doesn't affect your gain or loss calculations (except for an adjustment to basis for depreciation, taken after May 6, 1997, to be recaptured and reported as ordinary income).

So recaptured depreciation is not treated as part of the excluded gain. It's treated as ordinary income and taxed accordingly, anywhere from 0% to a maximum of 25%

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbotax calculation error if selling home which was partly depreciated

In my case the other case on Pg.11 applies: Space formerly used for business or rental. The property was first used completely as a rental and then I moved into it mid-year requiring a fractional calculation. I took depreciation at the time it was being reported as a rental.

Worksheet 3 (Pub 523) Sec.B Step 1 asks for Line 7 in worksheet 2 which already subtracted the depreciation. So the fractional calculation is done on the gain minus the depreciation. TT doesn't do that. Is the IRS worksheet wrong ?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbotax calculation error if selling home which was partly depreciated

Or else it's recapturing the depreciation twice, once in the TT "Home Adj Basis" Line 10 worksheet, and again in the "Home Sale Wks" Line 30! And if you delete either one and leave the other the resulting tax is vastly different. What am I missing?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbotax calculation error if selling home which was partly depreciated

Home Sale Worksheet Line 36 is subtracting Line 35 from Line 31. Instead, according to the IRS Worksheet 3 Pub.523, Line 35 should be subtracted from Line 7.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbotax calculation error if selling home which was partly depreciated

I am working on this scenario and wondered if you would like to share your file. Please tag me by using @DianeW777.

You can send us a “diagnostic” file that has your “numbers” but not your personal information. If you would like to do this, here are the instructions:

TurboTax Online:

Go to the black panel on the left side of your program and select Tax Tools.

- Then select Tools below Tax Tools.

- A window will pop up which says Tools Center.

- On this screen, select Share my file with Agent.

- You will see a message explaining what the diagnostic copy is. Click okay through this screen and then you will get a Token number.

- Reply to this thread with your Token number. This will allow us to open a copy of your return without seeing any personal information.

TurboTax CD/Download:

If you like, you can send a copy of your return that will be scrubbed to eliminate your personal data by using these steps:

- Click on Online in the top left menu of TurboTax CD/Download for Windows

- Select 'Send Tax File to Agent'

- Write down or send an image of your token number then place in this issue.

- We can then review your exact scenario for a solution.

- Please also tell us any states included in the return.

We will then be able to see exactly what you are seeing and we can determine what exactly is going on in your return and provide you with a resolution.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbotax calculation error if selling home which was partly depreciated

The Token number is 1096065 and the State return is Arizona @DianeW777

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbotax calculation error if selling home which was partly depreciated

The total taxable gain is being included in your total capital gains on Schedule D and then carried to your Form 1040, Line 7. It does not double your depreciation portion of the gain as part of your income. The depreciation recapture portion is separately stated on your Schedule D, Line 19 to specifically identify this as the part of the taxable gain that is taxed as ordinary income so that it will not be confused with special capital gain treatment.

When the tax for your total income is calculated beginning on the Schedule D tax worksheet line 11, shows the breakdown of the different incomes and applies the correct tax to each type. This is always used when capital gains are part of the return so that you get the lowest tax possible. The depreciation recapture must be taxed at your regular tax rate and the remainder of the taxable gain is taxed at the special capital gains rates which are maxed at 20% in your case.

Your home sale exclusion is fully tax free as you know. Please update here if you have more questions and one of our tax experts will help.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbotax calculation error if selling home which was partly depreciated

I see. I previously wrote "Home Sale Worksheet Line 36 is subtracting Line 35 from Line 31. Instead, according to the IRS Worksheet 3 Pub.523, Line 35 should be subtracted from Line 7. "

Regardless of the above discrepancy the full exclusion still applies in the result of both ways of calculating on line 37.

Another thing is: why doesn't the depreciation previously entered on the Home Adj Basis worksheet automatically carry over to the Home Sale Worksheet, instead of the user having to input it twice?

Thank you very much for the detailed explanation by the way 🙂

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbotax calculation error if selling home which was partly depreciated

When I review the worksheet line 35-- What I can see is that it is taking the full gain, reducing it for the depreciation and the portion of the nonqualified gain. The result removes the depreciation that must be recaptured from the rest of the gain before calculating the allowable exclusion.

The field is used by different areas of the tax return such as if your rental was still active in the year it was sold as example. I can't be certain of the background details, however this seems logical to me why you may have to enter the depreciation in the worksheet even though you did enter it through your step by step process.

Thank you for your kind words.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

jjon12346

New Member

user17550208594

New Member

user17550208594

New Member

SB2013

Level 2

CalcGuarantee

New Member