- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- Re: Schedule K-1 when Box 20 has no value but there is Section 199A to report

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule K-1 when Box 20 has no value but there is Section 199A to report

I've tried several ways to remove the error message from my return since my K-1 has a z code in box 20 but no value and then has Section 199A Business amount. What I want to know if it is okay to not have Code Z listed on the K-1 for BOX 20 since it has no number associated with it on my k-1 AND then on Section D1 for QBI I do have a value for UBIA of qualified property.

It seems that TT won't let me keep the Z code with no value on the Schedule K-1.

Please advise. Thanks

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule K-1 when Box 20 has no value but there is Section 199A to report

If you are able to enter the Section 199A information from Statement A without using Code Z in Box 20, then this is your best option.

However, if the review message continues to appear, please post a screenshot of the actual message. This helps us locate the issue in the program.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule K-1 when Box 20 has no value but there is Section 199A to report

You may see a code Z in box 20 of the K-1 and the detail for the QBI income, UBIA and other components of the 199A computation are reported on a separate schedule.

The entity should provide section 199A information to compute the qualifying business income deduction.

2023 Shareholder’s Instructions for Schedule K-1 Form 1065 page 29 states:

The partnership will provide the information you need to figure your deduction.

If the 199A information is not entered, you will not qualify for a QBI deduction.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule K-1 when Box 20 has no value but there is Section 199A to report

tehr may be a supplement to give you the 199A info you need. look on the back of the k-1 and any additional paperwork that was included.

then again certain activities may not qualify for QBI. so what does the partnership do?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule K-1 when Box 20 has no value but there is Section 199A to report

Thanks-

mu question though was I have all that information just that TT doesn’t want line 20 to include code z with an empty value on the form. I also entered the 199a information.

just anted to know if IRS will be okay with the sch k showing nothing about z in box 20 but the info is in the section 199A.

TT is forcing me to do this. In 2022 I showed z with no $$ amount and it was fine. Just making sure that’s okay for 2023

thanks

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule K-1 when Box 20 has no value but there is Section 199A to report

Since TT does not allow me to have a z with no value on the form, I need to omit on the form to avoid a TT error. I do have the section 199a information and can enter it on the form in the appropriate place for it.

my concern is just that I am not making an entry on the form for the z that is in box 20 since TT is not allowing it.

maybe TT will fix this in an update prior to my filing in the meantime I just was seeing if I could find out it there is another workaround with TT for this

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule K-1 when Box 20 has no value but there is Section 199A to report

We are unable to reproduce the experience you have reported. Please post the actual error message you see and where in the program the message appears.

Note that you will be unable to e-file your return if the error persists.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule K-1 when Box 20 has no value but there is Section 199A to report

Thanks for responding. I am going to attach 3 screens that I filled out. While the K-1 I have has a Z in box 20, there is no value. However, I do have a Statement A that came with the K-1 so I can fill in the answers for the subsequent screens. If I put the Z with no information on the screen that says “Enter Box 20 Info” then TT shows an error later on in review because there is nothing to put into that screen.

When I look at my 2022 return, the form allows me to have a Z with no value and the Statement A (UBIA of qualified property) is filled out, just like this year.

My question is will it be okay for the form k-1 in our return; for that line to have no Z printed on it even though the K-1 from the partnership has a Z. It seems there is a TT bug for 2023 that I can’t work around to show the Z on Line 20 of FORM K-1 in our personal tax return. Please know that UBIA information is provided, I didn’t include that amount on the screen shot.

When I leave that line blank in the first screen shot, no errors. If I put a Z, error.

Please advise

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule K-1 when Box 20 has no value but there is Section 199A to report

If you are able to enter the Section 199A information from Statement A without using Code Z in Box 20, then this is your best option.

However, if the review message continues to appear, please post a screenshot of the actual message. This helps us locate the issue in the program.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule K-1 when Box 20 has no value but there is Section 199A to report

I have the same issue as the OP. My K-1 just shows "STMT" in the Box 20 Code Z line. The statement included with my K1 lists a UBIA value.

If I leave Code Z off of my Box 20 entry, I'm later asked if I missed Code Z, and to answer yes even if my K-1 doesn't have Code Z in Box 20:

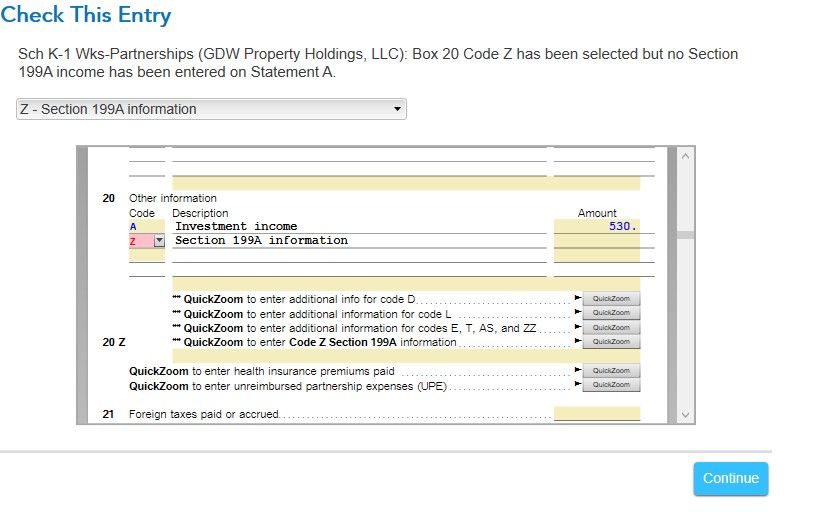

When I get to the end of the Federal section, and the software checks for errors, it comes up with one error, this:

I've put 0 on the entry form for Code Z, and tried random numbers as well. Nothing seems to make this form happy.

Other conditions that may or may not affect performance are:

This is for an LLC K-1

Income is all real estate rental

Tenant is a business that I own and participate in

Special handling is required

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule K-1 when Box 20 has no value but there is Section 199A to report

Enter IRS form K-1 (1065) information at the screen Enter Box 20 info,

- Select code Z Section 199A information. Do not enter a value to the right.

- Click Continue.

- At the screen We need some information about your 199A income, you will likely enter the following information:

- Ordinary business income (loss) from this business, and/or

- Rental income (loss).

Enter these values for the Qualified Business Income Deduction to be calculated.

Some preparers of the K-1 form will include the Section 199A information on a separate statement called a Statement A.

It is possible that additional information, such as the UBIA that you mentioned, may need to be entered. Click the box to the left to open up entry boxes.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule K-1 when Box 20 has no value but there is Section 199A to report

Thank you very much!

I had the UBIA box filled in, but the income wasn't filled in.

I assumed that it had carried over the rental income from when I entered it for the K-1. I don't remember having to enter it again last year. But, I entered the data on this form, and everything is happy.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

ripepi

New Member

rpaige13

New Member

mellynlee1

Level 3

justine626

Level 1

MeeshkaDiane

Level 2