- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- Re: Sale of Rental Property

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of Rental Property

I entered my sales information under sale of business property and then then went back to the asset summary screen and indicated that I had stopped using the asset. It then walked me thru inputting the sales info but now my sale has doubled? Where did I go wrong?

I had sales price of $40000.00

Cost was $22617 with $5400 of this allocated to land

Prior depreciation on structure was $17034

Cost of Improvements was $17306

Prior depreciation on Improvements was $11835

Sales expense was $2400

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of Rental Property

You need to add the cost of improvements to the original purchase price. If these improvements are depreciable assets you need add these to the as part of selling the property. If the improvements are not part of your depreciable assets then you need to add the information to your basis in the house.The program does not have the information to do this for you.

Tips on Rental Real Estate Income, Deductions and Recordkeeping

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of Rental Property

These entries will record the sales of a rental asset.

- At the screen Review your xxx rental summary, click Start/Update to the right of Sale of Property/Depreciation.

- At the screen Do you want to go directly to your asset summary?, click Yes.

- At the screen Your property assets, click Edit to the right of the asset(s) disposed of.

- Continue through the interview questions.

- At the screen Tell us more about this rental asset, click on The item was sold, retired, stolen, destroyed, disposed of….

- Enter the date sold/retired from use.

- Continue through the interview questions.

Did you also enter information directly on an IRS form 4797? I assume that this is the source of the duplicate entries.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of Rental Property

I entered the sale of the rental property first under Less Common Business Situations - Sale of Business Property

I did increase land value by using the percentage of .2387 that I was told to use. Once I completed this I then went back to my assets summary screen and selected that I sold the asset and it took me thru inputting sale information. Should I not have done both? Instructions I was following said to do so.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of Rental Property

Yes, you should not have done both.

Just enter it through the rental property, and delete the entry under sale of business property.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of Rental Property

Doing it this way it states I have a gain of $32,755. How is that possible?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of Rental Property

Have you allocated a portion of the selling price to the land at the screen Sales Information?

I enter these figures and come up with a figure lower by about the about of the cost of the land.

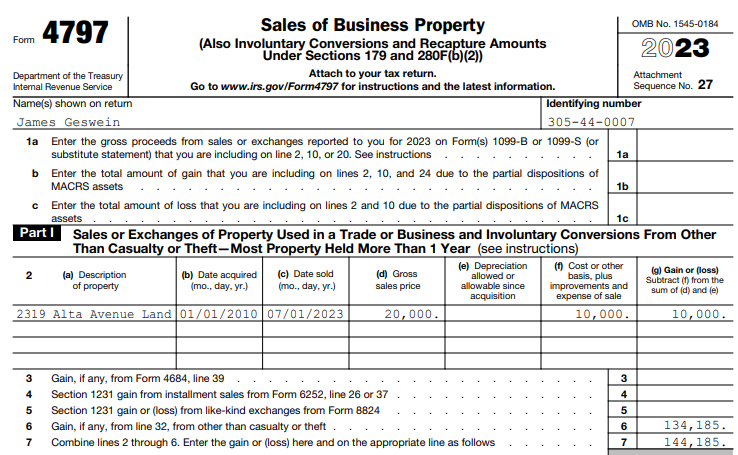

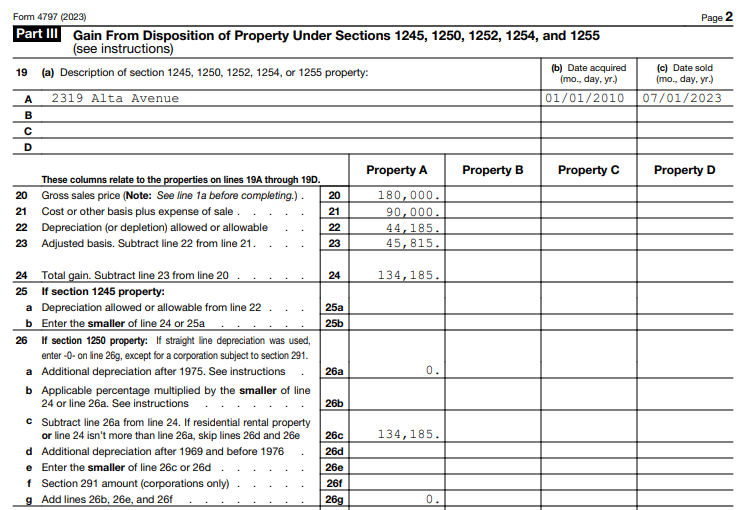

You will be recapturing the depreciation which in your example is $17,034 and $11,835 = $28,879. This takes place on page two of the 4797 Part III line 22. You may not be expecting the depreciation recapture will take place.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of Rental Property

I was expecting the recapture and when viewing the Form 4797 it shows it. But what doesn't appear anywhere is the cost of the improvements/assets purchased. It is stating a gain on the sale of $32,400 as it is not adding the cost of the improvements to the cost basis of the structure. It is showing a loss on the land of $555. So it is recapturing the depreciation taken on the structure and improvements without adding the cost of the improvements to the original purchase price of structure????

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of Rental Property

You need to add the cost of improvements to the original purchase price. If these improvements are depreciable assets you need add these to the as part of selling the property. If the improvements are not part of your depreciable assets then you need to add the information to your basis in the house.The program does not have the information to do this for you.

Tips on Rental Real Estate Income, Deductions and Recordkeeping

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of Rental Property

In reporting the sale of a rental property turbotax 4797 II showed double the sale and Part I showed double the cost basis. I can't find the extra source files in the Schedule E business sales sections, in order to delete them. What can I do?

Laurence

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of Rental Property

In many cases, the sale of rental property on IRS form 4797 Sales of Business Property will report the sale of the land in Part I and the sale of the structure in Part III. Is this what you are seeing? Have you allocated the sale of the rental property over the two business assets?

Or are you saying something else? Please advise.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

syounie

Returning Member

ramseym

New Member

DallasHoosFan

New Member

eric6688

Level 2

William--Riley

New Member