- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- Re: New TT user: rental property improvements and depreciation

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

New TT user: rental property improvements and depreciation

I'm a new TurboTax user, so no taxes were filed in previous years using TT software.

I have a rental property that I've owned for about 5 years. In the first year, I spent a good amount of money to renovate the property.

Since I didn't use TT in previous years, it has no record of the improvements that I've made. How do I enter this into TT? Will that change the depreciation amount?

Also, if I sold a rental property this year (different property than the one mentioned above), I understand that I will have to pay capital gains tax on the profit from sale (sale price - closing costs - remaining mortgage - commissions). Will I also have to pay capital gains tax on the depreciation that I took since purchasing the rental property? Where do the improvements (eg new bathroom) get taken to account? What will happen to my carry forward losses?

Thank you!

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

New TT user: rental property improvements and depreciation

Since I didn't use TT in previous years, it has no record of the improvements that I've made. How do I enter this into TT? Will that change the depreciation amount?

First, lets confirm a few things beyond any doubt.

In your 2020 tax return package (which I assume you have a copy of) look for and pull out these documents.

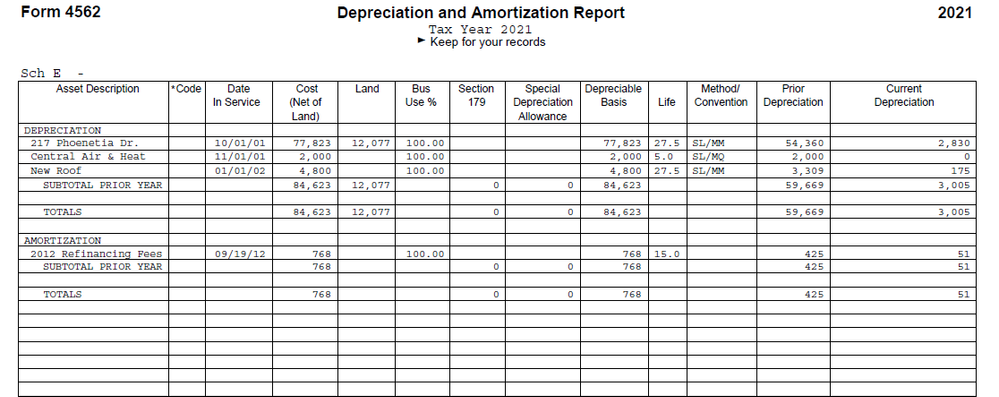

- Two form 4562's that print in landscape format. One is titled "Depreciation and Amortization Report" and the other is "Alternative Minimum Tax Depreciation report"

- IRS Form 8582 titled "Passive Activity Loss Limitations". If you don't have this document, then most likely you you did not have any unallowed losses on your rental property in 2020. Not common, but not impossible either due to some changes in the tax law that took effect in 2018.

On the 4562 titled Depreciation and Amortization Report, I expect you to see at a minimum, the property itself listed there. I also expect you to see any property improvements that you paid for since converting the property to a rental. You "might" also see property improvements you paid for before converting it to a rental, unless the cost of those improvements were already included in the "Cost (Net of Land)" box for the property itself.

So are you seeing what I expect? (I really hope so. Otherwise, you have a problem that we may or may not be able to take care of.)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

New TT user: rental property improvements and depreciation

I only have forms 4562 in the years that I purchased the investment property.

I have two sets of forms 8582 every year for the past several years: one regular form and another amt version.

It doesn't look like the 4562 form took into account the capital improvements. It just lists a special depreciation in line 14 of $1331 and other depreciation in line 16 of $6627.

How much trouble am I in?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

New TT user: rental property improvements and depreciation

How much trouble am I in?

No one says you're in trouble. My apologies if I insinuated such.

It doesn't look like the 4562 form took into account the capital improvements.

Either the property itself and all the capital improvements are listed there, or they are not.

It just lists a special depreciation in line 14 of $1331 and other depreciation in line 16 of $6627.

You're not looking at the 4562 that I"m hoping you have. the one you're looking at prints in portrait format and is the "official" form that gets filed with a tax return. The one you need is not an official IRS form. But most tax preparation programs will include them, or some variant of them.

Here's a screen shot of one of the two forms I'm referring to.

The one pictured above is titled "Depreciation and Amortization Report. The other one is pretty much the same, except it's titled "Alternative Minimum Tax Depreciation Report". As you can see, it shows each individual asset acquired and placed in service after the property was converted to a rental, as indicated by the "in service" date for each asset. You also see a section for "Amortization" which I won't get into right now. There's no need to unless you do have amortized costs shown on your 4562.

Now depending on what was used to prepare your prior year tax return, whatever you have may not be the same as pictured above. But it will have the same information as the 4562 does, that is pictured above. This is something you really have to have. Especially since you also have assets where you took the Special Depreciation Allowance and/or SEC 179 deduction.

If I may ask, what software was used to prepare your 2020 tax return? (If you know, that is). If you don't know, was it prepared by a professional tax preparer? (CPA, EA, Tax attorney, or whatever.)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

New TT user: rental property improvements and depreciation

Thanks so much Carl.

Unfortunately I don't have the landscape form example that you posted in my 2020 returns. It was prepared by a CPA firm. The form 4562 in my 2020 returns is mostly blank except for lines 1, 3, 16, and 22. Line 16 = Line 22.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

New TT user: rental property improvements and depreciation

The one you have will not help at all, in setting things up correctly in the TurboTax program. If you don't have some type of worksheet that "Breaks it down" for each individual asset, then you need to contact the CPA that prepared the 2020 return and ask for a copy of everything. Any CPA should provide that upon request. One reason is that if you were ever audited, then you would "need" to prove your numbers. You can't do that without the worksheets. Until then, we're at an impasse.

As late as it is you may want to consider having the CPA do your 2021 taxes. Then make absolutely certain they give you a hard copy of "everything", and use TTX starting next year with your 2022 taxes.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

New TT user: rental property improvements and depreciation

I managed to get a copy of the workbooks from the CPA. They were using a 90% / 10% improvement / land ratio to calculate depreciation.

This is nowhere close to the ratio in the tax assessment. Should I correct the depreciation basis or just leave it and keep using the same?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

New TT user: rental property improvements and depreciation

Should I correct the depreciation basis or just leave it and keep using the same?

No, to the point that I really want to say it as "absolutely not" without sounding to "bossy". Any change in the cost basis/allocation of any asset will completely skew the depreciation history, and the current and all future depreciation will be flat out wrong. I also don't know what the chances are that doing so would get the attention of the IRS. But I certainly wouldn't want to be the one to find out either.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

c0ach269

Returning Member

SB2013

Level 2

Idealsol

New Member

SB2013

Level 2

Kenn

Level 3