- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Investors & landlords

How much trouble am I in?

No one says you're in trouble. My apologies if I insinuated such.

It doesn't look like the 4562 form took into account the capital improvements.

Either the property itself and all the capital improvements are listed there, or they are not.

It just lists a special depreciation in line 14 of $1331 and other depreciation in line 16 of $6627.

You're not looking at the 4562 that I"m hoping you have. the one you're looking at prints in portrait format and is the "official" form that gets filed with a tax return. The one you need is not an official IRS form. But most tax preparation programs will include them, or some variant of them.

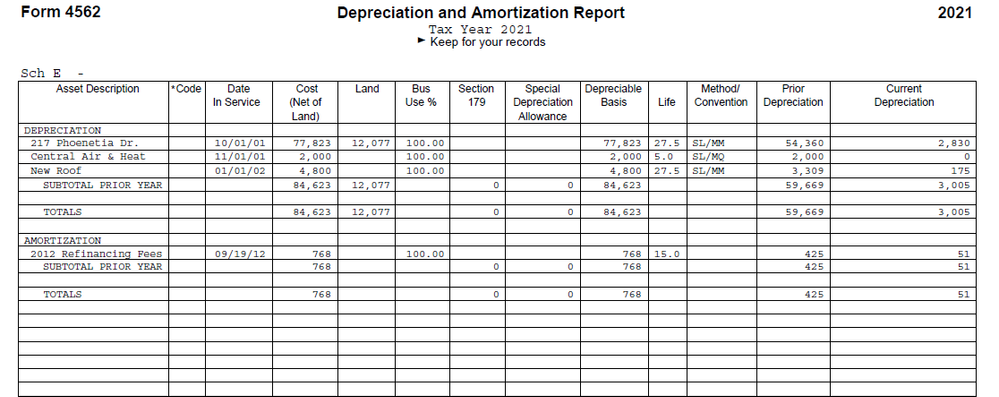

Here's a screen shot of one of the two forms I'm referring to.

The one pictured above is titled "Depreciation and Amortization Report. The other one is pretty much the same, except it's titled "Alternative Minimum Tax Depreciation Report". As you can see, it shows each individual asset acquired and placed in service after the property was converted to a rental, as indicated by the "in service" date for each asset. You also see a section for "Amortization" which I won't get into right now. There's no need to unless you do have amortized costs shown on your 4562.

Now depending on what was used to prepare your prior year tax return, whatever you have may not be the same as pictured above. But it will have the same information as the 4562 does, that is pictured above. This is something you really have to have. Especially since you also have assets where you took the Special Depreciation Allowance and/or SEC 179 deduction.

If I may ask, what software was used to prepare your 2020 tax return? (If you know, that is). If you don't know, was it prepared by a professional tax preparer? (CPA, EA, Tax attorney, or whatever.)