- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- Re: Is anyone else having the depreciation / amortization on there rental properties for 2020 not...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is anyone else having the depreciation / amortization on there rental properties for 2020 not match there 2019 taxes?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is anyone else having the depreciation / amortization on there rental properties for 2020 not match there 2019 taxes?

If you are referring to the 2019 depreciation not carrying over to 2020, please see this TurboTax Help page describing the workaround for this issue. Please see this TurboTax webpage.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is anyone else having the depreciation / amortization on there rental properties for 2020 not match there 2019 taxes?

Unfortunately I am aware of the not transferring over the problem I’m having is that when I input this information in. I get a different depreciation number then it should be based on my atomization schedule from previous filings. Building’s/ homes should be done over 27.5 years and be the same year after year but when I input the information they ask for. the system kicks back different numbers or that I have already take all the depreciation.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is anyone else having the depreciation / amortization on there rental properties for 2020 not match there 2019 taxes?

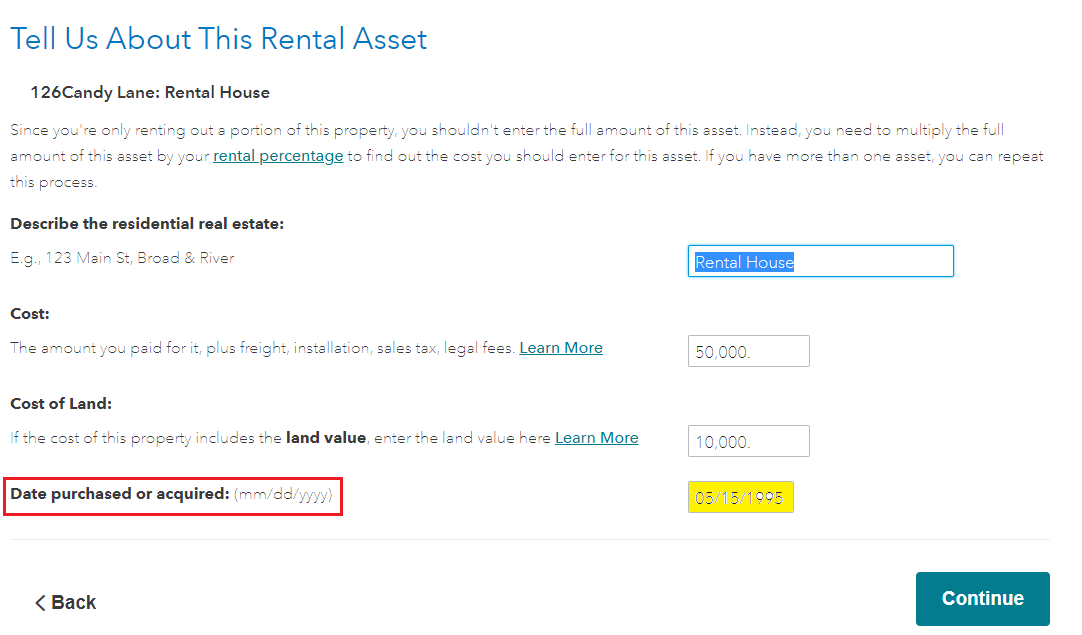

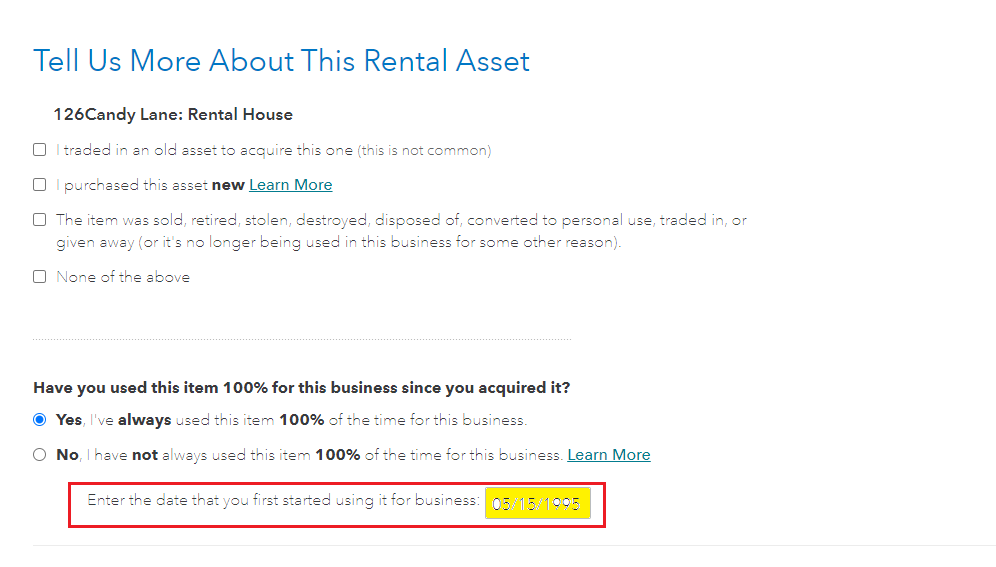

There are two screens to enter a date, which are very important, first the purchase date and next the date placed in service. It's easy to miss the second one because it's at the bottom of the screen. As long as you are selecting the correct property "Residential Rental" for the buildings and capital improvements the depreciation calculations will be correct.

See both screens below. Please update the issue if you have more questions.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is anyone else having the depreciation / amortization on there rental properties for 2020 not match there 2019 taxes?

I was aware of this though. Thank you for your answer unfortunately this did not fix the problem that I was having. Maybe it will for some people. What I did to fix was. Pay turbo tax and access the true forms not there program style to see what numbers they where inputting and found a solution.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

c0ach269

Returning Member

SB2013

Level 2

Farmgirl123

Level 4

eedavies4

New Member

alvin4

New Member