- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- Re: I refinanced my rental property in <1 year of purchasing it. How do i deduct my original m...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I refinanced my rental property in <1 year of purchasing it. How do i deduct my original mortgage costs entirely in this year?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I refinanced my rental property in <1 year of purchasing it. How do i deduct my original mortgage costs entirely in this year?

Mortgage cost are added to the basis of your property. When you refinanced the original fees that were added to your basis do not change. The basis in your property will be used when you sell the property to determine any gain or loss on the sale.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I refinanced my rental property in <1 year of purchasing it. How do i deduct my original mortgage costs entirely in this year?

Where in TurboTax-online do i add the original mortgage closing costs, so that it adds to the cost basis? It's not in the "Report Mortgage Interest" section, and it suggests going to the Assets/Depreciation section as an Amortizable Intangible, but that would amortize the cost over 27.5 years - I want to book the cost upfront, because i refinanced that mortgage.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I refinanced my rental property in <1 year of purchasing it. How do i deduct my original mortgage costs entirely in this year?

Unlike your primary residence, where you can only deduct qualified points and interest, you can deduct all costs associated with obtaining a new mortgage for your rental property. Typical loan-related expenses include:

- Points

- Loan origination and loan assumption fees

- Mortgage insurance premiums

- Application fees

- Credit report fees

- Appraisal fees (if required by the lender)

The costs associated with obtaining a mortgage on rental property are amortized (spread out) over the life of the loan. For example, if it cost you $3,000 to refinance your 30-year mortgage, you'd be able to deduct $100 per year for the next 30 years.

Other refinance-related expenses not directly related to the mortgage may also be deductible. Generally, if the cost is associated with operating the property (like real estate taxes or hazard insurance) they're deducted as expenses, whereas costs associated with purchasing the property (like title search fees or recording fees) are added to the property's cost basis, which means they get depreciated.

When you enter your rental property information, we'll ask about all of these things and deduct them according to the rules.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I refinanced my rental property in <1 year of purchasing it. How do i deduct my original mortgage costs entirely in this year?

Sorry these responses didn't address my question. Please reply ..

I don't see the original mortgage costs added to the basis of the property and depreciated over 27.5 years.

For example, my property is $1.1M, the building part of it is $330K, and my mortgage cost is $8K. In the Form 4562, I only see the $330K being depreciated over 27.5 years, and there's no mention of my original mortgage costs.

1) How do i ensure these costs are added to the basis of my property and depreciated?

2) Since I refinanced my original mortgage in the same year (2019), my entire undepreciated original mortgage costs of $8K should be depreciated (expensed) entirely in this year (vs 27.5 year depreciation). How do i enter this in TurboTax so that it ensures this is expensed this year? I understand that the refinancing cost ($3K) will now be depreciated over 30 year amortization schedule, and this is reflected on my Form 4562.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I refinanced my rental property in <1 year of purchasing it. How do i deduct my original mortgage costs entirely in this year?

When you enter the new rental into the TurboTax program, the program adds the closing costs to the value of the improvement.

After you add the original purchase, the refinance is entered under expenses. The refinance closing fees are also entered.

If you refinance again, the amortized closing costs for this refinance may be expensed for that year, but the original costs to purchase will always be included in the original basis.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I refinanced my rental property in <1 year of purchasing it. How do i deduct my original mortgage costs entirely in this year?

If you refinanced with the same lender, then you don't get to deduct the remaining amortized costs from the first loan. Those remaining costs get added to your new loan acquisition cost and that new total gets amortized over the life of the new loan.

If you refinanced with a new lender, then the program "should" automatically adjust your cost basis of your "ORIGINAL" purchase price by adding the remaining amount to be amortized, to that original cost basis. But the key to getting the program to do that, is to enter the 1098 from the "OLD" loan first. Then when you enter the 2nd 1098 (which is from the new loan) *AND* check the box to indicate this is a refi, if the new loan is not from the same lender the program will take care of this for you.

I do not know weather or not the program handles it correctly if the refi is from the same lender, as I've not been through that scenario myself with any of my rentals I've refi'd.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I refinanced my rental property in <1 year of purchasing it. How do i deduct my original mortgage costs entirely in this year?

Hi RobertG,

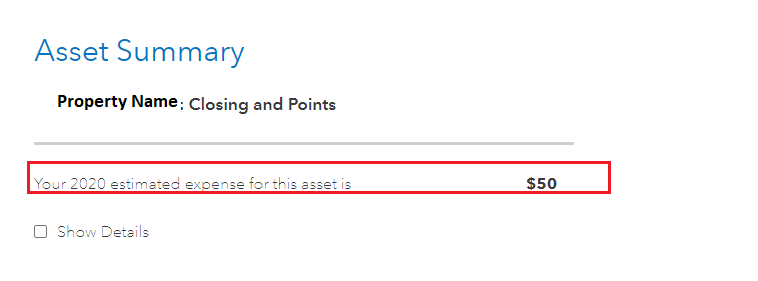

I refinanced a rental property this year. Turbotax tells me that my closing costs of $1500 can be fully deducted over 30 years. In the assets summary, it shows MACRS Convention is NA and no Depreciation Method is listed. Why does it say that I can only depreciate $5 per year? Shouldn't it be $50 per year ($1500/30=$50)?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I refinanced my rental property in <1 year of purchasing it. How do i deduct my original mortgage costs entirely in this year?

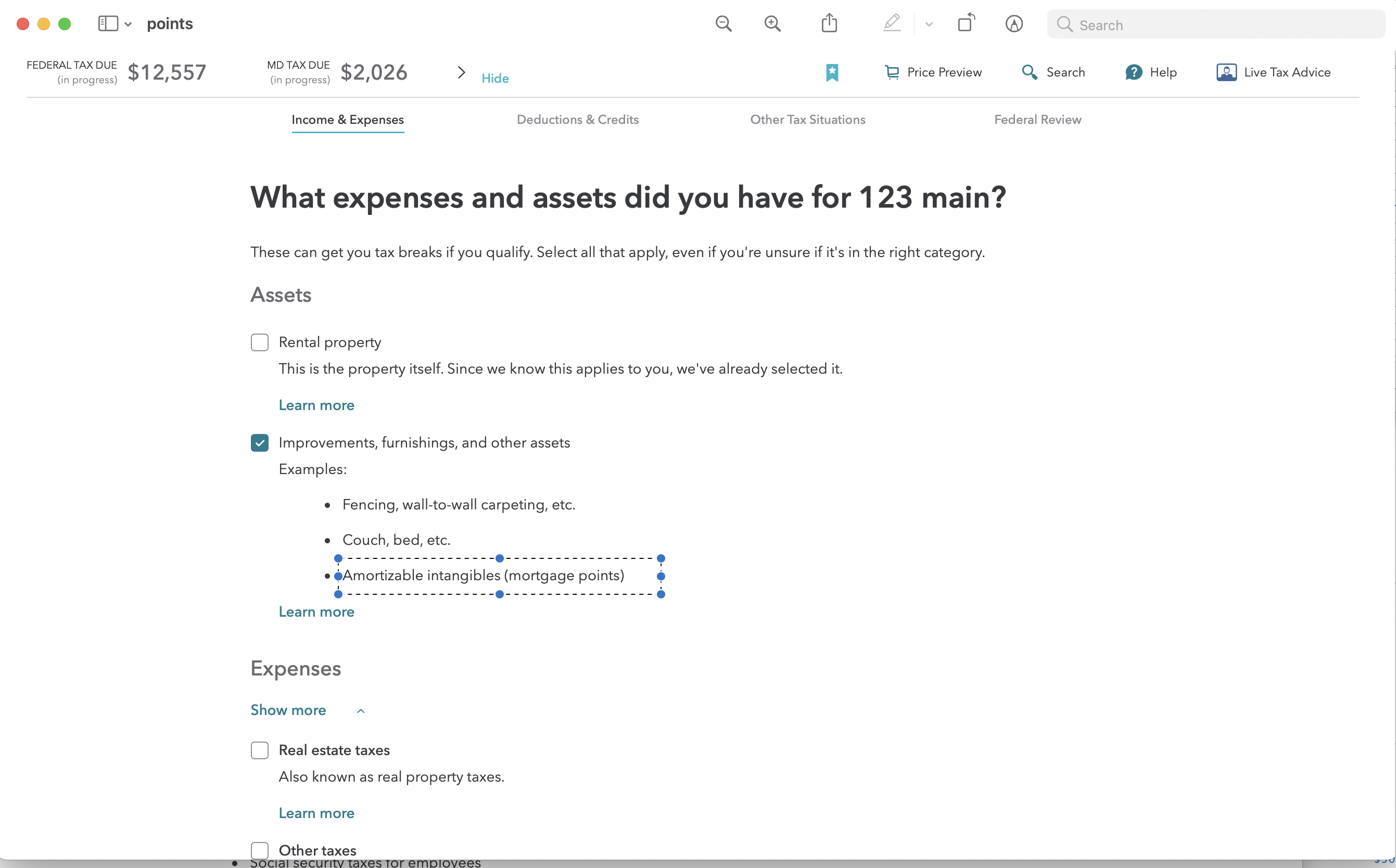

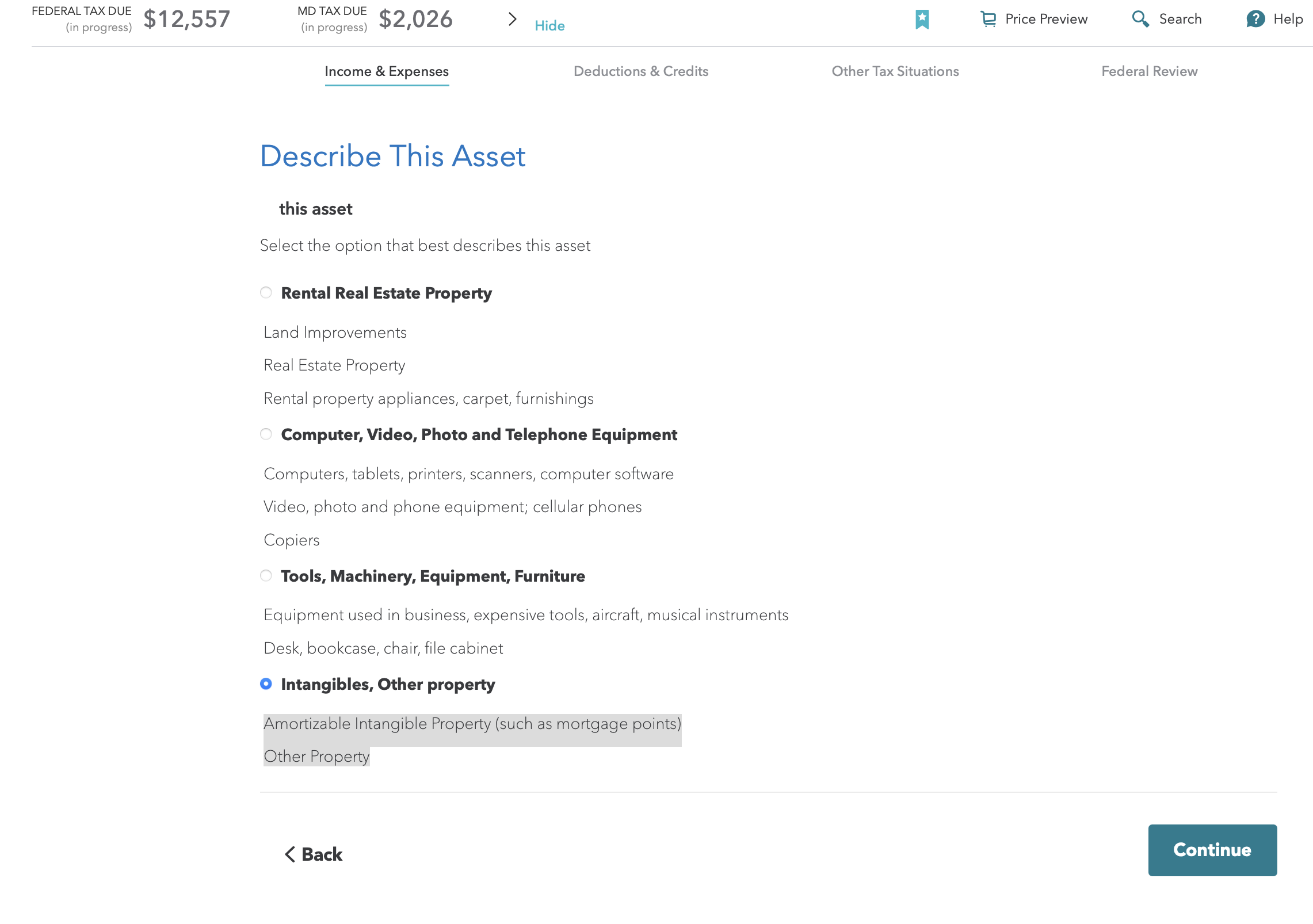

The steps will be placed here for your convenience as well as in your other post.

You are correct, the deduction is not correct due to the entries. Follow the steps below to add this asset for the appropriate outcome.

- Sign into your TurboTax Account > Search (upper right) > Type rentals > Press enter > Click on the Jump to .... Link

- Edit beside the rental you want to work on > Scroll to Assets > Edit

- Select Yes to go directly to the asset summary >

- Add or Edit the asset for the closing costs and or points > Select Intangibles, Other Property > Continue

- Select Amortizable intangibles > Continue > Enter the details about your costs including the refinance date

- Continue > Select the Code Section 163 for loan fees > Enter the useful life (number of months of the loan)

- The final screen will show the deduction.

- See the images below.

Notice the end result is what you want to see, the date the refinance began in this example is 01/05/2020. The date the refinance began will alter the deduction if it was not a full year.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I refinanced my rental property in <1 year of purchasing it. How do i deduct my original mortgage costs entirely in this year?

I did follow the depreciation of the new refi costs at 30 years but how do I take care of the old depreciation of the refi costs? Do I just retire it and add the remainder to the new refi costs? Or do I just start a new depreciation entry for the old refi cost at 30 years? Also, would i depreciate for the remaining amount or the full amount of the old refi cost. Where do I find the remaining amount? Thank you.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I refinanced my rental property in <1 year of purchasing it. How do i deduct my original mortgage costs entirely in this year?

Dispose of the "old financing costs" as if you quit using them and sold them for $0.

They should have been entered as an intangible asset and amortized over the life of the old loan. Now that that loan is gone, any unamortized loan costs can be written off. "Selling" them for $0. accomplishes this.

The new financing costs (points) are entered as a new intangible asset and, going forward, will be amortized over the life of the new loan.

See the following screenshots for aid in navigation.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I refinanced my rental property in <1 year of purchasing it. How do i deduct my original mortgage costs entirely in this year?

Can't dispose as in deleting for the sake of deleting of the old refi costs since i refi'd with the same lender, right? So, I should be adding the old with the new costs, depreciating the total for the new life of the loan, right?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I refinanced my rental property in <1 year of purchasing it. How do i deduct my original mortgage costs entirely in this year?

how do I take care of the old depreciation of the refi costs?

First, some clarification here.

Financing cost are not capitalized and depreciated. They are amortized and deducted over the life of the loan.

Now if you refinanced with the same lender, you can NOT fully deduct your cost of the old mortgage. You can just leave it alone and let it continue to amortize and be deducted over the life of that original loan.

If you refinanced with a NEW lender, then those costs are fully deductible in the tax year of the refi. To deduct those old costs (I am assuming you entered them correctly at the time you took out the old loan), in the Assets/Depreciation section elect to EDIT that item and start working it through.

On the screen "Did you stop using this asset in 2020?" select YES.

For date of sale enter the closing date of the new loan, and continue.

on "Special Handling Required?" click YES.

On "Depreciation Deduction Amount" select "Transfer these fees for me to other expenses", then continue.

That does it. The remaining financing fees will be transfered to the "Miscellaneous Expenses" part of the Rental Expenses section. If you want to confirm it, just work through the rental expenses section and on the last screen you'll see them clearly labeled and entered there as a deduction.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I refinanced my rental property in <1 year of purchasing it. How do i deduct my original mortgage costs entirely in this year?

Thanks so much! My only thing now is that I entered the 2019 depreciation wrong, MACRS 27.5 instead of the 20 years I was suppose to. Can I go ahead and recharacterize that to the right one by disposing and then re-entering? I surely don't want to do an amend to 2019, if that is the only wrong thing i did :(

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I refinanced my rental property in <1 year of purchasing it. How do i deduct my original mortgage costs entirely in this year?

My only thing now is that I entered the 2019 depreciation wrong, MACRS 27.5 instead of the 20 years I was suppose to

Ummmmm... residental rental real estate is depreciated over 27.5 years. So your 2019 entry is correct. Or are you talking about the refi fees and the loan was a 20 year mortgage?

Can I go ahead and recharacterize that to the right one by disposing and then re-entering?

Unfortunately, no. That would just be wrong on so many fronts. It would be like hanging out a sign reading HEY! IRS! AUDIT ME NOW! PLEASE! HURRY! FAST! 🙂 But again, if this was for the actual rental property, then 27.5 years is correct if the property is "residential" rental property, and is located in the U.S.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

scatkins

Level 2

CDJackson

Returning Member

swearmir

New Member

MBSC

Level 3

MBSC

Level 3