- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- Re: I received CRITICAL NOTICE: for Rental Properties and Royalties (Sch E) but I have not filed Form 4562 Depreciation and Amortization Report last year, what should I do?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I received CRITICAL NOTICE: for Rental Properties and Royalties (Sch E) but I have not filed Form 4562 Depreciation and Amortization Report last year, what should I do?

@Anonymous_ Now I only find 2 pages for this property. Let me give you a bit of information about that property.

Its a duplex and I bought it and got the mortgage. I only had on mortgage on it its had two addresses like 01 yyy and 02 yyy. I only received one page 1098 from the lender and during the filing I had it as 01 & 02 yyy and averaged the personal usage by (rental usage of property 1 + rental usage of property 2 -my usage of property 1) / (rental usage of property 1 + rental usage of property 2)

was that a complete mistake? if so, how can I fix the mess I made?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I received CRITICAL NOTICE: for Rental Properties and Royalties (Sch E) but I have not filed Form 4562 Depreciation and Amortization Report last year, what should I do?

It appears as if you have utilized an overly complex formula but I believe it would yield accurate results (i.e., interest paid from your usage is entered on Schedule A and interest paid from the rental use is entered on Schedule E).

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I received CRITICAL NOTICE: for Rental Properties and Royalties (Sch E) but I have not filed Form 4562 Depreciation and Amortization Report last year, what should I do?

So I shouldn't worry about it, right? Just I go ahead and do the steps recommended here https://ttlc.intuit.com/community/asset-depreciation/help/how-do-i-fix-my-rental-properties-and-roya...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I received CRITICAL NOTICE: for Rental Properties and Royalties (Sch E) but I have not filed Form 4562 Depreciation and Amortization Report last year, what should I do?

Yes, do the steps in that help article.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I received CRITICAL NOTICE: for Rental Properties and Royalties (Sch E) but I have not filed Form 4562 Depreciation and Amortization Report last year, what should I do?

Thanks you were really helpful 🙂

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I received CRITICAL NOTICE: for Rental Properties and Royalties (Sch E) but I have not filed Form 4562 Depreciation and Amortization Report last year, what should I do?

I can't find anything called Form 4562-Depreciation and Amortization Report in my 2019 return....what do I do now?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I received CRITICAL NOTICE: for Rental Properties and Royalties (Sch E) but I have not filed Form 4562 Depreciation and Amortization Report last year, what should I do?

@amill0419 in order to get the two 4562's that print in landscape format, you *must* save *everything* in the tax return as a PDF file. Not just the "forms to be filed" and not just the "forms for your records". You *must* save the tax return, all forms, and all calculation worksheets. Saved as a PDF, the document will easily contain over 100 pages. (with three rentals of my own, my PDF is over 200 pages). Then you can search the PDF for the two form 4562's as titled and explained in this thread already.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I received CRITICAL NOTICE: for Rental Properties and Royalties (Sch E) but I have not filed Form 4562 Depreciation and Amortization Report last year, what should I do?

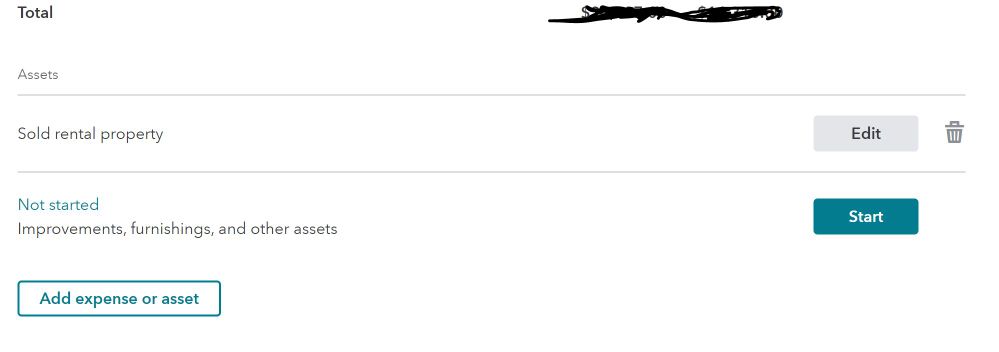

Another question. I sold the property and I only see it under the sold rental property. Is this the same as what is described here (https://ttlc.intuit.com/community/asset-depreciation/help/how-do-i-fix-my-rental-properties-and-roya...) or should I do it differently?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I received CRITICAL NOTICE: for Rental Properties and Royalties (Sch E) but I have not filed Form 4562 Depreciation and Amortization Report last year, what should I do?

Is there anyway to actually see the link? I get an "access denied" when clicking the link.

The problem I have is that the form 4562 is not able to be printed. It doesnt as an option when I try to print. Yet I can access the 4562 form that is filled out, I just cant print it. It doesnt show up in the list of availble forms, but when I search on it, the 4562 shows up.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I received CRITICAL NOTICE: for Rental Properties and Royalties (Sch E) but I have not filed Form 4562 Depreciation and Amortization Report last year, what should I do?

If you can actually view the form, you should be able to print it out individually.

The links apparently have been archived.

- « Previous

-

- 1

- 2

- Next »

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

c0ach269

New Member

SB2013

Level 2

Farmgirl123

Level 4

eedavies4

New Member

alvin4

New Member