- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- Re: I did not claim depreciation on my rental home since it was converted from personal use several years ago, how do I do an amend return in Turbo Tax?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I did not claim depreciation on my rental home since it was converted from personal use several years ago, how do I do an amend return in Turbo Tax?

Thank you. I guess my only option is filing a 3115 form with a CPA this year. I understand filling 3115 is not an easy DIY process, but do I need to dig past related-documents such as tax bill, lease agreements, past tax filing, etc.. for my CPA?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I did not claim depreciation on my rental home since it was converted from personal use several years ago, how do I do an amend return in Turbo Tax?

I suppose that is dependent upon your CPA, but you should not have to dig up tons of past documents.

Actually, although the form is rather complicated, all that is needed is to make the appropriate Section 481(a) adjustment to account for past foregone depreciation deductions.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I did not claim depreciation on my rental home since it was converted from personal use several years ago, how do I do an amend return in Turbo Tax?

Thank you @Anonymous_, you're awesome!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I did not claim depreciation on my rental home since it was converted from personal use several years ago, how do I do an amend return in Turbo Tax?

Re a rental apt. I took building depreon ciation the first year (2003) I put my property in service, using Turbotax software. I never took depreciation after that. In the following years from 2003 to 2018, I was relaying the Turbotax program to complete the tax return, and somehow I missed that. How can I make correction and how many years I can go back?

Thank you

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I did not claim depreciation on my rental home since it was converted from personal use several years ago, how do I do an amend return in Turbo Tax?

@diacri See https://www.irs.gov/publications/p946#en_US_2018_publink1000107385

You can make a Section 481(a) adjustment by filing Form 3115 to catch up on foregone depreciation, but you will most likely need professional guidance and/or professional tax preparation.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I did not claim depreciation on my rental home since it was converted from personal use several years ago, how do I do an amend return in Turbo Tax?

I have sold my home in 2019, and reported depreciation for that year. I also filled out a 3115 form with the help of an Intuit CPA to recapture depreciation (say X amt) I failed to take in previous years. This was a rental property. On the rental income walk through where they ask about the sale, do I specify X amt on previous years depreciation or leave it at 0. If I specify X then it taxes me on the previous years, even though I didn't take the depreciation.

Form 3115 says it is used to fill out 481(a). I'm not sure what a 481(a) is, still looking for it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I did not claim depreciation on my rental home since it was converted from personal use several years ago, how do I do an amend return in Turbo Tax?

@kesnerb wrote:Form 3115 says it is used to fill out 481(a). I'm not sure what a 481(a) is, still looking for it.

The CPA should have helped you with that in the process of preparing Form 3115; the 481(a) adjustment is part of the form (Part IV can be used for "catch up depreciation").

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I did not claim depreciation on my rental home since it was converted from personal use several years ago, how do I do an amend return in Turbo Tax?

I learned yesterday that Turbo Tax "Desktop software" failed to include my rental home's value depreciation for 2019. I will combing thru my last 9 years of returns to see if I have ever listed depreciation. Sold the property for a 25K loss (purchase / sold price) in 2020. Not real thrilled with Turbo Tax right now. Been a loyal TurboTax user for the last 18 years.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I did not claim depreciation on my rental home since it was converted from personal use several years ago, how do I do an amend return in Turbo Tax?

amended returns where a refund is due can only be filed for 2017 forward. correction of this depreciation error for 9 years, if needed, will require filing form 3115. I suggest you use a pro. it is in your best interest to file for this relief if needed. you may have taken no depreciation for 9 years but the IRS rules say when you sell depreciable property you must take into account the larger of depreciation allowed (might be 0 in your situation) or the amount that would have been allowed if depreciation was computed correctly. so the basis of your property for computing gain/loss would be reduced by 9 years of phantom depreciation.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I did not claim depreciation on my rental home since it was converted from personal use several years ago, how do I do an amend return in Turbo Tax?

Failure to include depreciation is a user entry error by virtue of not reading the screens in the rental entry section. Asset entry is part of the interview process if you follow the interview path step by step and don't skip sections. If you did miss 9 years of depreciation you really need to use a local professional to make the correction. If you still have the rental you can wait until you file the 2020 return to make this correction.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I did not claim depreciation on my rental home since it was converted from personal use several years ago, how do I do an amend return in Turbo Tax?

Agreed it was "entry error" but I make a point of never using the "easy" method and have the software walk me thru every form and sheet. Yet "I" still didn't see it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I did not claim depreciation on my rental home since it was converted from personal use several years ago, how do I do an amend return in Turbo Tax?

Thank you for the suggestion / instructions. I'm working with someone on this now. Looks like my 25K loss is not enough to make up for this. This is not my regular job and I did not have this rental as an income source. I got stuck underwater in 2008 and my family needed a larger place. This Condo just will not let me go cleanly.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I did not claim depreciation on my rental home since it was converted from personal use several years ago, how do I do an amend return in Turbo Tax?

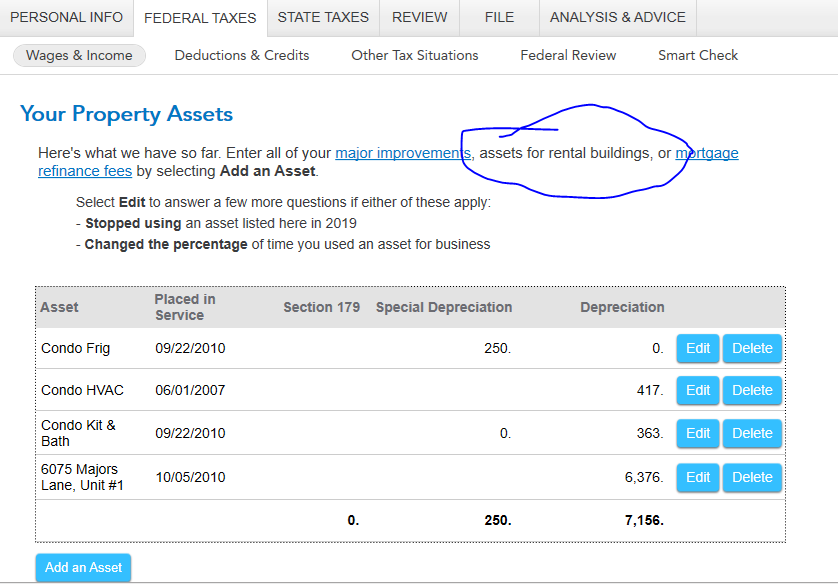

For anyone reading this after me. Here is the un-defined fine print that I failed to notice. The 6k is what I failed to enter. Turbo Tax CPA told me I was not the only person to miss that line.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I did not claim depreciation on my rental home since it was converted from personal use several years ago, how do I do an amend return in Turbo Tax?

In all fairness ... when you enter the rental the first time these are the screens you see ... if you do not understand something then click on the LEARN MORE links and/or seek out more information ... that is your responsibility when you use a DIY program ... if you do not want to take on this responsibility then you should seek local professional assistance to get the return done correctly and get educated on how to complete a section of the program correctly if you are not fully aware of what is needed.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I did not claim depreciation on my rental home since it was converted from personal use several years ago, how do I do an amend return in Turbo Tax?

That’s my whole point. There isn’t a “what does that mean” hyperlink. In my profession, an asset is a thing not a building.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

SB2013

Level 2

Idealsol

New Member

Binoy1279

Level 2

in [Event] Ask the Experts: Tax Law Changes - One Big Beautiful Bill

THtax2024

Level 1

in [Event] Ask the Experts: Tax Law Changes - One Big Beautiful Bill

eric6688

Level 2