- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- Re: How to Enter Depreciation Recapture in TurboTax

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to Enter Depreciation Recapture in TurboTax

Hi, I am looking to put in depreciation recapture into my filing this year and don't see where to put it, I believe it is a 4797 form. I sold a condo after owning it for five years. I lived in it over 3 for years, which meets the no capital gains tax criteria. I did rent it out twice though in which I depreciated the condo in previous tax years. Where do i put this info in the TurboTax program? Thanks, Brian.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to Enter Depreciation Recapture in TurboTax

If it was not rented in 2019, you will need to make your entries in Sale of Business Property. You can account for both the depreciation and the personal use for the exclusion.

It it was rented in 2019, you can also account for the depreciation and there is a screen to enter your personal use.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to Enter Depreciation Recapture in TurboTax

If t he last occupant to move out of the property prior to the sale, then you report the sale in the Rental & Royalty Income (SCH E) section following the guidance below. The program will take care of all depreciation capture "for you" in the background. Once you have completed the SCH E section of the program you can view the forms in forms mode *ONLY* if you are using the desktop version of TurboTax. (Forms mode is not possible in the online version.)

If the last occupant to move out of the house was the owner of the property, then you can NOT report the sale in the SCH E section of the program, You have to report it in the "Sale of Business Property" section. For that, you will have to manually figure and enter the total of all prior depreication taken on the property, when the program asks you for it. To get the "correct" figure, take a look at the last tax return you reported rental income on the property.

You will find two IRS Form 4562's for the property. Both of them print in landscape format. One is titled "Depreciation & Amortization Report" and the other is "Alternative Minimum Tax (AMT) Report". You'll be most interested in the first one. Add together the amounts in the "prior year depr" column and the "current year depr" column to get the total amount of depreciation you've taken since you owned it. That's the figure you need.

Do be careful though, becasue your "AMORTIZED" costs if you have any, are deducted, not depreciated.So if you have any amortized items listed that have not been fully deducted as of the date of sale, they need to be accounted for separately from the depreciation recapture so they're not taxed "as if" it was recaptured depreciation.

The below guidance applies only if the last occupant to move out prior to the sale was a renter.

Reporting the Sale of Rental Property

If you qualify for the "lived in 2 of last 5 years" capital gains exclusion, then when prompted you WILL indicate that this sale DOES INCLUDE the sale of your main home. For AD MIL personnel who don't qualify because of PCS orders, select this option anyway, because you "MIGHT" qualify for at last a partial exclusion.

Start working through Rental & Royalty Income (SCH E) "AS IF" you did not sell the property. One of the screens near the start will ahve a selection on it for "I sold or otherwise disposed of this property in 2019". Select it. After you select the "I sold or otherwise disposed of this property in 2019" you continue working it through "as if" you still own it. When you come to the summary screen you will enter all of your rental income and expenses, even it it's zero. Then you MUST work through the "Sale of Assets/Depreciation" section. You must work through each individual asset one at a time to report its disposition (in your case, all your rental assets were sold).

Understand that if more than the property itself is listed in your assets list, then you need to allocate your sales price across all of your assets. You will only allocate the structure sales price; you will NOT allocate the land sales price, since the land is not a depreciable asset. Then if you sold this rental at a gain, you must show a gain on all assets, even if that gain is $1. Likewise, if you sold at a loss then you must show a loss on all assets, even if that loss is $1

Basically, when working through an asset you select the option for "I stopped using this asset in 2019" and go from there. Note that you MUST do this for EACH AND EVERY asset listed.

When you finish working through everything listed in the assets section, if you ever at any time you owned this rental you claimed vehicle expenses, then you must also work through the vehicle section and show the disposition of the vehicle. Most likely, your vehicle disposition will be "removed for personal use", as I seriously doubt you sold your vehicle as a part of this rental sale.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to Enter Depreciation Recapture in TurboTax

@Carl Thanks, that helped with some of my questions about selling our previous primary residence that we rented before selling. I'm not clear about how you handle deducting partially depreciated assets other than the house from the house sales price.

Do you simply deduct the depreciation taken previously and will be taken the current year of the sale from the house asset's sale price, and have the sale price of the asset be that depreciation... or do you need to do something else to offset what depreciation has not been taken yet (because maybe it would be included otherwise)?

Also, one more somewhat related topic: what about loan points?

I understand how tangible assets like improvements or furniture get sold with the house, but not clear about loan related items, as loan items are often disregarded in closing costs, etc for the basis.

Do intangible assets get "sold" with the house too, such that the sale price of the house gets allocated across them too, or is that only tangible ones that you do that with?

And does it matter if the depreciation was all taken on them yet?

Thanks again!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to Enter Depreciation Recapture in TurboTax

I'm not clear about how you handle deducting partially depreciated assets other than the house from the house sales price.

Did you not read/see that part in the "sale of rental property" guidance above maybe? It's a lot to read, I know. But I can't make it any simpler or shorter really.

Understand that if more than the property itself is listed in your assets list, then you need to allocate your sales price across all of your assets. You will only allocate the structure sales price; you will NOT allocate the land sales price, since the land is not a depreciable asset.

Do intangible assets get "sold" with the house too

I assume you are referring to the financing fees listed under "Amortization" on the 4562. You can't "Sell" that. What you do is select the option that it was "converted to personal use" and on the next screen elect to have the program transfer the remaining balance to be deducted to the rental expenses section. When done, you can work through rental expenses and you'll see the very, very, very last screen in that section is for Miscellaneous Expenses. On that screen you'll see and entry for your financing fees and the remaining amount to be deducted, claimed as a rental expense.

And does it matter if the depreciation was all taken on them yet?

Not sure I follow you here. There is no such requirement for assets to be fully depreciated. It doesn't work that way. But understand that depreciation (unlike amortization) is *not* a permanent deduction. When you sell the property you are required to recapture the total amount of depreciation already taken on an asset. You will pay taxes on that depreciation, and that recaptured depreciation will increase your AGI for the tax year. (Recaptured depreciation is taxed anywhere from 0% to a maximum of 25%, depending on your AGI.)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to Enter Depreciation Recapture in TurboTax

NVM, I figured at least part of it out through trial and looking how TT responded.. and posted a direct question about the other.

The answer I figured out:

When allocating part of the sales price to the improvements, seems like entering in the full price of the improvement yields the most reasonable result in TT. Then it considers the prior and current depreciation as the gain on it.

When it comes to loan points, they are amortized, and there is a place to indicate it is a non-Section 1245 intangible, but I'm not clear if points on a loan are section 1245 or not, so am posting separately about that.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to Enter Depreciation Recapture in TurboTax

When reporting the sale in the SCH E section of the program, the program will take care of depreciation recapture for you. During the data entry/selection process the program doesn't "bother you" will the details. But when complete you can review the 4797 and SCH D to see the process.

As for your amortized loan fees, how you deal with that is covered in my previous post.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to Enter Depreciation Recapture in TurboTax

@Carl ,

I sold a rental that had been my primary property. The transaction qualifies for the Section 121 Exclusion, and the property was sold to the renter. I depreciated assets sold with the property (e.g. new water boiler) in addition to depreciating the structure.

Your guidelines for reporting a sale of a rental property have been very helpful, but I still have a few hazy points.

Let’s assume the structure and the boiler as the only depreciable assets; and $100,000 gross proceeds from real estate sale form 1099-S.

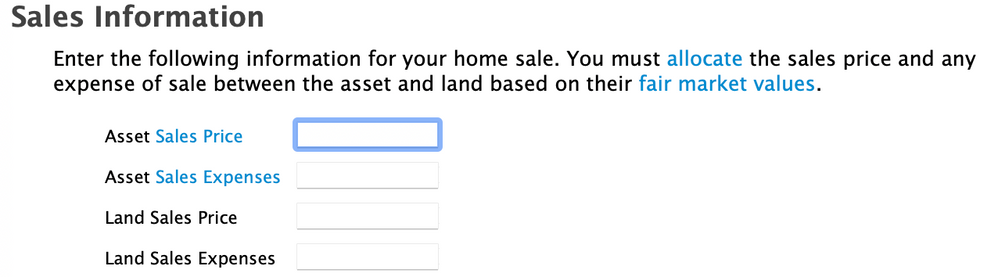

I am reporting the sale using Rental Properties and Royalties -> Rental Properties and Royalties (Sch E) -> Sale of Property / Depreciation. I answered YES to the question “Was this asset included in the sale of your main home”. All good until I reach the Sales information screen…

SALES INFORMATION - STRUCTURE

(1a) Asset Sales Price: $59,500

(1b) Asset Sales Expenses: $1,000 (seller closing costs)

(1c) Land Sales Price: $40,000

(1d) Land Sales Expenses: $0

SALES INFORMATION - BOILER

(2a) Asset Sales Price: $500

(2b) Asset Sales Expenses: $0

(2c) Land Sales Price: $0

(2d) Land Sales Expenses: $0

In (2a) I bought the boiler for $600, and sold for $500 so I would be selling at a loss while the rental is being sold at a gain. This contradicts your previous guidance. What should I use for this amount?

Am I correct in understanding that (1a)+(1c)+(2a)+(2c) should total $100,000 gross proceeds from real estate sale form 1099-S?

Are Assets with a special depreciation allowance reported differently in the Sales Information Screen?

Thanks a billion for any additional guidance.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to Enter Depreciation Recapture in TurboTax

@Anonymous

Step 1 ... in the rental section convert the property & assets to personal use as of the date of sale.

Step 2 ... save a PDF of the return with the depreciation worksheet (online use Print Center under tools/ Forms mode in the download)

Step 3 ... enter the sale only in the home sale section where you will enter the depreciation taken

Enter your sale of your primary residence (which may require an upgrade in TurboTax), please follow these steps:

- Once you are in your tax return (for TurboTax Online sign-in, click Here), click on the “Federal Taxes” tab ("Personal" tab in TurboTax Home & Business)

- Next click on “Wages & Income” ("Personal Income" in TurboTax Home & Business)

- Next click on “I’ll choose what I work on”

- Scroll down the screen until to come to the section “Less Common Income”

- Choose “Sale of Home (gain or loss)” and select “start’

- You will want to use the "Easy Guide" to determine the adjusted basis on this home

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to Enter Depreciation Recapture in TurboTax

If you sell the boiler for $601 then you sold it at a gain. If you sell the boiler for $10,000 then you "STILL" sold it for a gain. A gain is a gain. Period.

If you sold the property at a gain, then you "MUST" show a gain on each and every asset listed. It does not matter if that gain is $1 on some asses, and $50,000 on another asset and $10 on yet another asset.

If you show a loss on some assets, and a gain on other assets, Then depreciation on those assets you show a loss on is included in the capital gains. It will be taxed at the higher capital gains tax rate. If you qualify for the "2 of last 5" exemption, then that recaptured depreciation will not be taxed, and you are required to pay taxes on recaptured depreciation no matter what. In the case of the exclusion, I would fully expect that to come back to bite you 24-36 months after your e-filed return is accepted by the IRS. Now I don't know for a fact that it will. But it would be no shocker at all, if it did.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to Enter Depreciation Recapture in TurboTax

@Critter-3thank you so much for the response. I started following your instructions using TurboTax Premier desktop version, but I need clarification on the conversion of each asset to personal use.

Each asset conversion requires the input of Sales Price, Sales Expenses, Land Sales Price, Land Sales Expenses. I have these numbers for the sale of the real estate, but what do I use for the other assets in the rental?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to Enter Depreciation Recapture in TurboTax

That's because you incorrectly selected NO on the "Special Handling Required" screen for the asset. Read the small print on that screen so you'll understand why I'm saying to select YES. Then select YES.

If you select "NO', then you will be forced to enter sales information.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to Enter Depreciation Recapture in TurboTax

Hi,

When you get a chance, could you look at my situation? I've posted it at the link below... I looked at Schedule E and have no idea where to enter the depreciation recapture (or if I even have to as I am not selling the property - just demolition of house in 2022)... not sure how I can increase the cost basis of the house or the land by including the demo cost??

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to Enter Depreciation Recapture in TurboTax

To clarify, are you using the Desktop program?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to Enter Depreciation Recapture in TurboTax

Yes I am... TurboTax Premier edition Windows Desktop.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Idealsol

New Member

SB2013

Level 2

alvin4

New Member

melillojf65

New Member

iqayyum68

New Member