- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Investors & landlords

@Carl ,

I sold a rental that had been my primary property. The transaction qualifies for the Section 121 Exclusion, and the property was sold to the renter. I depreciated assets sold with the property (e.g. new water boiler) in addition to depreciating the structure.

Your guidelines for reporting a sale of a rental property have been very helpful, but I still have a few hazy points.

Let’s assume the structure and the boiler as the only depreciable assets; and $100,000 gross proceeds from real estate sale form 1099-S.

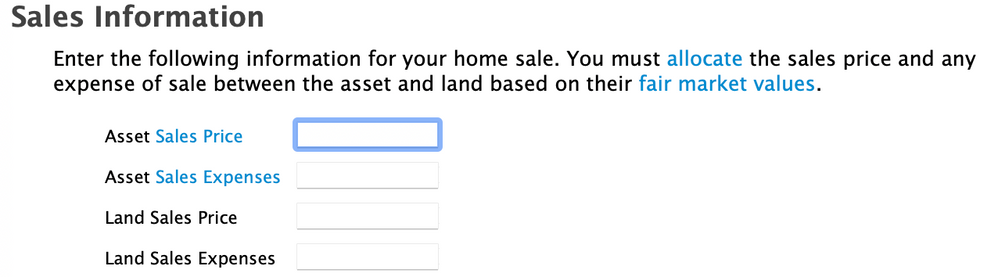

I am reporting the sale using Rental Properties and Royalties -> Rental Properties and Royalties (Sch E) -> Sale of Property / Depreciation. I answered YES to the question “Was this asset included in the sale of your main home”. All good until I reach the Sales information screen…

SALES INFORMATION - STRUCTURE

(1a) Asset Sales Price: $59,500

(1b) Asset Sales Expenses: $1,000 (seller closing costs)

(1c) Land Sales Price: $40,000

(1d) Land Sales Expenses: $0

SALES INFORMATION - BOILER

(2a) Asset Sales Price: $500

(2b) Asset Sales Expenses: $0

(2c) Land Sales Price: $0

(2d) Land Sales Expenses: $0

In (2a) I bought the boiler for $600, and sold for $500 so I would be selling at a loss while the rental is being sold at a gain. This contradicts your previous guidance. What should I use for this amount?

Am I correct in understanding that (1a)+(1c)+(2a)+(2c) should total $100,000 gross proceeds from real estate sale form 1099-S?

Are Assets with a special depreciation allowance reported differently in the Sales Information Screen?

Thanks a billion for any additional guidance.