- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- Re: How to defer your capital gain income tax liability into the following income tax year with T...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to defer your capital gain income tax liability into the following income tax year with TurboTax?

I sold an investment property, closed on 9/1/21 while tried to do a 1031 exchange which had failed and got my fund released from the intermediary company on 2/7/22. I have long term capital gain taxes to pay for the relinquished property.

According to my research, I could choose to "defer your capital gain income tax liability into the following income tax year rather than the current income tax year in which the relinquished property was sold (and closed)."

How can I do this in TurboTax? the software seems to do it for me for the 2021 tax year.

"You should not forget to take depreciation recapture into account. Income taxes due from depreciation recapture can not be deferred into the following income tax year and are due in the taxable year in which you sold (and closed on) your relinquished property."

I need to do depreciation recapture, but not the capital gain, TurboTax seems to do both together.

Also, I have $20k remodel cost, prior to sale, to use as basis to reduce my capital gain amount, but if I'm deferring my gains until next year, do I enter this and use it as a loss to carry to next year? TurboTax advised me to add it as an Asset. Do I add it as "improvement to land" or "Real Estate".

Thanks

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to defer your capital gain income tax liability into the following income tax year with TurboTax?

SEE IF USING THE INSTALLMENT SALE METHOD OF REPORTING PRODUCES THE CORRECT RESULTS

For failed 1031 exchanges that straddle tax years, taxpayers may seek installment tax reporting on IRS Form 6252 in the year of the relinquished property sale. If the 1031 exchange fails by non-identification or by failure to purchase a replacement property, the sale proceeds would be returned to the exchanger in a different tax reporting year. In this circumstance, the IRS allows taxpayers to either report the gain in the year of sale or in the year the proceeds were received under IRC 453 installment sale rules.

BEWARE

Installment sale treatment generally requires a bona fide intent to complete an exchange. This means that the taxpayer had reason to believe, based on the facts and circumstances at the beginning of the exchange, that a like-kind replacement property would be acquired during the exchange period.

Other installment sale issues:

If there was debt paid off at closing of the relinquished property and gain associated with this debt, generally recognized in the year of sale. (This could happen if there have been cash-out refi's)

Depreciation recapture under section 1245 or 1250 is taxable as ordinary income in the year of sale.

A charge paid by a borrower to a lender for the opportunity to borrow funds via a loan or the funds earned by an account owner/beneficiary on the amount held on deposit.Interest is charged on the tax deferred if the sale price of the relinquished property is over $150,000 and certain other instalment obligations exceed $5 million.

using the installment method you report cost which would include remodeling cost.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to defer your capital gain income tax liability into the following income tax year with TurboTax?

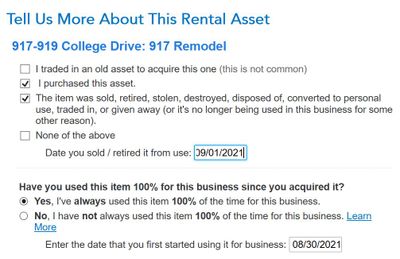

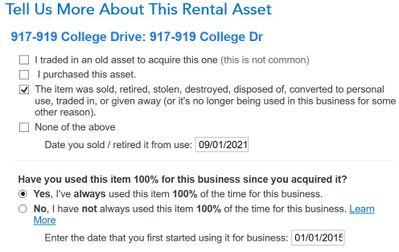

Is this how I report the remodel, by adding it as an asset, land improvements, and indicate it was purchased date and the property sold date?

Under rental property, I have listed 2 assets (one remodel prior to sale, and the rental property itself as another asset with its cost). By checking or unchecking "The item was sold..." my refund differs about 1k. Since the remodel is just before sale, I'd rather not take any depreciation, but to use the whole amount to reduce my capital gain instead.

Since my relinquished property was 9/1/21, I need to pay depreciation recapture for 2021, however, I am able to defer my gains to 2022 tax year since my 1031 exchange failed and my funds were not released until March 2021. Turbo Tax did not initiate the depreciation recapture.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to defer your capital gain income tax liability into the following income tax year with TurboTax?

Once the property is sold and you have expenses for improvements you would add these to your basis. If these improvements were performed to get the property ready to sell, and you sold the property in 2021, then you do not need to add them to your fixed asset list. The costs of the improvements would become part of your basis in the property. Your basis is the cost of the property plus any improvements or repairs made to the property during your ownership. The basis is used to determine the capital gain.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to defer your capital gain income tax liability into the following income tax year with TurboTax?

Thank you for your explanations.

Ok, I will remove the improvements that were performed to get the property ready to sell from the asset list.

This is my first year with TurboTax.

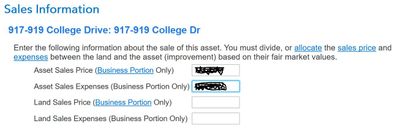

For the main rental property itself, is this where I declare it was sold, previous depreciations, and sale information (I would have to figure out how much is the land and how much is the asset too)?

I finished the federal section, but depreciation recapture did not occur because I am still getting a refund. Depreciation recapture at 25% would require me to pay about $5k to the IRS.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to defer your capital gain income tax liability into the following income tax year with TurboTax?

Yes, this looks correct. The depreciation recapture is at your ordinary tax rate. You have entered everything required for TurboTax to do the depreciation recapture.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to defer your capital gain income tax liability into the following income tax year with TurboTax?

I finished my taxes, reviewed and didn't see any depreciation recaptures.

Oh well, I went ahead and efiled, what's the worst that could happen!? 😀

Will deal with it again next year, maybe 2 years at once. 😀

Thanks!

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

mdminuto

New Member

Richard137

New Member

austeve79

Returning Member

sparksj337

New Member

Scottn1

New Member