- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Investors & landlords

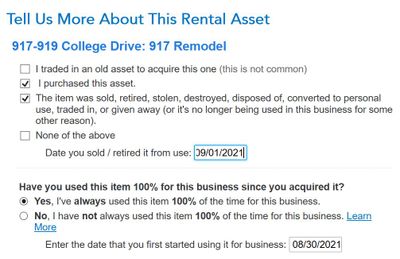

Is this how I report the remodel, by adding it as an asset, land improvements, and indicate it was purchased date and the property sold date?

Under rental property, I have listed 2 assets (one remodel prior to sale, and the rental property itself as another asset with its cost). By checking or unchecking "The item was sold..." my refund differs about 1k. Since the remodel is just before sale, I'd rather not take any depreciation, but to use the whole amount to reduce my capital gain instead.

Since my relinquished property was 9/1/21, I need to pay depreciation recapture for 2021, however, I am able to defer my gains to 2022 tax year since my 1031 exchange failed and my funds were not released until March 2021. Turbo Tax did not initiate the depreciation recapture.