- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Investors & landlords

Thank you for your explanations.

Ok, I will remove the improvements that were performed to get the property ready to sell from the asset list.

This is my first year with TurboTax.

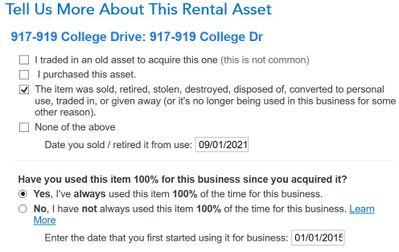

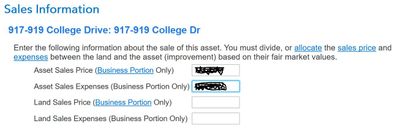

For the main rental property itself, is this where I declare it was sold, previous depreciations, and sale information (I would have to figure out how much is the land and how much is the asset too)?

I finished the federal section, but depreciation recapture did not occur because I am still getting a refund. Depreciation recapture at 25% would require me to pay about $5k to the IRS.

April 3, 2022

10:44 AM