- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- Re: How many years should a residential rental property be depreciated over that was put in service in 2011? 40 or 27.5

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How many years should a residential rental property be depreciated over that was put in service in 2011? 40 or 27.5

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How many years should a residential rental property be depreciated over that was put in service in 2011? 40 or 27.5

See the attached publication:

https://www.irs.gov/pub/irs-prior/p527--2011.pdf

The depreciable period is 27.5

Also keep in mind the date of replies, as tax law changes.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How many years should a residential rental property be depreciated over that was put in service in 2011? 40 or 27.5

Any residential rental property placed in service after 1986 is depreciated using the general Modified Accelerated Cost Recovery System (MACRS), an accounting technique that spreads costs (and depreciation deductions) over 27.5 years. This is the amount of time the IRS considers to be the “useful life” of a rental property.

You would use 40 years if you elected to use the alternative MACRS for depreciation

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How many years should a residential rental property be depreciated over that was put in service in 2011? 40 or 27.5

See the attached publication:

https://www.irs.gov/pub/irs-prior/p527--2011.pdf

The depreciable period is 27.5

Also keep in mind the date of replies, as tax law changes.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How many years should a residential rental property be depreciated over that was put in service in 2011? 40 or 27.5

Any residential rental property placed in service after 1986 is depreciated using the general Modified Accelerated Cost Recovery System (MACRS), an accounting technique that spreads costs (and depreciation deductions) over 27.5 years. This is the amount of time the IRS considers to be the “useful life” of a rental property.

You would use 40 years if you elected to use the alternative MACRS for depreciation

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How many years should a residential rental property be depreciated over that was put in service in 2011? 40 or 27.5

As of the TCJA:

Domestic residential rental real estate paced in service after 1986 is depreciated over 27.5 years.

Foreign residential rental real estate placed in service before Jan 1 2018 is depreciated over 40 years.

Foreign residential rental real estate place in service after Dec 31 2017 is depreciated over 30 years.

If you propertly identify the property in TurboTax, and provide the correct in service date, the program will take care of all this for you automatically.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How many years should a residential rental property be depreciated over that was put in service in 2011? 40 or 27.5

Turbotax is calculating 27.5 years depreciation for my foreign rental property (pre-2018) instead of 40 years.

Foreign address has been entered. How can I fix this please?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How many years should a residential rental property be depreciated over that was put in service in 2011? 40 or 27.5

In TurboTax Home and Business, search for the Residential Asset Worksheet. For Recovery period, type 40. This will change the depreciation period from 27.5 or 30 to 40 years or follow the steps the below, your property will be depreciated for 40 years:

- Under Business Income and Expenses tab, in "Tell us a little more about your rental asset" section, click the bullet "Residential Rental Real Estate", then click continue.

- Enter the property information such as description, cost of the home, and land, and date property was purchased, then click continue.

- The next screen, "Tell us more about this Rental Asset", you must choose or answer the question, then click continue.

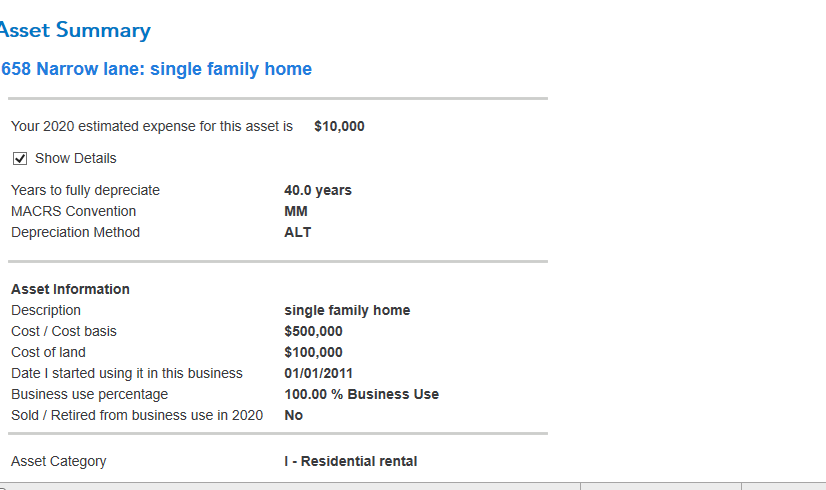

- The next screen is Asset Summary, click Show details - property depreciated for 40 years.

- Below is the screenshot of "show details" of rental property

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How many years should a residential rental property be depreciated over that was put in service in 2011? 40 or 27.5

Besides the foreign address, there should be a check-box to indicate it is outside of the US. That should automatically trigger it to use 40 years.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How many years should a residential rental property be depreciated over that was put in service in 2011? 40 or 27.5

Yes, the foreign rental real estate will be depreciated up to 40 years. Under Property Profile section, under Business Income and Expenses tab, click update and recheck or renter the foreign address, and that should take care of the depreciation.

In TurboTax Home and Business, search for the Residential Asset Worksheet. For Recovery period, type 40. This will change the depreciation period from 27.5 or 30 to 40 years or follow the steps below:

- Under Business Income and Expenses tab, in "Tell us a little more about your rental asset" section, click the bullet "Residential Rental Real Estate", then click continue.

- Enter the property information such as description of the property, cost of the home/ land, and date property was purchased, then click continue.

- The next screen, "Tell us more about this Rental Asset", you must choose or answer the question, then click continue.

- The next screen is Asset Summary, click Show details - property depreciated for 40 years.

- Below is the screenshot of "show details" of rental property

Note: Changing the recovery period on the form may void the Accuracy Guarantee.

edited 2/1/2021 @ 3:02 PST.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How many years should a residential rental property be depreciated over that was put in service in 2011? 40 or 27.5

@monster77 wrote:Turbotax is calculating 27.5 years depreciation for my foreign rental property (pre-2018) instead of 40 years.

Foreign address has been entered. How can I fix this please?

After thinking about it, 40 years is wrong. The recent law retroactively changed it to 30 years.

The IRS has not really released any information on how to handle the retroactive change though, so you will probably want to wait a while until more information is available, and then for the tax programs to update their software.

It might be quite a while, so you may even need to file an extension.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

c0ach269

Returning Member

SB2013

Level 2

user17550205713

Returning Member

Kenn

Level 3

Farmgirl123

Level 4