- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Investors & landlords

In TurboTax Home and Business, search for the Residential Asset Worksheet. For Recovery period, type 40. This will change the depreciation period from 27.5 or 30 to 40 years or follow the steps the below, your property will be depreciated for 40 years:

- Under Business Income and Expenses tab, in "Tell us a little more about your rental asset" section, click the bullet "Residential Rental Real Estate", then click continue.

- Enter the property information such as description, cost of the home, and land, and date property was purchased, then click continue.

- The next screen, "Tell us more about this Rental Asset", you must choose or answer the question, then click continue.

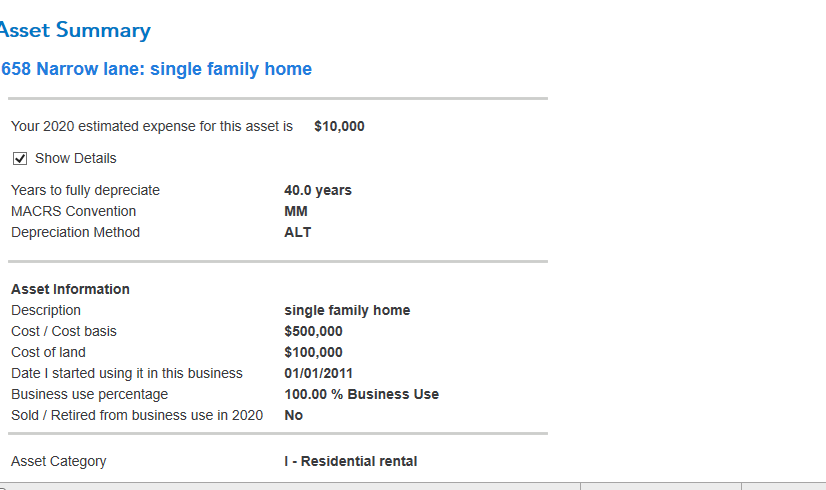

- The next screen is Asset Summary, click Show details - property depreciated for 40 years.

- Below is the screenshot of "show details" of rental property

February 1, 2021

11:59 AM