- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- Re: Do I submit a hard copy of the HUD Statement?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Do I submit a hard copy of the HUD Statement?

I am reporting the sale of an inherited house and using the HUD Statement for the "Sale Proceeds". Do I need to submit a hard copy of this form?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Do I submit a hard copy of the HUD Statement?

No, this is not a required attachment to your tax return. Keep this with your tax records should you need it in the future. The sale of an inherited house is always considered long term so I have included the appropriate reporting process so that you get the capital gain treatment you deserve should there be a gain on the sale.

The sale of inherited property can be entered using the following instructions.

- Open or continue your return (you can choose the Search box and type 'sale of second home' then use the Jump to link to enter your inherited sale) or follow the menu.

- Under Wages & Income scroll to Stocks, Cryptocurrency, Mutual Funds, Bonds, Other (1099-B)

- Answer Yes on the Did you sell any stocks, mutual funds, bonds, or other investments in 2021? screen

- If you land on the Your investment sales summary screen, select Add More Sales

- On the OK, let's start with one investment type screen, select Other, then ContinueOn the Tell us more about this sale screen, enter the name of the person or institution that brokered the sale

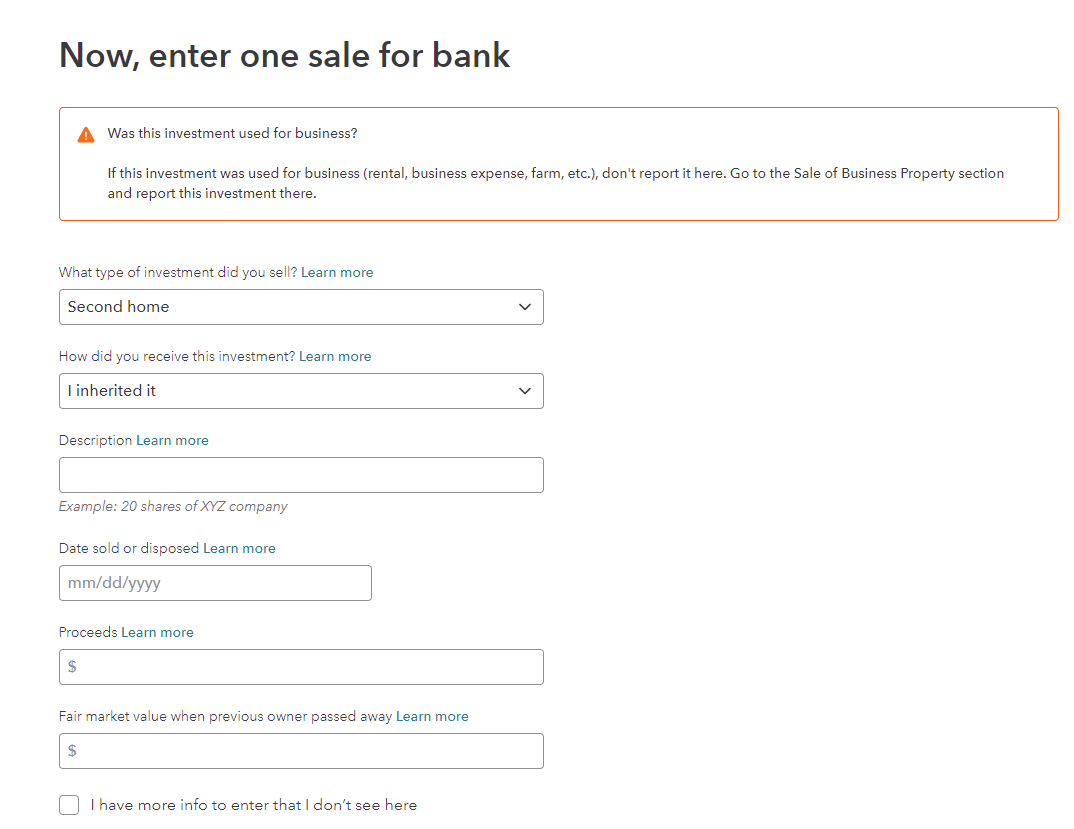

- On the next screen, select Other (choose this also for inherited homes) then select I inherited it under How did you receive this investment?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Do I submit a hard copy of the HUD Statement?

First of all thank you for the very quick reply. Just a couple of follow-up questions / comments please.

My Premier Turbo Tax does not appear to have the drop-down question boxes that ask how you acquired the asset, etc. Also, I cannot find a way to add the Financial Institution (Title Company I think) name. This information is populated for my brokerage account (data was imported).

Doesn't appear to be an issue, but I would like to confirm that I have done all that is possible.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Do I submit a hard copy of the HUD Statement?

You do not need to enter the financial institution. If the screen will not let you pass, type in Bank. I

Where are you entering the sale? It should be in the Investment section as a second home. If you do so, you will be asked how you received it.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

ajm2281

Level 1

jtmcl45777

New Member

dianagandara1016

New Member

kendunk21

Level 1

rbasel

New Member